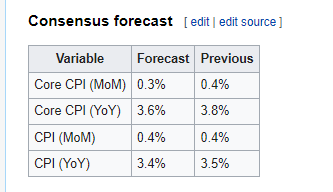

These are April 2024 expectations. Month-over-month increases are still relatively high.

This month’s underlying developments were again more inclined to upside risks, but maybe more mixed as important components such as wages that have been moderating and used car prices declining very significantly.

These are components that could be important for CPI, but I haven’t studied correlations yet to know the real impact between these metrics and CPI, including lags between them

- Wages have been having more moderate increases in the last 3 months. The 6M annu rate is running at 3.85% currently, still a bit higher than before covid.

- Oil and Gasoline continued to increase in April, both up over 5% m/m. However prices have started to decline in May.

- Food Index had the second consecutive month of increases at 0.3% m/m, but still down 7.5% Y/Y.

- Supply chain index declined during April, but remains stable.

- Housing prices recorded an increase of 0.6% m/m during April, after a few months of declines, at 6.5% Y/Y currently. Rents also increased by 0.5% m/m.

- Used car prices continued to decline in April being -2.3% m/m, but new car prices recorded a 2.2% increase during april 2024.

- Import prices continued to increase being up 0.6% in March 2024, reverting the deflation experienced during 2023.

- Both the ISM manufacturing and services prices paid index continued to accelerate its rate of increase during April. Manufacturing increased 6.1 points to 60.9 (14.5%Y/Y) and services up 5.8 points to 59.2 (-0.6 Y/Y)

- US PPI during April was 0.5% m/m, higher than expected, but mostly due to prior down revisions. Still increasing Y/Y at 2.2%.

- Small business planning price increases declined 7 points during April, to the lowest in a year.For now, dissipating fears of an acceleration in prices for small businesses.

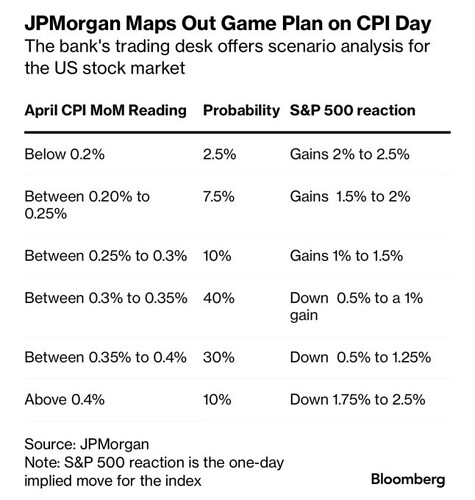

These are JPM probabilities and expected market reaction.

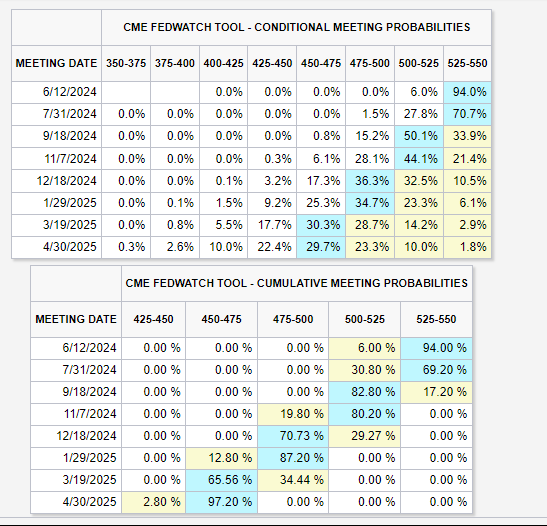

The market before CPI expects 2 rate cuts in 2024 starting in September.