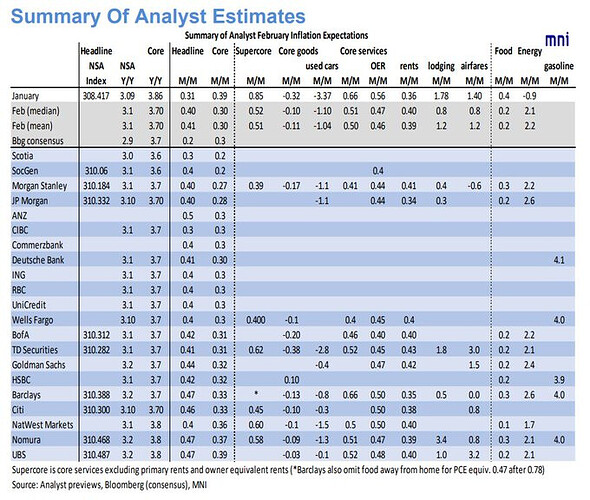

There is not much improvement expected for February CPI. Actually, I would say the expected M/M increases remain high, including super core, services, and rents.

- Energy had a significant increase in January, which will most likely put pressure on headline CPI

- Used and new car prices declined again in February, continuing to put downward pressure on goods CPI.

- Wages had a nice downside surprise, but remain ~4% y/y, so don’t expect that much impact on services yet.

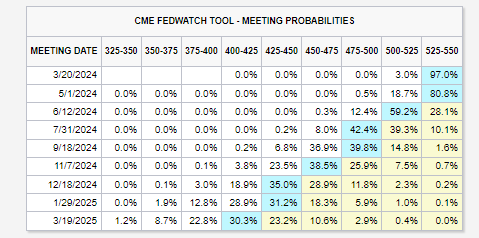

From last month rate expectations have changed very significantly. Now cuts are expected to start until June, and on average ~3/4 cuts for 2024.

If inflation continues to surprise, IMO cuts could continue to be pushed further.