August 2024 report showed significant upward revisions to Personal Income

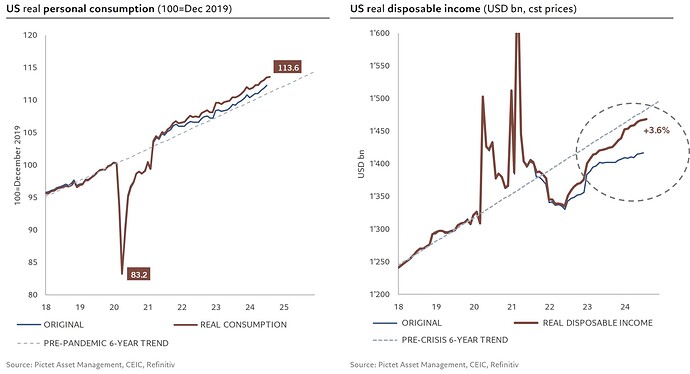

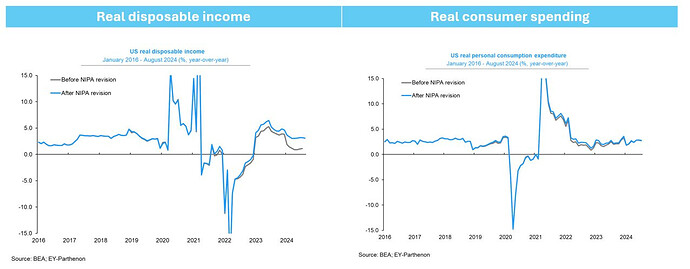

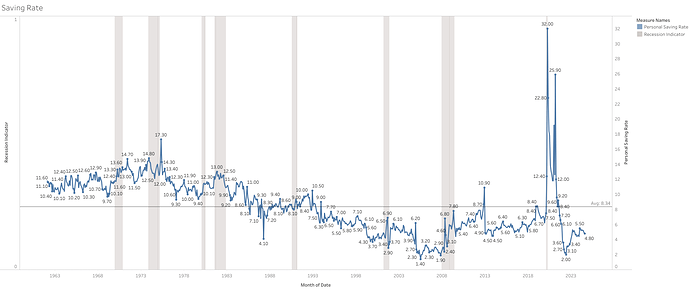

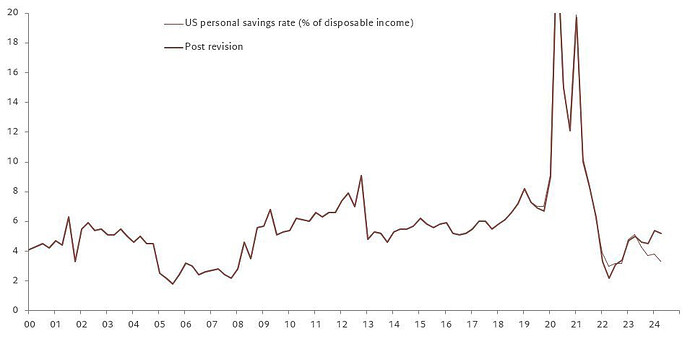

Despite income and spending falling short of expectations, the most notable development this month is the significant upward revision to disposable income across all series. This revision has, in turn, lifted the savings rate from previously concerning lows to a level that no longer signals such weakness.

This shift alters the economic picture, especially in the short term, as my previous concerns about sluggish income growth and consumer spending beyond their income growth are now moderated. With these revisions into account, it will take a much weaker labor market to significantly impact consumer behavior. (important to note that there has been recessions where consumer spending barely declines or doesn’t decline at all eg. 2001, 1970)

I was already anticipating only a very mild economic downturn in 2025/2026, and this revision doesn’t seem likely to alter my GDP outlook substantially, particularly as a trend toward further weakness is still present, especially in the labor market. However, I will await more data before updating my forecast.

-

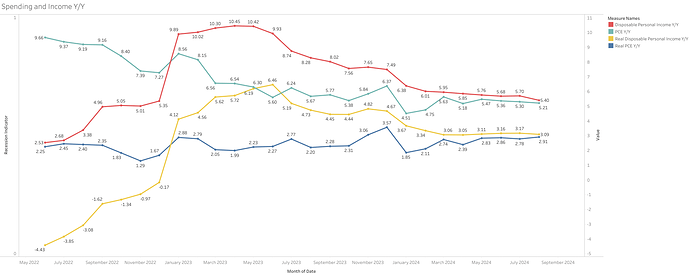

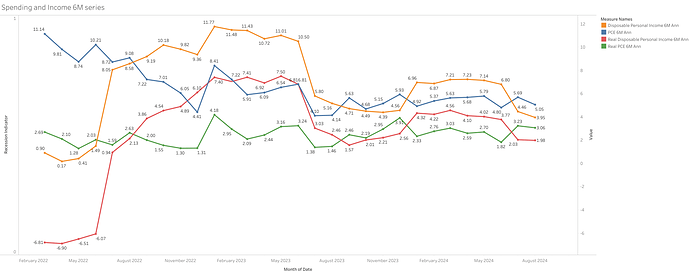

Real Disposable Income now reflects a year-over-year growth of 3.10% in August 2024 (previous growth of around 1% Y/Y.) This puts it slightly now ahead of the spending growth rate of 2.91% Y/Y.

However personal income is starting to show more weakness than spending on a 6M trend basis

-

The saving rate went from 2.9% last report to 4.8% in August 2024.

A revision of almost 2%.

And while it has been decreasing lately due to weaker income growth, it does not show anywhere the weakness that it did before.