China Discussion about its economic developnments

China’s economy seems to be in trouble. The government could be underestimating the weakness, and not reacting on time. But, also the confidence seems really low too, firms and consumers don’t want to take on more credit even with easing conditions.

China’s central bank unexpectedly reduced a key interest rate by the most since 2020 to bolster an economy that’s facing fresh risks from a worsening property slump and weak consumer spending.

The surprise move came shortly before the release of disappointing economic activity data for July showing growth in consumer spending, industrial output and investment sliding across the board and unemployment picking up.

Obviously, the question is about the impact this weakness will have in Europe, especially Germany (big trading partner), and also the US. In the portfolio, from my understanding, VW has a lot of dependency on China

Past cycles China has been key in the economic recovery (Eg. 2008), but this time it looks instead of a tailwind will be an additional drag for global growth.

I also already wanted to write something about China.

Here are some interesting videos about China i saw

- Interesting comparison between the debt problem in Japan and China which has deflationary effects.

- Short summary of the reasons for the slowdown. Confidence after Covid is lower due to lower property prices as people’s wealth is tied to it.

- A fund manager says Xi wanted to slow down price growth in real estate in order to make living more affordable and increase the birth rate. He also says the PBOC governor has been fired and reassigned multiple times. He thinks it is likely that Xi is preparing for war in Taiwan. More here:

The same fund manager that warned about an increasing risk of a war between China and Taiwan is saying that Chinas banking system is in free fall right now.

@Magaly do you have insights into current economic developments in China? Are you able to assess the credibility of his economic warnings?

I unfortunately don’t have enough knowledge into China to really understand the risks.

The property sector seems very much in a real crisis though. Huge over supply, with lots of properties still not even finished, and demand is currently slow. Combined with big developers in huge debt loads with banks having significant exposure.

Some developments I have found:

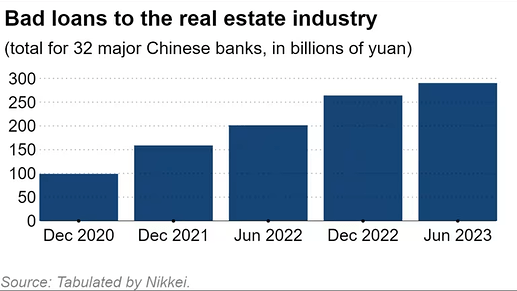

- Bad loans to the real estate sector at the four state-owned banks rose to 185.8 billion yuan in the first half of the year from 180.1 billion yuan at year’s end. CCB, ICBC and ABC reported increases of 18%, 15% and 12.3%, respectively. BOC had a decline of 22.8%.

"Banks’ bad debts to the property sector are not reaching the peak level anytime soon, as many top companies have only started to report questions," said Weiqing Li, a seasoned banker and member of the Private Banking Committee of the China Banking Association.

-

Bad loans to the real estate industry at 32 major Chinese banks jumped 44% on the year to 290.1 billion yuan at the end of June, based on a tabulation by Nikkei. Regional banks are being hit especially hard, such as Bank of Gansu and Bank of Jiujiang, which saw bad real estate-related debts double in just six months.

-

Banks hold about 75% of Chinese developers’ financial liabilities, according to Goldman Sachs, which estimates that the banks could face roughly 1.2 trillion yuan in losses on this debt. Small and midsize institutions with fragile capital bases could end up running short of liquidity, Goldman’s analysis said.

-

The government is trying a lot of stimulus already, but apparently, they are not having the desired effect to push demand up. Xi warned that China’s economic recovery remained "at a critical stage, and ordered measures to boost demand and “defuse” risks.

Beijing’s top decision-makers, including President Xi Jinping, pledged at an annual closed-door meeting held Monday and Tuesday to “actively yet safely defuse risks in the real estate sector” and "meet the reasonable financing needs of real estate enterprises

-

Moody’s cut outlook to negative, Moody’s said it expected contracted sales to fall by about 5% over the next six to 12 months in China, and the impact of government measures to boost property purchases was likely to be short-lived and uneven.

-

The problem is that approx. 70% of the wealth in China is in real state, a decline or collapse in prices, could cause a stop in spending, and a sustained deleverage. (Similar to what Japan experienced). For now, Capital Economics estimates net household wealth declined 4.3% overall last year, due to falling house and stock prices, the first decline since at least 2001.

“Households appear to have cut back their consumption in response to negative wealth effects,” said Julian Evans-Pritchard, head of China economics at the research firm.

“Recent homebuyers with large mortgages will have suffered the most and therefore likely cut back the most.”

-

Personal defaults are also already increasing, which could deepen the negative sentiment on consumers.

-

Oxford Economics lead economist forecasts the housing market correction will take about 2-3 more years, but the economy will grow at an average 4.0 percent over the next five years (2024-28).

She also thinks the spillovers will be limited due to the greater role of policy, state-controlled banks and more stringent mortgage terms.

“We think China’s housing downturn will tread a different path than that of the US, Spain, or Ireland 10-15 years ago, and is unlikely to trigger a broader financial crisis,” she said.

I also have heard that most likely people are being overlypesimistic, and that the economy is not as bad.

At this point, I am unsure if analysts are being complacent about the risks or if it’s really contained.

China stocks are on free fall, CSI 1000 index hits a 30% loss YTD. This looks like 2008, but in China.

The government is trying to increase stimulus and create restrictions to stop the sell-offs, but until now has been unsuccessful

New restrictions include:

-

Limiting investors’ ability to short Hong Kong stocks

-

Some investors told that they are not allowed to sell their positions

-

Some quant funds are completely banned from placing sell orders

-

Other quants funds banned from cutting leveraged positions

https://twitter.com/KobeissiLetter/status/1754488591856652291

It could be that in hindsight we see that this was creating huge opportunities eg BABA, but with China’s political uncertainty is difficult to make a call like that because of so many unknown risks.

Chinas local government debt crisis explained. According to the video Beijing’s artificial GDP targets lead to unnecessary over construction and high debt burdens for some provinces.

Generally speaking I like the clear and simple format with which TLDR boils down the essence of developments in the world.

@Magaly do you have any take how the situation in China continued to develop? Those numbers of potential losses seem manageable to me at first glance not considering ripple effects but obvs. i could be wrong.

I also saw that stock indices started to recover but have no idea if things actually improved from the end of last year or even got worse.

I also do not follow China closely. So, I am not in a place to know the real risks there either, seems for now remain stable, but not really like a strong recovery or something similar.

And the government intervention is what seems to have been a significant driver of the index stabilizing.

Its overall economy is showing signs of doing better at least, but still weak. Still uncertain if it’s only due to the festivities.

- The Caixin/S&P Global China manufacturing purchasing managers’ index was 51.1 in March — its strongest since February 2023 — after coming in at 50.9 in February. Economists had expected the reading to hit 51, according to a Reuters poll.

“Overall, the manufacturing sector continued to improve in March, with expansion in supply and demand accelerating, and overseas demand picking up,” Wang Zhe, a senior economist at Caixin Insight Group, said in the survey release.

https://www.cnbc.com/2024/04/01/china-april-2024-caixin-manufacturing-pmi.html

The property issues seem to continue. The government seems to want to move away from the dependence on real estate too, but at the same time continues to provide stimulus.

- New property sales reached a total of 1.06 trillion yuan ($147 billion) in the first two months of this year, -29.3% Y/Y. The drop also marks a much faster pace of decline from the year-ago period, when new property sales dipped just 0.1%.

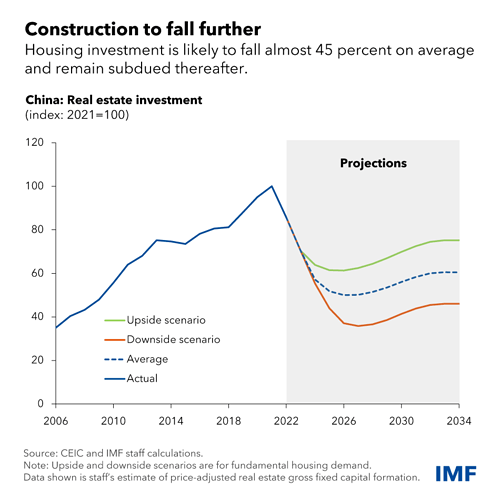

- Property investment fell 9% in the January-to-February period, which was faster than the 5.7% decrease registered during the same period last year.

“The correction in property construction is still in its early stages,” Capital Economics analysts said in a research note on Monday. “We expect it [property construction] to halve in the coming years, pulling down economic growth over the medium-term.”

https://edition.cnn.com/2024/03/18/economy/china-property-market-weakness-intl-hnk/index.html

“For real estate companies that are seriously insolvent and have lost the ability to operate, those that must go bankrupt should go bankrupt, or be restructured, in accordance with the law and market principles,” Ni Hong, Minister of Housing and Urban-Rural Development, said at a press conference Saturday.

https://www.cnbc.com/2024/03/11/chinas-housing-minister-property-developers-must-go-bankrupt-if-needed.html

And is expected that the huge leverage and structural issues in the property market are going to take years to resolve, and the bottom is not expected to have happened yet in this sector.

China’s housing market faces additional pressures in coming years from structural factors, in particular demographic change. The need for additional new housing will diminish in coming years as the population declines and urbanization slows. Large public subsidies in the previous decade helped millions of people move to newer housing from older buildings lacking modern amenities. Such demand will likely be more limited as depressed land sale revenues have tightened local government fiscal constraints and fewer residents live in older housing.

Banks seem to continue to be under pressure, but according to them is manageable.

- Non-performing loans at China’s big four banks jumped 10.4% in 2023, from 1.117 trillion Chinese yuan, about $155 billion, in 2022 to 1.23 trillion yuan. Despite the rise in bad loans, Chinese lenders said they had enough buffers to weather the storm and will control lending risks to property developers.

- Combined profits at China’s commercial banks rose 3.2% to 2.38 trillion yuan last year, the slowest pace since 2020, according to official data. Outstanding bad loans climbed to a record 3.23 trillion yuan.

The nation’s largest state-owned banks are struggling to maintain growth as Beijing tasked them with duties to help pump up the domestic economy as well as rescue its debt-laden property developers and local governments. The state banks have so far heeded Beijing’s call to lower lending rates and step up financing support for developers.

China Property Crisis Erodes Banks Balance Sheets as Investors Await Earnings - Bloomberg

As a reference, the outstanding amount of loans to the property sector was 53.19 trillion yuan ($7.3 trillion) at the end of September. And, property development was 13.17 trillion yuan.

https://www.bloomberg.com/news/articles/2023-11-01/china-s-property-sector-loans-contract-for-first-time-on-record

Well made interesting video about Chinas dominance and overcapacity esp. in EVs, Solar and Batteries.

The video illustrates Chinas economic model which combines capitalism with state planning/support and highlights effects that Chinas competitive products can cause in other parts of the world.

Esp. the part around min 16 is relevant for us as we need to analyze how large the advantage of Chinese Cars and esp. EVs is when it comes to tech/software, price etc. @Aron

Depending on how we want to structure the Forum findings could be summarized in the broader “Volkswagen Competition” topic or a more specific “Analysis of competitive pressures from chinese cars and evs” topic.

Good summary of chinas economic problems in this short Ray Dalio Video.

- Real Estate Sector is in trouble

- Consumers are not spending money as 70% of their net-worth is tied to real estate and they got more cautious

- Problematic for domestic business sales (?) → wages are lower

- 83% of government spending has been done by local governments which got their money partially through land sales

- Lenders to local governments are not getting paid (?)

- Larger question: Will property rights be respected? “Is it still glorious to be rich?” (Or is China getting more dictatorial/communist?)

- Technological development & innovation is still strong. Only competitor to U.S at that front

Yes, China seems to be in serious trouble, I recently saw parts of this interview, which was very informative in understanding China’s current issues.

According to Richard Koo (chief economist at Nomura Research Institute, and pioneer of the “balance sheet recession” phenomenon), China is entering a balance sheet recession (similar to that of Japan in 1990 and the US in 2008)

- Declining real estate prices are undermining household and corporate wealth, leading to increased savings and debt repayment efforts to stabilize balance sheets.

- As private sector borrowing decreases, the funds repaid on debt are flowing back into the financial system, but financial institutions are finding it difficult to allocate these funds due to weak borrowing demand.

- Despite ultra-low interest rates, borrowing demand remains subdued, leaving the central government as the only entity capable of taking on debt to stimulate the economy.

- The key issue in China is that the central bank seems reluctant to acknowledge the country is facing a balance sheet recession. It is not implementing a sufficiently large fiscal stimulus, which is crucial in such a situation because monetary policy alone (low interest rates) is ineffective.

- China initiated large fiscal stimulus since 2016, increasing deficits to around 6% to support the economy as corporate savings increased and investment slowed. The government’s reluctance to increase stimulus currently is due to concerns about deficits potentially rising to 10-12%.

- Many local governments are insolvent currently, limiting their ability to provide stimulus, leaving the central government alone to act. Without action, China risks a deeper deflationary cycle, signs of which are already emerging.

- China is already the largest trade surplus country, due to the political situation they wont be able to export their way out of this recession, since the rest of the world wont let it.

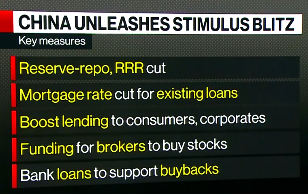

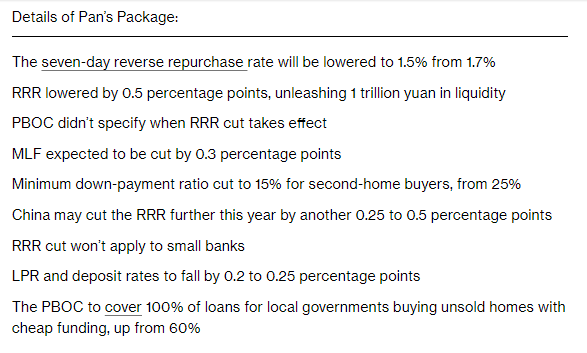

China’s Biggest Stimulus Package so far this year

It seems the the government is finally starting to wake up to the reality of its economy, but still skeptical this will be enough, since as outlined by this analyst above, rate cuts are not necessarily stimulative when the private sector is saving and not borrowing.

The stock market reacted positively to the measures, especially as there as measures to support the stock market.

China’s benchmark CSI 300 Index of shares ended the session 4.3% higher, close to erasing losses for the year, though the gauge is still down more than 40% from its recent peak in 2021.