Main Article: Bankruptcies: US - InvestmentWiki

Bankrupcies in the US continue to increase, this is before a possible recession, and before the maturity wall of 2024/2025:

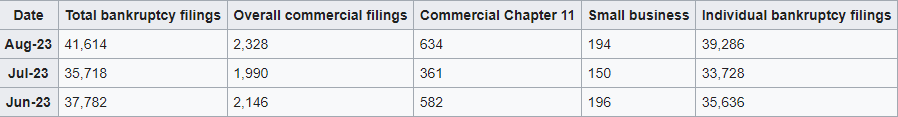

Epiq data:

“Elevated interest rates, rising prices due to inflation and resumption of student loan payments are just a few examples of the economic headwinds facing businesses and individuals,” said ABI Executive Director Amy Quackenboss. “Struggling families and companies looking to find their financial footing are increasingly turning to the established path of bankruptcy.”

- Charter 11 filings 54 percent y/y, and 76% m/m

- Overall commercial filings increased 14 percent y/y and 17% m/m

- Small business filings (captured as subchapter V elections within chapter 11) increased 43 percent y/y and 29% m/m

- Total bankruptcy filings increased 18 percent y/y and 17% m/m

- Individual bankruptcy increased 18 percent y/y, and 16% m/m

August Commercial Chapter 11 Filings Increase 54 Percent Over Last Year, Total Filings up 18 Percent

Large/medium companies:

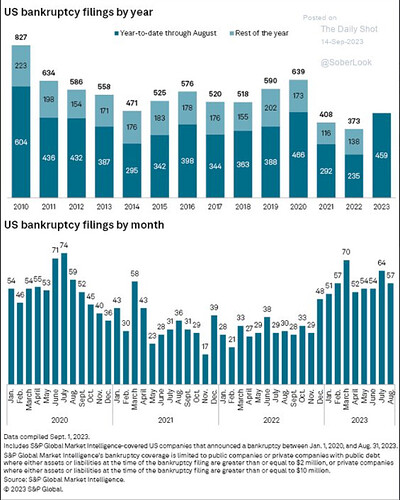

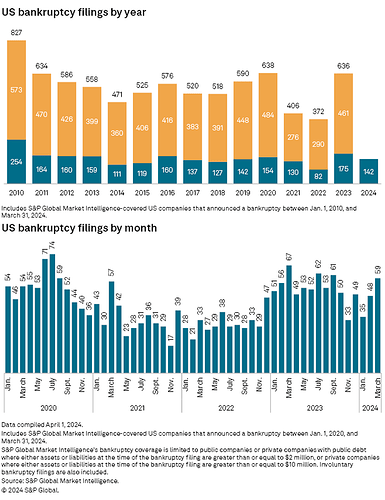

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities.

-

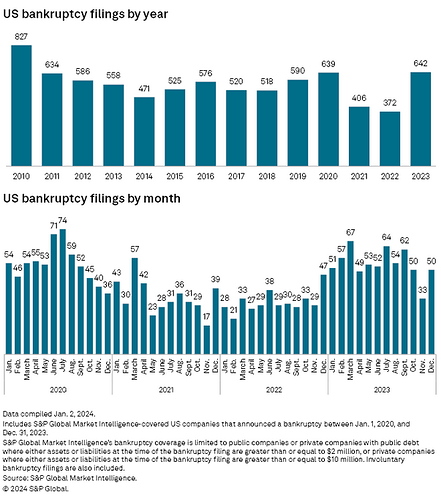

S&P Global Market Intelligence recorded 459 bankruptcy filings in 2023 as of Aug. 31, more than the full-year totals for 2021 and 2022. The year-to-date figure is also higher than the comparable total for all but two of the prior 13 years.

-

Fifty-seven companies sought bankruptcy protection in August. While the total was lower than July’s 64 filings, it was still markedly above most months in the prior two calendar years.

2023 Big Picture: US Consumer Survey Results | S&P Global Market Intelligence

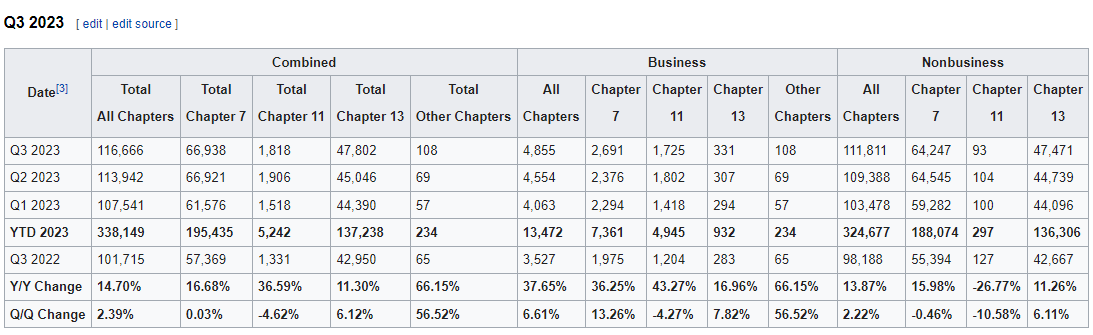

Total Bankrupcies are up 14% y/y in Q3. YTD they are now 338K, as reference in all 2022 they were only 387k.

Business bankruptcies are up 37% y/y in Q3. YTD is 13.4K, equal to all 2022 now.

Levels are still way below pre-pandemic levels.

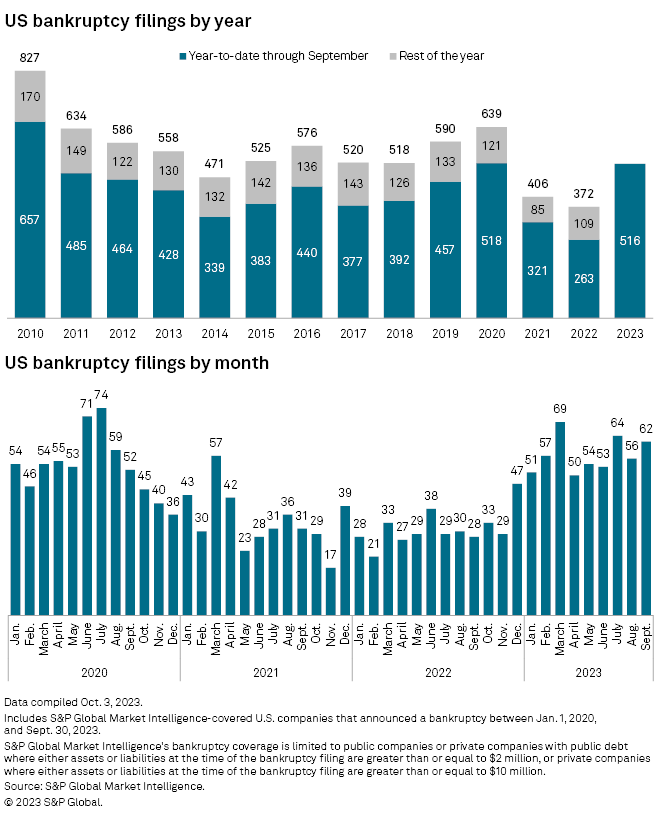

Large/medium companies are a different story, YTD is equal to 2020, already at levels not seen since 2010 before the pandemic

And according to EPIQ, Small business filings, captured as subchapter V elections within chapter 11, totaled 1,419 in the first nine months of 2023, a 41 percent increase from the 1,009 elections during the same period in 2022.

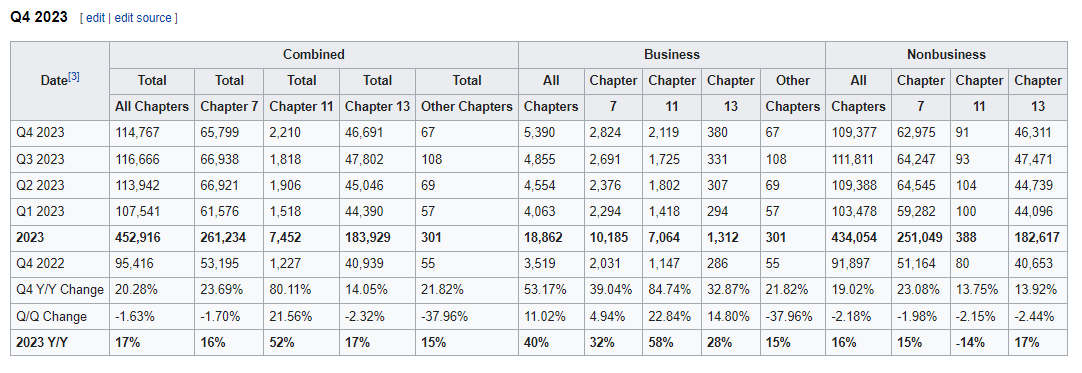

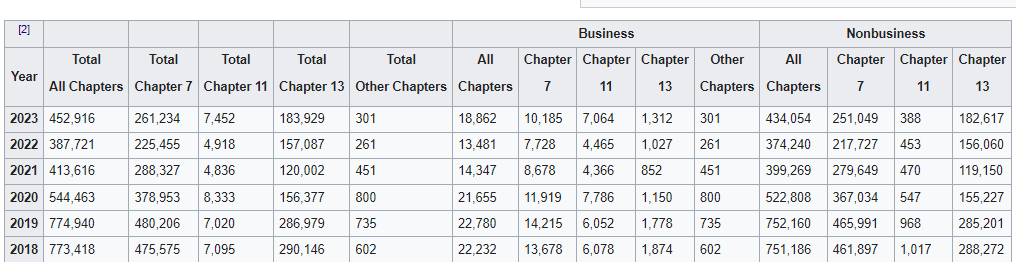

2023 ended with 452k bankruptcies in total, representing a 17% increase from 2022 levels.

Bankrupcies are still way below pre-pandemic levels and in some cases are only normalizing, this is mostly true for non-business ones.

The rate of increase for business bankruptcies is the most concerning currently, especially since the maturity wall for most companies is still ahead.

- Business bankruptcies totaled 18,862 in 2023, for a 40% rise.

- Non-business were 434,054 in 2023, a 16% increase.

Bankruptcy Filings Statistics | United States Courts

Bankrupcies for larger corporations ended at the highest levels since 2010, for a 72.5% y/y increase.

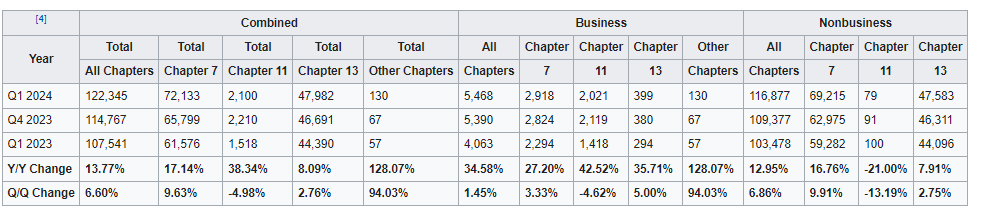

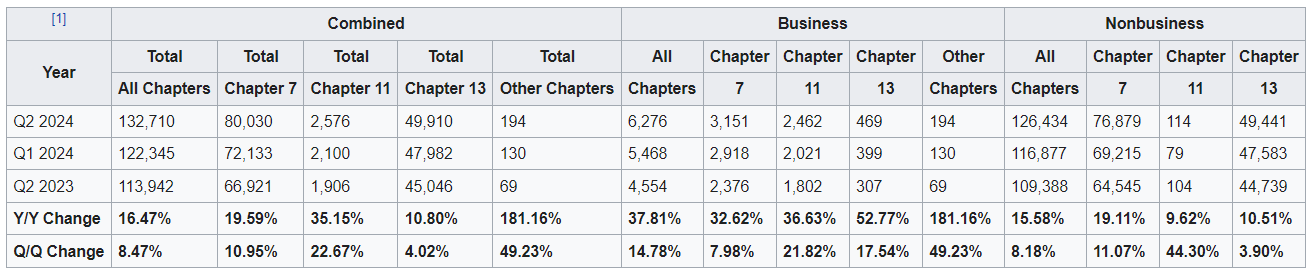

Bankrupcies continue to increase during Q1 2024. But levels remain relatively low.

- Total bankruptcies 13.77% y/y, and 6.60%q/q.

Year over year increase is more pronounced on business bankruptcies than nonbusiness, but on a quarterly basis nonbusiness bankruptcies had a higher increase, different than what we saw during all of 2023.

For medium/big companies Q1 2042 levels declined by 18%Y/Y.

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-corporate-bankruptcies-pick-up-pace-in-march-59-new-filings-8108545i

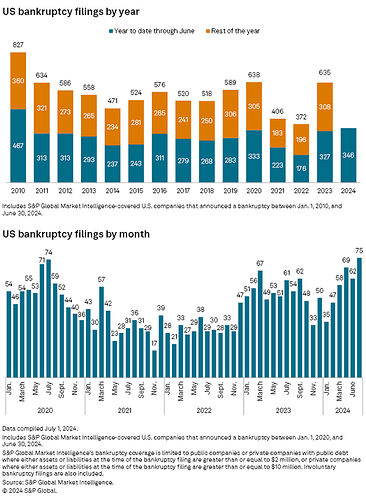

Q2 2024 Bankrupcies continue to rise, still below pre-pandemic levels

Bankruptcy filings across all categories and chapters have increased both on a year-over-year and quarter-over-quarter basis in Q2 2024. Notably, Chapter 11 bankruptcies, typically associated with reorganizations, have seen a substantial rise, especially in business categories

Business bankruptcies show a larger deterioration overall than non-business entities.

Medium/big company bankruptcies measured by SP Global, are up 5.81% YTD to the highest level since 2010, although the rate of increase has slowed.

There was a moderate increase in filings from Q1 to Q2 of 2024, with a 4.28% rise.

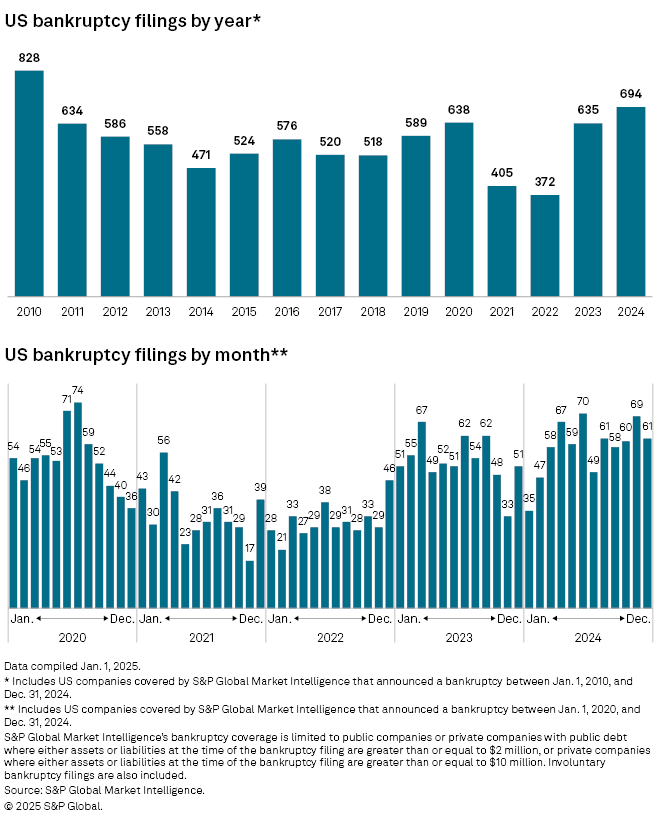

Bankruptcy filings in the U.S. increased by 14.2% in the 12-month period ending December 31, 2024, continuing a rebound after over a decade of decline.

- Total filings: 517,308 (up from 452,990 in 2023).

- Business bankruptcies: 23,107 (+22.1% from 18,926 in 2023).

- Non-business bankruptcies: 494,201 (+13.9% from 434,064 in 2023).

Trends:

- Filings have been increasing each quarter since their low of 380,634 in June 2022.

- However, they remain significantly below the peak of 1.6 million in September 2010.