Topic to discuss the developments and growth in Bank Lending

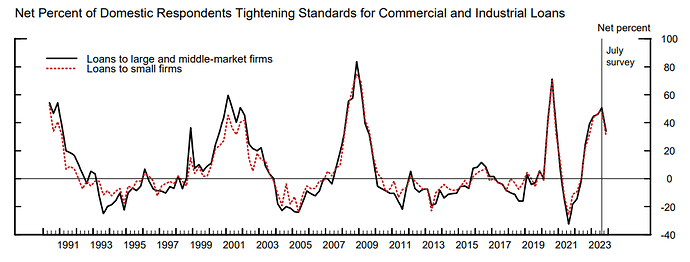

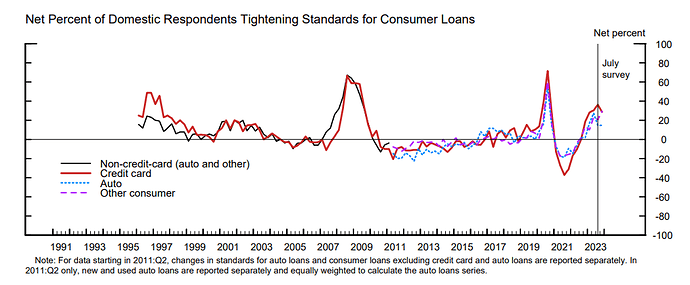

Credit standards continue to tighten, and had a more bit more accelerated pace in Q2 compared to the one in Q1. Banks expect to tighten even more later in the year, this is my opinion is not good news for the economy, since standards are already significantly tighter.

At the levels we see at the moment, we were already in a recession before.

Banks reported that, on balance, levels of standards are currently on the tighter end of the range for all loan categories. Compared with the July 2022 survey, banks reported tighter levels of standards in every loan category.

Regarding banks’ outlook for the second half of 2023, banks reported expecting to further

tighten standards on all loan categories. Banks most frequently cited a less favorable or more

uncertain economic outlook and expected deterioration in collateral values and the credit quality

of loans as reasons for expecting to tighten lending standards further over the remainder of 2023.

https://www.federalreserve.gov/data/documents/sloos-202307-fullreport.pdf

https://www.reuters.com/business/finance/us-banks-report-tighter-credit-weaker-loan-demand-fed-survey-2023-07-31/

Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms (DRTSCILM) | FRED | St. Louis Fed

Banks continue to tighten standards, but the percentage that did it in Q3 compared to Q2 was lower, suggesting some stabilization for now. This could be in correlation to a stronger-than-expected Q3 2023.

There were a lot of respondents saying they remained unchanged from Q2, and almost no one eased.

- Loans to businesses, survey respondents, on balance, reported tighter standards and

weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third

quarter. - Banks most frequently cited a less favorable or more uncertain economic outlook; reduced tolerance for risk; deterioration in the credit quality of loans and collateral values; and concerns about funding costs as important reasons for tightening lending standards over the third quarter.

- Banks reported that they were less likely to approve loans for borrowers with FICO scores of 620 and 680 in comparison with the beginning of the year, while they were more likely to approve credit card loan applications and about as likely to approve auto loan applications for borrowers with FICO scores of 720 over this same period.

https://www.federalreserve.gov/data/documents/sloos-202310-fullreport.pdf

While banks continue to tighten lending standards fewer banks are doing so that from the peak.

Most are remaining unchanged, and almost no easing.

While some are seeing this as positive, it just means banks remain very tight compared to the loose standards we saw before. But at least they are stable for now.

Demand for loans is also slowly improving from the lows. Probably as yields decline from the highs.

Banks, on balance, reported expecting lending standards to remain basically unchanged for C&I and RRE loans, but to tighten further for CRE, credit card, and auto loans. In addition, banks reported expecting loan demand to strengthen across all loan categories, and loan quality to deteriorate across most loan types.

Is there some easy and objective/absolute data point/measurement we could focus on that would tell us how much tighter standards are currently compared to before and what the impact of this is? (Low priority topic)

I don’t think there is, this survey does not provide any type of absolute data. It is all relative to the quarter before.

And can be misleading if one only looks at the graph, and does not analyze the tables.

It also only focuses on the % of banks that have tightened or considered X factor important compared to the quarter before, but not how tigh they are.

Data is only useful to know they are higher now than at the beginning of the cycle, but not by how much.

To understand lending compared to other periods is it better to focus on loan levels and growth by sector.