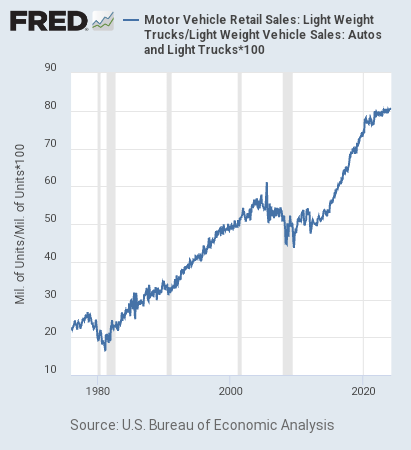

Yes, that could be one of the reasons. As an example the share of light trucks in light weight vehicle sales volumes have definitely increased a lot since 2010 in the US. But it has since data is available.

However, when analyzing a company, I think not only the price matters, but also the sales mix between cheaper/expensier vehicles?

So maybe avg transaction prices could be more useful to us?

It could also happen in the current environment that prices don’t necessarily come down a lot, but consumers start to prefer cheaper options due to affordability.

Also, as a mention in the post, the BLS changed methodology in 2022, they could also have realized the old methodology was not reflecting very well the true changes in cost of living for new cars.

Before they used surveys to dealers, not transaction data, so the data is probably less reliable before 2022. But I think sales mix could still be one of the primary reasons.