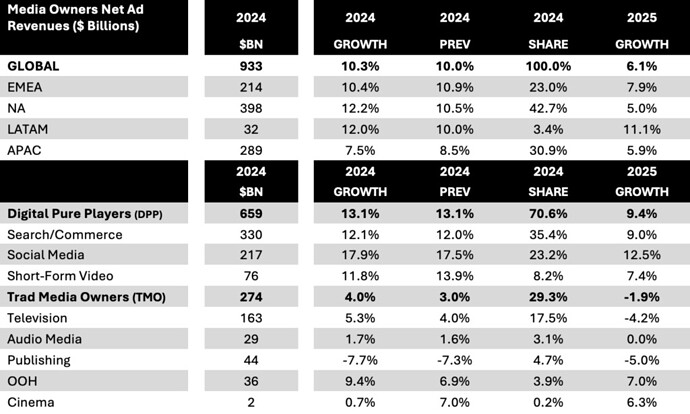

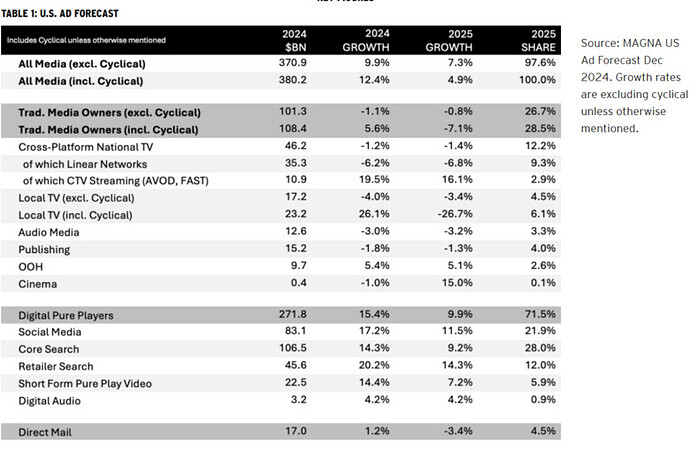

Magna December 2024 forecast: In 2024 ad revenues reached $933 billion, growing by +10.3%. Growth of 6.1% is expected in 2025.

- After a strong first half (+12%), the global ad market slowed slightly in the second half (+8%). Expected to slow further in 2025, including digital.

- Digital Pure Players (DPP) ad sales grew by double-digits through the year despite tougher comps in the second half.

- +11% (Google), +22% (Meta), and +21% (Amazon), increasing their market share to 51% globally and 61% outside China.

“The strong growth of advertising spending in 2024, despite a challenging economic environment, was of course driven by an unusually high number of major cyclical events but, more fundamentally, media innovation is what attracts a growing share of marketing budgets into advertising formats. Digital Pure-Play ad formats (Search, Retail Search, Social and Short-Form Video) are fueled by the rise of Commerce Media redirecting billions of dollars from trade marketing into digital formats. The growing reach of ad-supported CTV streaming makes cross-platform long-form video more attractive to advertisers as it now offers scale on top of addressability and brand safety. With no major cyclical drivers in 2025, MAGNA expects ad spend growth rates to slow, but the organic factors will remain at work, stabilizing TMO ad revenues, and growing DPP ad sales.”