As discussed here in Investment Philosophy it might be very useful if I start creating clear descriptions of which scenarios are acceptable to me for each individual investment case and which scenarios are not.

That might help tremendously to focus on risks that go beyond acceptable scenarios and give more clarity and security when it comes to them. In addition, it becomes clear which types of developments I don’t regard as a problem and why I am ignoring them.

Over time we should go one step further and start discussing which scenarios should be acceptable or not. Depending on the case those discussions require a more advanced description of the whole investment case from my side which is something we want to definitely develop over time but what I cannot do for all companies at once and which is not a priority as of now.

Nevertheless, feel free to ask all kinds of follow-up and specification questions or ask specifically about different scenarios or start already criticizing what I think is acceptable. (I will consider the input but will not be able to get into a deep discussion on the subject as of now)

Here is an example:

Volkswagen

Based on 2022 annual numbers and today’s share price of €123 Volkswagen’s valuation is extremely attractive with a PE of approx. 4. (Does not even account for profits in China).

Volkswagen reinvested most of its profits into its electric transformation and growing portfolio of fully collateralized loans to it’s customers and distributed a 7% dividend yield.

Volkswagen remaining 75% stake in Dr. Ing. h.c. F. Porsche AG is currently worth more than it’s entire market cap.

While Volkswagen management guides to a positive 2023, potential troubles from a slowing economy seem to be more than priced into the by now.

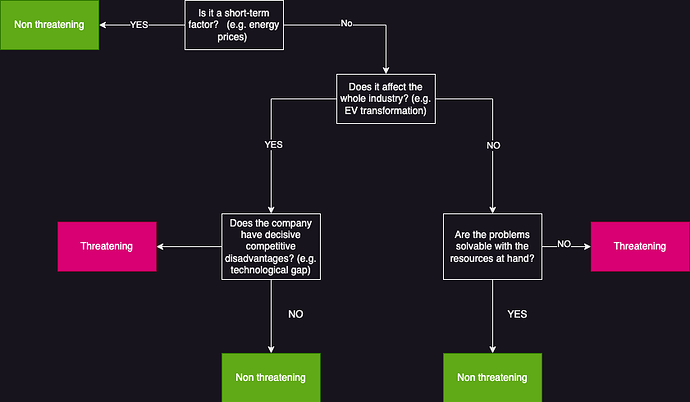

Acceptable scenarios: Given the above-described very attractive valuation the following scenarios are totally acceptable to me and I would use the opportunity in case of falling share prices to increase the position:

- Multiple years (2-3) without profits. In case the automotive market deteriorates heavily it would be fine for me if Volkswagen does not generate any profits for a while if we have a clear sense that old profitability can be achieved again.

- Slowing shrinking profits. If profits shrink a few % per year due to some troubles it would not change my investment thesis. Root causes could be e.g. the transformation to EVs or a growing share of self-driving cars.

Non-acceptable scenarios: If we think the following scenarios are likely I would reconsider my Volkswagen position:

- Company threatening losses. In case Volkswagen gets into a position in which it suffers heavy company-threatening losses due to the macroenvironment or other factors.

- Dramatically different revenue and profitability outlook. In case we think Volkswagen cannot maintain its current profitability due to long-term changes in competition or a different environment coming from regulation, the transformation to EVs or self-driving cars.

What do you think? Do you agree with the usefulness? Is this format sufficient or do you need more/other information to start with?

Which company scenarios should I describe next?