@magaly created a good overview over the debt-ceiling crisis in the wiki.

Discussion and old updates about the debt-ceiling crisis in archived discord thread

Originals posts in archived discord thread

MagalyNH6 — 04/24/2023 7:46 PM

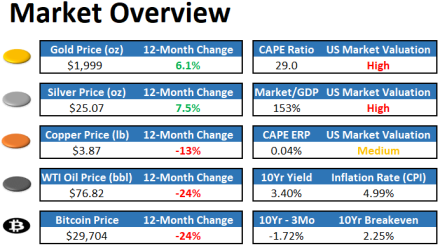

wow that spread between 1 month and 3 month is crazy, 1 month yield at 3.83% does not even makes sense. Probably a combination of a run to safest collateral, yield seeking, could be collateral scarcity too. But the debt ceiling does not seem a good explanation, I don’t think anyone expect the government to not be able to meet its obligations. https://www.wsj.com/articles/debt-ceiling-standoff-warps-treasury-trading-a3d3c383?mod=mhp&reflink=share_mobilewebshare United States Government Bonds - Yields Curve. (edited)

WSJ

Debt-Ceiling Standoff Warps Treasury Trading

The divergence between one-month and three-month bills is the largest on record.

United States Government Bonds - Yields Curve

United States Government Bonds and Yields Curve. Updated charts and tables, agencies ratings, spread comparisons, current prices.

Pirate Captain — 04/25/2023 9:43 AM

Yeah true pretty interesting. Given the short duration the effective yield for that time is low (3.83%/12) so people might decide to just take slightly less money than being caught up in any delay of payment? (I don’t know if that could happen with 3 month durations or not)

April 27, 2023

MagalyNH6 — 04/27/2023 9:30 PM

Interesting that Lyn thinks is possible a short term default.

- [9:30 PM]

4.“A small temporary default would negatively impact the country’s credit worthiness and negatively impact some individual entities that are temporarily defaulted on, while a large permanent default would heavily disrupt the entire system, since Treasuries represent the leveraged foundation that the system is built upon. The latter scenario of a large permanent default is very unlikely, while the former scenario of a temporary default is reasonably possible, given how polarized politics have become and how large the debt and deficits are now.”* April 2023 Newsletter: Navigating the Debt Ceiling Impasse - Lyn Alden

April 2023 Newsletter: Navigating the Debt Ceiling Impasse

April 26, 2023 Latest Article: Implications of Open Monetary and Information Networks The poor tax haul here in April has moved forward the United States’ debt ceiling deadline. It’s now likely to strike in late spring or early summer. This newsletter issue discusses some of the nuances and liquidity implications around this event for investors,…

- [9:37 PM]

She also says that when it is resolve: “Sucking $500 billion of liquidity out of bank reserves to refill the Treasury General Account might not be tenable, and would likely be negative for financial assets.” That would be a negative double-whammy for liquidity if the FED is also doing QT. She says options to manage liquidity and lack of treasury demand:

- Option 1) The Federal Reserve could capitulate, and begin buying Treasuries.

- Option 2) The U.S. Treasury Department could issue a ton of T-bills to refill its general account, rather than issue long-duration bonds. It would likely suck cash out of reverse repos and allow the Treasury to refill its account without damaging commercial bank liquidity

- Option 3) If the dollar weakens enough, then foreign buyers might step back in to buy Treasuries with offshore dollars. The problem is that liquidity-negative conditions usually result in a strong dollar.

1

MagalyNH6 — 04/27/2023 9:38 PM

Options 2 probably seems better.

April 28, 2023

Pirate Captain — 04/28/2023 8:59 AM

Interesting: https://twitter.com/biancoresearch/status/1651005327024717826?s=46&t=5oXkanW-2wRRV8LliD_gUg

Jim Bianco biancoresearch.eth (@biancoresearch)This is a tiny market, with $12 billion of CDS versus $23 trillion of U.S. Treasury debt. No one knows exactly what an “event of default” is, as such an event has not happened in the U.S. in the era of CDS trading. This event is determined by a committee that has not explained…

Likes

898

Retweets

180

Twitter•04/26/2023 1:28 AMMay 1, 2023

MagalyNH6 — 05/01/2023 11:26 PM

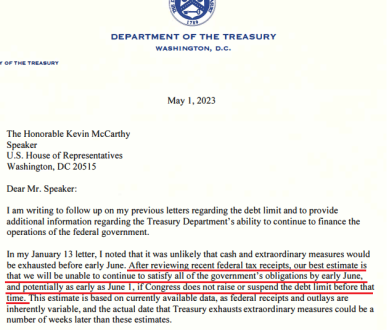

@PiratePirate Captain basically 1 month https://twitter.com/NickTimiraos/status/1653133812040081431?t=EfUEZT7_6YD5fitGsqqG8Q&s=19 (edited)

Nick Timiraos (@NickTimiraos)In a letter, Janet Yellen says the debt-limit “X date” could bind “potentially as early as June 1” https://home.treasury.gov/system/files/136/Debt_Limit_Letter_Congress_Members_05012023.pdf

Likes

212

Twitter•05/01/2023 10:26 PM- [11:28 PM]

I am still not sure what are the consequences of not raising debt ceiling on time

May 4, 2023

Pirate Captain — 05/04/2023 6:28 PM

Me neither….do you think there will be any? (Apart consequences for limited investor groups e.g. in cds)

May 9, 2023

MagalyNH6 — 05/09/2023 7:43 PM

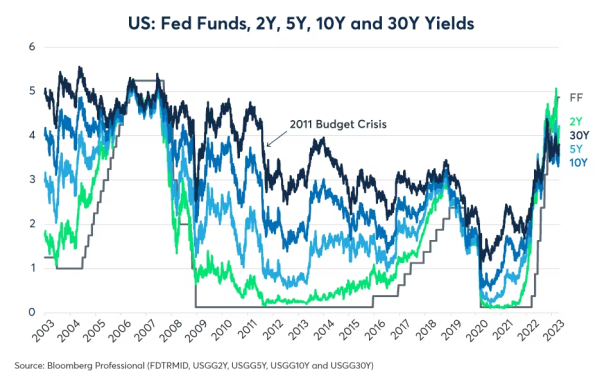

Seems something like this happened in 2011, and it was not good for markets. In 2011 there was not missed payments, only a very late decision, which could also be the case this time . https://twitter.com/KobeissiLetter/status/1655926422941097984?t=3Ci10gxDWdRQcxgHbQK9Rw&s=19 (edited)

The Kobeissi Letter (@KobeissiLetter)The US is 3 weeks away from a possible default. The US Treasury said default could come as soon as June 1st if the debt ceiling is not raised. Even if it is raised, waiting until the last minute would be costly. This happened in 2011, the “most volatile week since 2008.” 1/5

Likes

1078

Retweets

249

Twitter•05/09/2023 3:23 P@Pirate @Pirate Captain

@Pirate Captain

Me neither….do you think there will be any? (Apart consequences for limited investor groups e.g. in cds)

MagalyNH6 — 05/09/2023 7:54 PM

Good explanation of market reaction in 2021, and differences between now and then. Debt Ceiling: Lessons from the 2011 Budget Debate - CME Group (edited)

- [7:55 PM]

- [7:55 PM]

May 13, 2023

Pirate Captain — 05/13/2023 9:38 AM

Both Janet Yellen (1) and Jamie Dimon (2) are warning markets and lawmakers that a failure to raise the debt ceiling would be catastrophic. JPM Morgan has a war room as a precautionary measure to prepare for a potential shortfall that is expected to meet daily from 21. May onwards in case there is no solution. Jamie Dimon states that consumers continuing spending their excess savings and the bite of QE not happening yet but both could change at the end of the year. (14:45) Overall he does not seem to be worried about a mild recession or CRE but he is very concerned about abnormal shifts in geopolitics, trade with china and democracy. (15:45) I completely agree that seismic but slow shifts at those front are way more worrisome and impactful than any medium term economic downturn (1) https://youtu.be/wXdszCz_yUQ (2) https://youtu.be/16ETuu-3EHw (edited)

Janet Yellen on US Debt Ceiling, Banking System, China

JPMorgan CEO Jamie Dimon on Banking Turmoil, First Republic, Deb@MagalyNH6 C…

- @MagalyNH6

Good explanation of market reaction in 2021, and differences between now and then. Debt Ceiling: Lessons from the 2011 Budget Debate - CME Group (edited)

Pirate Captain — 05/13/2023 9:39 AM

what’s the summary of that in 2 sentence@Pirate?

May 15, 2023

@Pirate Captain

@Pirate Captain

what’s the summary of that in 2 sentences?

MagalyNH6 — 05/15/2023 8:20 PM

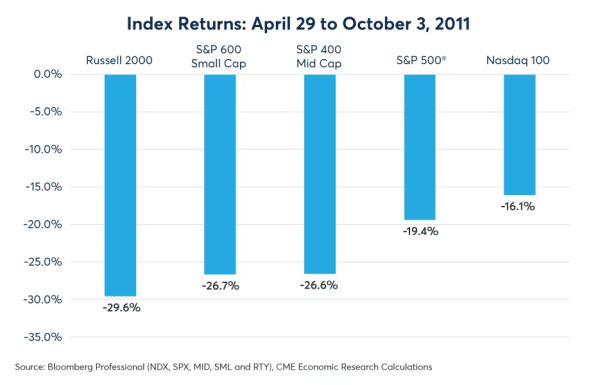

In 2011 there was also an debt ceiling issue in congress, the market had a negative reaction close to the date and even after the decision was made, selling off close to 20%. Yields in long term born also fell pretty dramatically. And gold went up. In 2011 there was only a very late decision, there was not any miss payment. -S&P 500 shed 19.4% of its value. Small and mid-cap stocks fared worse, with the Russell 2000 losing 29.6%, the S&P MidCap 400 falling 26.6% and the S&P SmallCap 600 losing 26.7%. The tech-heavy Nasdaq 100 was the outperformer, losing a relatively low 16.1% peak to trough.

May 16, 2023

MagalyNH6 — 05/16/2023 11:37 PM

Looks like a deal could be close, but who knows, at least they are progressing https://www.youtube.com/watch?v=6jZWavGrqxM (edited)

It appears debt default is off the table after White House meet@Pirateng,…

May 18, 2023

@Pirate Captain

@Pirate Captain

Both Janet Yellen (1) and Jamie Dimon (2) are warning markets and lawmakers that a failure to raise the debt ceiling would be catastrophic. JPM Morgan has a war room as a precautionary measure to prepare for a potential shortfall that is expected to meet daily from 21. May onwards in case there is no solution. Jamie Dimon states that consumers continuing spending their excess savings and the bite of QE not happening yet but both could change at the end of the year. (14:45) Overall he does not seem to be worried about a mild recession or CRE but he is very concerned about abnormal shifts in geopolitics, trade with china and democracy. (15:45) I completely agree that seismic but slow shifts at those front are way more worrisome and impactful than any medium term economic downturn (1) https://youtu.be/wXdszCz_yUQ (2) https://youtu.be/16ETuu-3EHw (edited)

MagalyNH6 — 05/18/2023 7:58 PM

Ray Dalio has been saying he is worried about something similar since some time already, but he also thinks the amount of debt will be a big problem. His changing world order views are drastic but who knows.

MagalyNH6 — 05/18/2023 11:27 PM

Dalio’s opinion What Should Be Done About the Debt Ceiling Argument Between the Democrats and Republicans?

What Should Be Done About the Debt Ceiling Argument Between the Dem…

I was recently asked what I thought of the debt ceiling debate. To answer that question, I will first explain what I think is likely to happen, and then I’ll explain where I am coming from, which will give you background for my explanation of what I think should be done.

May 21, 2023

Pirate Captain — 05/21/2023 7:46 PM

Did anyone of you see a good basic explainer video of the two positions and how exactl@Pirate they differ?

May 22, 2023

@Pirate Captain

@Pirate Captain

Did anyone of you see a good basic explainer video of the two positions and how exactly they differ?

MagalyNH6 — 05/22/2023 7:12 AM

What do you mean by this?

Pirate Captain — 05/22/2023 2:55 PM

Like a summary of the current state of negotiations when it comes to the debt ceiling and the negotiation stances and positions of both parties. I am just curious about it but it would be also important to know how far their positions are still apart from each other (edited)

- [2:58 PM]

So far I’ve read one article that democrats want more taxes in return for some reductions in social spending broadly speaking but a more comprehensive summary and overview would be interesting.

MagalyNH6 — 05/22/2023 10:05 PM

- House Republicans’ plan would increase the US debt ceiling by $1.5 trillion, which would stave off a US payments default until March 31, 2024 at the latest. In exchange, Republicans demand $4.8 trillion in budget deficit cuts over a decade

- The savings in the bill would be achieved by cutting discretionary spending in 2024 by $130 billion to 2022 levels and capping its growth at 1% for a decade. In addition, it would add new work requirements for some Medicaid and increasing them for food stamps and welfare.

- Moody’s Analytics forecast the Republican budget cuts would reduce employment growth by 784,000 jobs through 2024 while a default that stretched on at least six weeks would cost the economy more than 7 million jobs.https://www.bloomberg.com/news/articles/2023-05-04/senate-democrats-slam-gop-debt-limit-plan-as-recession-risk This article explain some of the republicans demands to raise it in more detail. Here’s what’s in the GOP bill to lift the U.S. debt limit | PBS News This video also explain that republicans want spending to stay flat, but want defense spending to increase, which means other domestic spending will need to be cut by about 22%, Something democrats are not willing to concede. (min 0:55) https://www.youtube.com/watch?v=lXj_-7888Vw

PBS NewsHour

Here’s what’s in the GOP bill to lift the U.S. debt limit

The bill has virtually no chance of becoming law, but Republicans hope it will force Biden to the negotiating table on the debt limit.

Debt limit negotiators seemingly miles apart as default deadline nears

1

MagalyNH6 — 05/22/2023 10:19 PM

This videos has a very good point. The economy is already slowing, monetary policy is thigh and now the banking crisis is adding to that, if on top of that there needs to be government spending cuts, the risks and headwinds becomes greater for the economy (min 4:30)

- 2011 the debt ceiling deal had 2 trillion in spending cuts, the market fell after the deal was made to reprice for those cuts in spending and lower economic growth according to the analysthttps://www.youtube.com/watch?v=iTb3J91NFNg (edited)

Debt ceiling debacle: Biden, McCarthy look for deal to avoid default

May 23, 2023

MagalyNH6 — 05/23/2023 12:12 AM

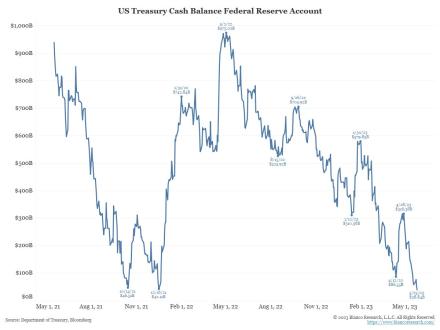

Goldman Says Treasury Will Drop Under Its Cash Minimum June 8-9 https://www.bloomberg.com/news/articles/2023-05-21/goldman-says-treasury-will-drop-under-its-cash-minimum-june-8-9

Goldman Says Treasury Will Drop Under Its Cash Minimum June 8-9

Goldman Sachs Group Inc. economists estimated that the Treasury Department will by June 8 or 9 see its cash levels drop below the $30 billion it’s signaled as a bare minimum for meeting federal obligations falling due.

05/21/2023 10:01 PM

- MagalyNH6

This videos has a very good point. The economy is already slowing, monetary policy is thigh and now the banking crisis is adding to that, if on top of that there needs to be government spending cuts, the risks and headwinds becomes greater for the economy (min 4:30)

- 2011 the debt ceiling deal had 2 trillion in spending cuts, the market fell after the deal was made to reprice for those cuts in spending and lower economic growth according to the analysthttps://www.youtube.com/watch?v=iTb3J91NFNg (edited)

MagalyNH6 — 05/23/2023 2:35 AM

I found this tweet with the latest developments https://twitter.com/JacquiHeinrich/status/1660764467305627649?t=aUmpP2ocqIqina9wMFx_Ww&s=19 (edited)

Jacqui Heinrich (@JacquiHeinrich)Debt limit update ahead of Biden/McCarthy meeting: -WH offered 2023 baseline with 0% increase for 2024, then 1% for 2025. WH wants 2 yr-caps -GOP wants FY 2022 levels, 1% increase per year with 10 yrs of caps

- possible compromise being floated: FY 2022, adjusted for inflation

Likes

508

Retweets

166

Twitter•05/22/2023 11:47 PM1

May 24, 2023

- @Pirate

MagalyNH6 — 05/24/2023 11:14 PM

@Pirate Captain Have heard some interviews today, and they obv blame each other for not being close to the deal. I think the deal could be made when their is more panic unfortunately https://www.youtube.com/watch?v=Cd_tib7wjW4 (edited)

Debt ceiling negotiations are not getting any closer to reaching a …

May 25, 2023

MagalyNH6 — 05/25/2023 6:56 PM

Fitch Places United States’ ‘AAA’ on Rating Watch Negative https://www.fitchratings.com/research/sovereigns/fitch-places-united-states-aaa-on-rating-watch-negative-24-05-2023

MagalyNH6 — 05/25/2023 10:53 PM

https://twitter.com/KobeissiLetter/status/1661834461162381319

The Kobeissi Letter (@KobeissiLetter)The US Treasury’s cash balance is now down to a fresh low of $49 billion. Meanwhile, Nvidia, $NVDA, just added over $200 billion in market cap in one day. When a tech stock is adds 4 times the US cash balance in market cap in 1 day, something is wrong. The US Treasury’s cash…

Likes

209

T@MagalyNH6itter•05/25/2023 10:39 PMMay 26, 2023

- @MagalyNH6

This videos has a very good point. The economy is already slowing, monetary policy is thigh and now the banking crisis is adding to that, if on top of that there needs to be government spending cuts, the risks and headwinds becomes greater for the economy (min 4:30)

- 2011 the debt ceiling deal had 2 trillion in spending cuts, the market fell after the deal was made to reprice for those cuts in spending and lower economic growth according to the analysthttps://www.youtube.com/watch?v=iTb3J91NFNg (edited)

Pirate Captain — 05/26/2023 8:47 AM

Very good point indeed. On the flip side If the Fed gets more support from the fiscal side on fighting inflation it might be able to lower interest rates sooner. An environment with less fiscal spend@Pirateng and less interest rates is obvs. more healthy

@Pirate Captain

@Pirate Captain

Very good point indeed. On the flip side If the Fed gets more support from the fiscal side on fighting inflation it might be able to lower interest rates sooner. An environment with less fiscal spending and less interest rates is obvs. more healthy

MagalyNH6 — 05/26/2023 6:04 PM

I don’t know an economy that needs rates near zero is not healthy. But would be interesting to see if they are able to stay at 3% or something like that. I also what I fear about inflation is it will be coming down because of a recession. After economic@MagalyNH6recovery it will have the risks to pick back up again.

- @MagalyNH6

I don’t know an economy that needs rates near zero is not healthy. But would be interesting to see if they are able to stay at 3% or something like that. I also what I fear about inflation is it will be coming down because of a recession. After economic recovery it will have the risks to pick back up again.

Pirate Captain — 05/26/2023 6:06 PM

I think it really depends on the circumstances. If there are large productivity gains like in the years before covid which frees up working capacity you can stimulate a healthy growing economy further with very low interest rates. The same could happen if there is a sustained ai revolution which will be deflationary. (edited)

- [6:06@PiratePM]

Do we your inflation assessment somewhere in an article?

@Pirate Captain

@Pirate Captain

I think it really depends on the circumstances. If there are large productivity gains like in the years before covid which frees up working capacity you can stimulate a healthy growing economy further with very low interest rates. The same could happen if there is a sustained ai revolution which will be deflationary. (edited)

MagalyNH6 — 05/26/2023 6:45 PM

I am not sure I understand your reasoning, an economy that have productivity gains, dont need lower rates to stimulate it, is actually the contrary. Allowing lower rates when is not needed only causes a lot of malinvestment and insolvent companies to survive thanks to easy money. You will see ridiculous valuations in companies that don’t deserve it. It is also healthy to have safer investment options that offer a good return, because it don’t stimulate the amount of speculation and risks taking we saw during the last decade from institutions that needs yield to survive. And Having rates at near zero don’t allow the FED to do monetary policy as it should when the economy slows, it limits it reaction , that’s why they had to do those ridiculous amounts of QE that is way more ineffective in getting to the real economy than rates.

MagalyNH6 — 05/26/2023 7:09 PM

I also looked about productivity in the US, because I have heard is actually been bad even with all the technology, and it has been indded: “In the past 15 years, productivity growth has averaged just 1.4 percent, even as incredible advances in digital technology put a supercomputer in every pocket. This state of affairs is well known. It is also not confined to the United States. Most OECD countries have seen a drop in labor productivity growth since 2005” https://www.mckinsey.com/mgi/our-research/rekindling-us-productivity-for-a-new-era#at-a-glance

Rekindling US productivity for a new era

Boosting US productivity growth represents a $10 trillion opportunity needed to confro@MagalyNH6t workforce shortages, debt, inflation, and the energy transition.

- @MagalyNH6

I am not sure I understand your reasoning, an economy that have productivity gains, dont need lower rates to stimulate it, is actually the contrary. Allowing lower rates when is not needed only causes a lot of malinvestment and insolvent companies to survive thanks to easy money. You will see ridiculous valuations in companies that don’t deserve it. It is also healthy to have safer investment options that offer a good return, because it don’t stimulate the amount of speculation and risks taking we saw during the last decade from institutions that needs yield to survive. And Having rates at near zero don’t allow the FED to do monetary policy as it should when the economy slows, it limits it reaction , that’s why they had to do those ridiculous amounts of QE that is way more ineffective in getting to the real economy than rates.

Pirate Captain — 05/26/2023 7:43 PM

Yes your right with all those things. Specifically before corona there has been a lot of discussion if the Phillips Curve was broken because there was consistent low unemployment, yet no inflationary pressures. I think (but am not sure) that the main reason for that has been productivity gains in the form of increasing software use and automation. So even though unemployment was low there was no pressure of wages as employers could substitute employees at a sufficient pace with software. Given that inflation was low central banks stimulated the economy with low interest rates. The same could happen again if there are productivity gains from Ai. (Which is bad for empl@MagalyNH6yees and wages and therefore disinflationary but great for companies) (edited)

- @MagalyNH6

I also looked about productivity in the US, because I have heard is actually been bad even with all the technology, and it has been indded: “In the past 15 years, productivity growth has averaged just 1.4 percent, even as incredible advances in digital technology put a supercomputer in every pocket. This state of affairs is well known. It is also not confined to the United States. Most OECD countries have seen a drop in labor productivity growth since 2005” https://www.mckinsey.com/mgi/our-research/rekindling-us-productivity-for-a-new-era#at-a-glance

Pirate Captain — 05/26/2023 7:52 PM

Hmm interesting. Maybe another trend in addition to productivity gains which lowered inflation has been internationalization and outsourcing. Maybe there has been something else. To look at what happened in those years before covid should be part of our long term inflation predictions research. (Low Prio) (The whole Inflation topic i@Pirate so large i think it should be either a project or get it’s own tag on linear) (edited)

@Pirate Captain

@Pirate Captain

Yes your right with all those things. Specifically before corona there has been a lot of discussion if the Phillips Curve was broken because there was consistent low unemployment, yet no inflationary pressures. I think (but am not sure) that the main reason for that has been productivity gains in the form of increasing software use and automation. So even though unemployment was low there was no pressure of wages as employers could substitute employees at a sufficient pace with software. Given that inflation was low central banks stimulated the economy with low interest rates. The same could happen again if there are productivity gains from Ai. (Which is bad for employees and wages and therefore disinflationary but great for companies) (edited)

MagalyNH6 — 05/26/2023 8:13 PM

Yes, I understand your point now, Productivity gains would have helped the economy to grow, and it was not the case, it remained very subdued. I have always though it was a mistake to continue trying to stimulate with ever lower rates if it was not working, they should have stop and try to fix what it was broken, because the economy was actually not growing as expected. From my understanding for why the curve was broken, it that even though they were doing zero rates and QE, the stimulus was funneled mostly to the financial markets and was not getting to the real economy , so inflation, growth, wages remained relatively low due to it. If you compare real econ@Piratemic growth with how the stock market did during that time, there is a huge mismatch. (edited)

@Pirate Captain

@Pirate Captain

Hmm interesting. Maybe another trend in addition to productivity gains which lowered inflation has been internationalization and outsourcing. Maybe there has been something else. To look at what happened in those years before covid should be part of our long term inflation predictions research. (Low Prio) (The whole Inflation topic is so large i think it should be either a project or get it’s own tag on linear) (edited)

MagalyNH6 — 05/26/2023 8:30 PM

I just think inflation was low because economic growth was low, but there can definite@MagalyNH6y be some additional factors that added to it. It will be interesting to understand all of them.

1

- @MagalyNH6

Yes, I understand your point now, Productivity gains would have helped the economy to grow, and it was not the case, it remained very subdued. I have always though it was a mistake to continue trying to stimulate with ever lower rates if it was not working, they should have stop and try to fix what it was broken, because the economy was actually not growing as expected. From my understanding for why the curve was broken, it that even though they were doing zero rates and QE, the stimulus was funneled mostly to the financial markets and was not getting to the real economy , so inflation, growth, wages remained relatively low due to it. If you compare real economic growth with how the stock market did during that time, there is a huge mismatch. (edited)

Pirate Captain — 05/26/2023 8:57 PM

To which period are you referring here before covid or during covid? Your argument is certainly true. We saw inflation in investment assets for a while not in the real economy. I am not sure if it fully explains the Phillips Curve though. According to the Phillips curve wages and inflations should have risen in the years before covid simply given the fact that the labor market was already tight and irrespective of the additional monetary stimulus in form of cheap money. (Cooperations have been doing very well and have been expanding and had the money to continue hiring) I think what we saw for sure is a shift in the economy from small business to large cooperations like Amazon and other Fangs and therefore an increasing need for highly skilled software engineers while regular people who operated e.g. stores went out of business. That constant job loss could have compensated for job gains in other sectors and could have kept inflation subdued. Another argument again could have been internationalization. Given that it is cheaper to produce abroad and companies are moving jobs and gdp abroad it is very challenging for an developed country to have to same growth rates as in earlier decades when internationalization ha@MagalyNH6 been less strong and internationalization is causing domestic unemployment which is limiting wage pressures

- @MagalyNH6

I just think inflation was low because economic growth was low, but there can definitely be some additional factors that added to it. It will be interesting to understand all of them.

Pirate Captain — 05/26/2023 8:59 PM

Yes it would certainly be great and one of our goals to model out inflation correctly. I just double checked and we already have the inflation tag under the macro category in Linear. That helps to organize all relate@Pirate issues already. I also just created a full backlog project “Inflation modeling” that can be started at a later stage

@Pirate Captain

@Pirate Captain

To which period are you referring here before covid or during covid? Your argument is certainly true. We saw inflation in investment assets for a while not in the real economy. I am not sure if it fully explains the Phillips Curve though. According to the Phillips curve wages and inflations should have risen in the years before covid simply given the fact that the labor market was already tight and irrespective of the additional monetary stimulus in form of cheap money. (Cooperations have been doing very well and have been expanding and had the money to continue hiring) I think what we saw for sure is a shift in the economy from small business to large cooperations like Amazon and other Fangs and therefore an increasing need for highly skilled software engineers while regular people who operated e.g. stores went out of business. That constant job loss could have compensated for job gains in other sectors and could have kept inflation subdued. Another argument again could have been internationalization. Given that it is cheaper to produce abroad and companies are moving jobs and gdp abroad it is very challenging for an developed country to have to same growth rates as in earlier decades when internationalization has been less strong and internationalization is causing domestic unemployment which is limiting wage pressures

MagalyNH6 — 05/26/2023 10:21 PM

Yes, I am talking about before covid, after covid there was huge fiscal stimulus, that did in fact overstimulate the economy instead. But we had zero rates most of the 2010s, so cheap money was there since the financial crisis, and QE in some instances too. In my opinion zero rates allow all this resources for financial markets and more importantly to questionable companies that in part due to this they were able to hire employees, but their productivity was very bad, because it was not being translate it into more growth or higher wages. They continue to add more and more debt, to generate very low output. Same is happening to the US as a country.

Is true that internationalization probably played a huge role in keeping wages pressures low, but more important in big companies. Still to this day small businesses combined continue to be the largest employer in the US, and almost half of GDP is coming from them. Small business had much less access to outside labor before, but the trend has been changing

- [10:22 PM]

Probably more off topic, but the phillips curve has a lot of criticism from today economist arguing such correlation is flaw, so I would not take it that should be 100% accurate always. The FED is always criticized too that they continue to use it in their models https://www.cato.org/cato-journal/winter-2020/phillips-curve-poor-guide-monetary-policy#how-a-nbsp-broken-theory-is-still-guiding-policy

- [10:27 PM]

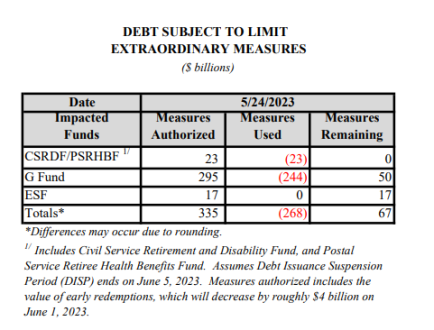

https://twitter.com/biancoresearch/status/1662192942851805184

Jim Bianco biancoresearch.eth (@biancoresearch)Wall Street was correct all along. June 1 is NOT the x-date. Crossing now *YELLEN ESTIMATES DEBT-LIMIT MEASURES WILL RUN OUT BY JUNE 5 ---- Also: *TREASURY CASH PILE DROPPED TO $38.8B THURS@MagalyNH6AY, LEAST SINCE 2017 *US HAS JUST $67B OF EXTRAORDINARY MEASURES LEFT UNDER DEBT-CAP

Twitter•05/26/2023 10:24 PM1

- @MagalyNH6

Yes, I am talking about before covid, after covid there was huge fiscal stimulus, that did in fact overstimulate the economy instead. But we had zero rates most of the 2010s, so cheap money was there since the financial crisis, and QE in some instances too. In my opinion zero rates allow all this resources for financial markets and more importantly to questionable companies that in part due to this they were able to hire employees, but their productivity was very bad, because it was not being translate it into more growth or higher wages. They continue to add more and more debt, to generate very low output. Same is happening to the US as a country. Is true that internationalization probably played a huge role in keeping wages pressures low, but more important in big companies. Still to this day small businesses combined continue to be the largest employer in the US, and almost half of GDP is coming from them. Small business had much less access to outside labor before, but the trend has been changing

Pirate Captain — 05/26/2023 10:50 PM

Interesting take. Similarly to you i heard a lot about zombie companies but i actually never saw one given that my investment focus has always been on exciting new technologies and evolving markets and i did not study a lot of legacy or “value” businesses. I think as we are evolving and on the road to research excellence it becomes increasingly important to structure and orchestrate our work correctly. Therefore i think we should create a backlog tasks for that “Zombie Companies” topic and structure it under the Macro->GDP label. Some of the questions that i have in mind:

- Which (publicly listed) companies are examples of Zombie companies? Are there curated lists of them online?

- Is there (detailed) research indicating that those companies produces a drag on GDP growth? If yes what is the quality level of this research and how much can we incorporate it in our thinking?

- Are there studies indicating productivity losses when money becomes too cheap even if inflation is not rising? (In an overheated economy that is certainly the case. Rising interest rates have the function of shaking out bad companies and freeing up worker capacity for good companies)

- How many of those companies are facing default in the current interest rate environment?

- Our research so far indicated that corporates are in a strong state. Did we miss anything? Are those type of unsustainable companies relatively rare?As always the main goal is to differentiate between signal and noise and reach an in depth and nuanced understanding of the situation that allows us to form our own opinions of the situation and see if there are real problems are just talk. Note: My take on the topic is that it should be backlog as i see the risk as relatively small. If you have another take feel free to reprioritize. Eventually i see this research as part of a Corporate Health:U.S article. (Or slightly differently structured if you think that fits better)

- [10:53 PM]

I think that article should also contain all the other important elements which we alr@MagalyNH6ady researched like all kinds of debt ratios e.g. debt to ebitda or interest cover and data on corporate profitability, margins etc.

- @MagalyNH6

Probably more off topic, but the phillips curve has a lot of criticism from today economist arguing such correlation is flaw, so I would not take it that should be 100% accurate always. The FED is always criticized too that they continue to use it in their models https://www.cato.org/cato-journal/winter-2020/phillips-curve-poor-guide-monetary-policy#how-a-nbsp-broken-theory-is-still-guiding-policy

Pirate Captain — 05/26/2023 10:54 PM

Yes i heard that as well but think the co@Piraterelation is deeply logical. At one point i want to reach a state at which we can judge things like that ourselves. (That’s even more backlog)

@Pirate Captain

@Pirate Captain

Interesting take. Similarly to you i heard a lot about zombie companies but i actually never saw one given that my investment focus has always been on exciting new technologies and evolving markets and i did not study a lot of legacy or “value” businesses. I think as we are evolving and on the road to research excellence it becomes increasingly important to structure and orchestrate our work correctly. Therefore i think we should create a backlog tasks for that “Zombie Companies” topic and structure it under the Macro->GDP label. Some of the questions that i have in mind:

- Which (publicly listed) companies are examples of Zombie companies? Are there curated lists of them online?

- Is there (detailed) research indicating that those companies produces a drag on GDP growth? If yes what is the quality level of this research and how much can we incorporate it in our thinking?

- Are there studies indicating productivity losses when money becomes too cheap even if inflation is not rising? (In an overheated economy that is certainly the case. Rising interest rates have the function of shaking out bad companies and freeing up worker capacity for good companies)

- How many of those companies are facing default in the current interest rate environment?

- Our research so far indicated that corporates are in a strong state. Did we miss anything? Are those type of unsustainable companies relatively rare? As always the main goal is to differentiate between signal and noise and reach an in depth and nuanced understanding of the situation that allows us to form our own opinions of the situation and see if there are real problems are just talk. Note: My take on the topic is that it should be backlog as i see the risk as relatively small. If you have another take feel free to reprioritize. Eventually i see this research as part of a Corporate Health:U.S article. (Or slightly differently structured if you think that fits better)

MagalyNH6 — 05/26/2023 11:34 PM

I am about to go out, I will review this later. Just wanted to share that bankruptcies is already at highest levels since 2010. So it could be that you indeed focus so much in the good part of businessi, that missed the other part. These numbers are even rising before a recession hit. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/april-adds-54-more-us-corporate-bankruptcies-2023-filings-highest-since-2010-75543160 (edited)

April adds 54 more US co@MagalyNH6porate bankruptcies; 2023 filings highest …

Monthly filings slowed from March, though the pace was still quicker than much of 2021 and 2022.

1

- @MagalyNH6

I am about to go out, I will review this later. Just wanted to share that bankruptcies is already at highest levels since 2010. So it could be that you indeed focus so much in the good part of businessi, that missed the other part. These numbers are even rising before a recession hit. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/april-adds-54-more-us-corporate-bankruptcies-2023-filings-highest-since-2010-75543160 (edited)

Pirate Captain — 05/26/2023 11:36 PM

Ok sure. Will go to sleep as well. Those bankruptcy sources could also added to the same article. The cool thing is that we see the amount of outstanding liabilities and on the grand scale of things they look very small and healthy. (To see bankruptcies rising was obvs. expected in the current environment)

- [11:38 PM]

We c@Pirateuld double check the companies with liability larger than 1billion to get a better sense of how much larger than 1 billion and which industries are affected

@Pirate Captain

@Pirate Captain

Ok sure. Will go to sleep as well. Those bankruptcy sources could also added to the same article. The cool thing is that we see the amount of outstanding liabilities and on the grand scale of things they look very small and healthy. (To see bankruptcies rising was obvs. expected in the current environment)

MagalyNH6 — 05/26/2023 11:51 PM

Yes, but the point is that those companies that are depending on cheap money do exist, they are having problems, so not all corporate is strong at the moment. But also I don’t see any great risks coming from it, more than unemployment rising at some point, and maybe private equityb To me that fact that they have to closed or restructure is healthy for the economy, since it will elimite those unproductive use of capital that have existed for years. (edited)

May 27, 2023

Pirate Captain — 05/27/2023 7:16 AM

Hmm for me the deciding factor I always to figure out at which scale something exists to understanding if it is relevant or not. So if it exists only at a very small level it does not have an impact on GDP productivity, the way we should think about the economy and no risks is coming from it. In that case it would be noise that some people talked about before without being relevant. (People talk about not relevant things because a) they don‘t understand the scale of things themselves or b) it makes a good argument and brings them attention) Are you going to create the proposed Linear Issue? Even though if we@Pirateagree a topic is not highest priority i like to prestructure work and eventually answer open questions and understand things as a large research org and community

@Pirate Captain

@Pirate Captain

Hmm for me the deciding factor I always to figure out at which scale something exists to understanding if it is relevant or not. So if it exists only at a very small level it does not have an impact on GDP productivity, the way we should think about the economy and no risks is coming from it. In that case it would be noise that some people talked about before without being relevant. (People talk about not relevant things because a) they don‘t understand the scale of things themselves or b) it makes a good argument and brings them attention) Are you going to create the proposed Linear Issue? Even though if we agree a topic is not highest priority i like to prestructure work and eventually answer open questions and understand things as a large research org and community

MagalyNH6 — 05/27/2023 11:50 PM

Yes, I agree. Also about my point about productivity, it not only implied zombie companies. Having bad productivity, or not being able to have the best productive use of debt is not only exclusive for these type of companies. And yes, I will create the linear issue.

1

May 29, 2023

MagalyNH6 — 05/29/2023 8:10 PM

The potential debt ceiling deal seems that will be way better than expected in terms on spending cuts, cuts are just 0.2% of GDP. But will definitely not help at all with the debt problem. Which is probably a bigger problem long term.

- Cap will be unlimited until 2025, this seems dangerous, in case of a bad recession they will be able to borrow an unlimited amount, making it even more unsustainablehttps://twitter.com/KobeissiLetter/status/1662650989873098753 (edited)

SUMMARY OF DEBT CEILING DEAL:

- Debt ceiling to be raised for 2 years

- Cuts spending by $50 billion

- $10 billion of new IRS funding clawed back

- No budget caps after 2025

- No new taxes or government programs

- Boost in defense and VA spending

- Domestic program…

Likes

3068

Retweets

832

Twitter•05/28/2023 4:44 AM1

May 31, 2023

MagalyNH6 — 05/31/2023 12:09 AM

https://twitter.com/KobeissiLetter/status/1663529692266209281

The Kobeissi Letter (@KobeissiLetter)Interesting note by Goldman Sachs today: In the debt ceiling deal inflation adjusted spending actually RISES next year. This means the debt deal will not only push total US debt above $35 trillion, but real spending actually RISES. Here’s a breakdown of why. (a thread) 1/5

Likes

1286

Retweets

311

Twitter•05/30/2023 2:56 PM1

June 1, 2023

MagalyNH6 — 06/01/2023 3:41 AM

https://twitter.com/keithboykin/status/1664081256731246592

Keith Boykin (@keithboykin)The House has passed a bill (314-117) lifting the debt ceiling until 2025. The bill now goes to the Senate.

Twitter•06/01/2023 3:27 AMIn case there are any last thoughts or updates on the topic let’s use the topic here in the forum.