The yen carry trade is a popular investment strategy that involves borrowing in Japanese yen at low-interest rates to invest in higher-yielding assets in other currencies. This strategy takes advantage of the low borrowing costs in Japan, where interest rates have been very low since the 90’s, and seeks to profit from the difference in interest rates between Japan and other countries.

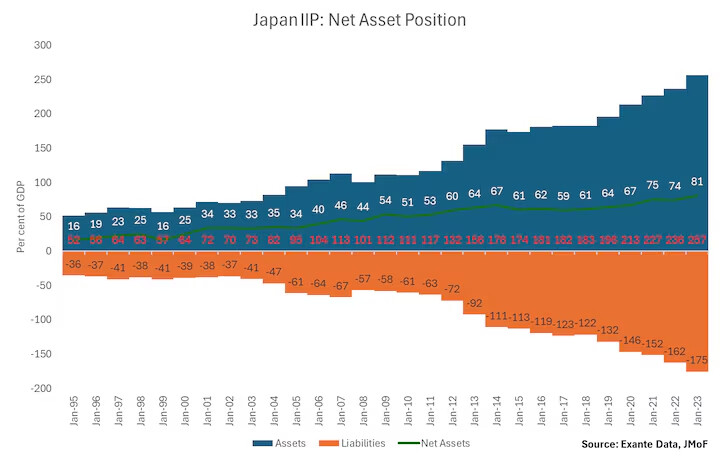

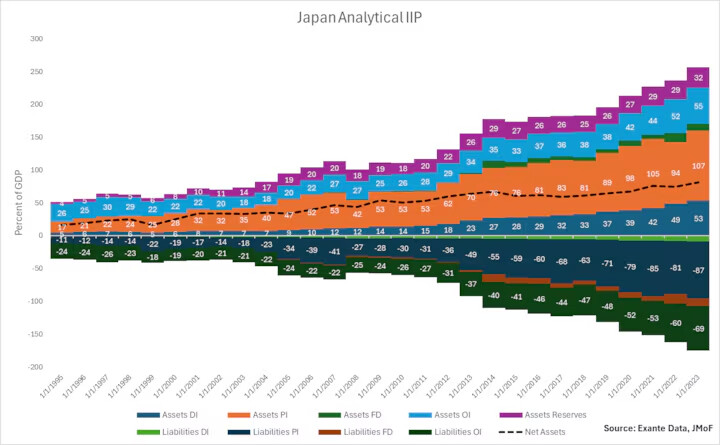

Japanese assets and investments held by foreigners to the tune of 471.3 trillion yen, MOF figures show.

- That’s $3.36 trillion at Dec. 31 exchange rates** and marks an increase of 51.3 trillion yen, or $366.5 billion, from a year earlier. It’s also a record 84.3% of GDP, up sharply from 76.6% a year earlier and a reminder of Japan’s muscle on the global financial stage.

- Exchange rate moves boosted Japan’s overall international investment position by 59.23 trillion yen, or $423 billion, and net asset buying in the broadest terms lifted it by $166.5 billion. These effects were offset by $223 billion of “other changes” such as mark-to-market changes in asset prices.

- Of the 86.1 trillion yen or $615 billion increase in the value of Japan’s portfolio investments abroad last year, around 40% was due to exchange rate moves, almost a third a result of “other changes”, and only 20% from actual asset purchases.

https://www.reuters.com/markets/asia/japan-keep-record-wealth-overseas-mcgeever-2024-05-30/

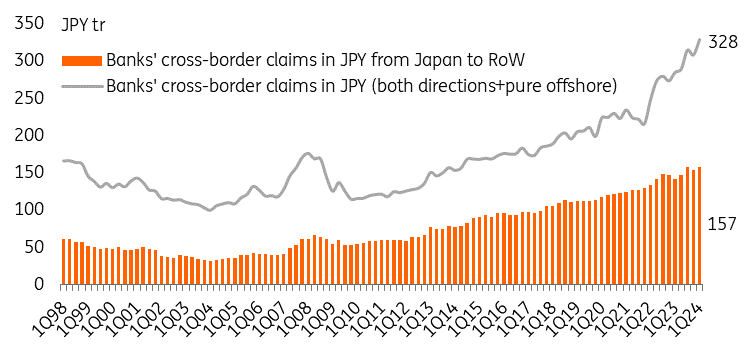

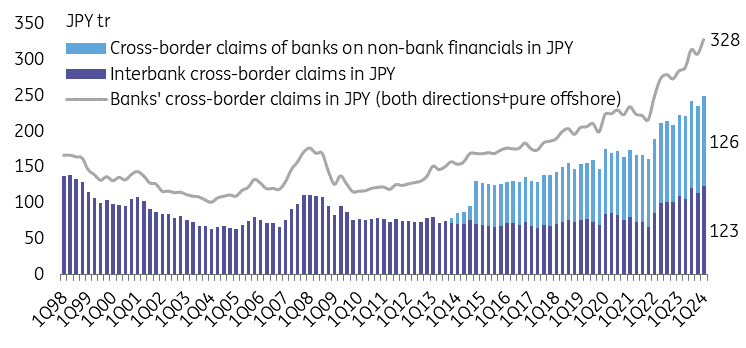

Yen carry trade (by foreign investors) could be about 1 Trillion dollars, according to BIS data,

- Banks’ JPY-denominated cross-border claims reached JPY328tr (US$2.2tr equivalent) as of the end of March 2024, showing a 52% (US$742bn equivalent net of FX revaluation effect) increase compared to the end of 2021. Meanwhile, the headline numbers cover a sum of cross-border lending in opposing directions, i.e. from and to Japan, as well between parties outside of the Japanese currency area.

- Cross-border loans originating in Japan should be the most relevant for the carry trade. The amount of such loans outstanding is JPY157tr (US$1.0tr equivalent) as of March 2024, and the growth compared to 2021 is 21% (US$181bn equivalent net of FX revaluation effect)

Additional details about the Yen carry trade size from the Bank of International Settlements head of research

On-balance sheet yen lending is not the only way that a carry trade could be constructed, FX swaps are also important in the construction of carry trades

- The size of FX swaps between dollars and yen stands at around 14 trillion dollars

In an FX swap, a lender provides dollars in return for yen, with a promise to repay the yen at an agreed exchange rate when the swap matures

The dollar provider who receives yen will normally park the yen proceeds in a safe yen asset - say in short-term JGBs. However, the yen proceeds could potentially be sold in the spot market for dollars, leaving the dollar provider with a yen obligation that is unhedged

This is a carry trade that is not captured in the BIS data

So, the 1 trillion dollar on-balance sheet* loan data from the BIS is likely to be capturing only a small portion of the yen carry trade.

Assessment: I continue to think Monday’s sell-off was just a very small part of the unwound of this carry trade, probably positions that got into it last and that got a margin call due to the recent yen appreciation (yen is still at 2023 levels) and rate increases.

I also don’t expect the whole 14 trillion to be a carry trade either, but probably a significant portion of it is.

For the time being the BOJ seems to have backed out from more rate hikes soon due to Monday’s reaction.

“I believe that the bank needs to maintain monetary easing with the current policy interest rate for the time being, with developments in financial and capital markets at home and abroad being extremely volatile,” Uchida said in a speech Wednesday to local business leaders in Hakodate, northern Japan.

Interesting sources cited, that would be interesting to understand better at some point: