This topic summarizes weekly macro briefings by firms such as BlackRock, Wells Fargo, JP Morgan, Charlie Bilello, Ed Yardeni e.t.c.

Weekly Macro Brief Week Ending June 23, 2025

- Tariff-driven inflation lag ending: With the effective tariff rate now at around 14.6 %, J.P. Morgan AM and Wells Fargo expect the delayed pass-through to push core PCE above 3 % in Q4, threatening to postpone Fed easing.

- Two Fed cuts pencilled in, but strictly data-dependent: The FOMC kept rates at 4.25 – 4.50 % and still signals two cuts for 2025, yet Chair Powell stressed that the path hinges on incoming inflation and labour data (Wells Fargo; Charlie Bilello; J.P. Morgan AM).

- Energy-supply risk back, but capped: Israeli strikes on Iran lifted oil +10 %; a Hormuz shutdown could send Brent > $100, though ample OPEC+ spare capacity and U.S. shale may limit a prolonged spike (J.P. Morgan WM; BlackRock).

- Growth mixed: strong headline, soft under-the-hood: Net-export reversal from tariff front-running keeps Q2 GDP tracking > 3 %, yet May retail sales –0.9 % and industrial output –0.2 % reveal cooling momentum (Wells Fargo; Charlie Bilello).

- Defense boom & China détente cushion sentiment: The EU’s 3.5 %-of-GDP defense push and a limited U.S.–China deal (visas, rare-earths, lighter export curbs) reduce supply-chain risk and help steady the USD (–9 % YTD) (BlackRock BII; J.P. Morgan WM).

Weekly Macro Brief Week Ending July 7, 2025

- Tariff fog returns, but shock delayed: The July 9 deadline to reinstate suspended “reciprocal tariffs” passed with no escalation; only two countries (UK, Vietnam) secured deals. The administration appears to be unofficially extending the pause to August 1, preserving uncertainty for Q3 CPI, earnings margins, and global supply chains. (Wells Fargo, J.P. Morgan AM, BlackRock)

- Labor market is cooling slowly: June added +147K jobs, but ~50% of gains came from state/local government. Private sector hiring is weak, and continuing claims are at 3-year highs. The Fed is unlikely to cut in July, but a September or December cut remains plausible as wage inflation stabilizes and hiring broadens. (Wells Fargo, Merrill/BofA, Charlie Bilello)

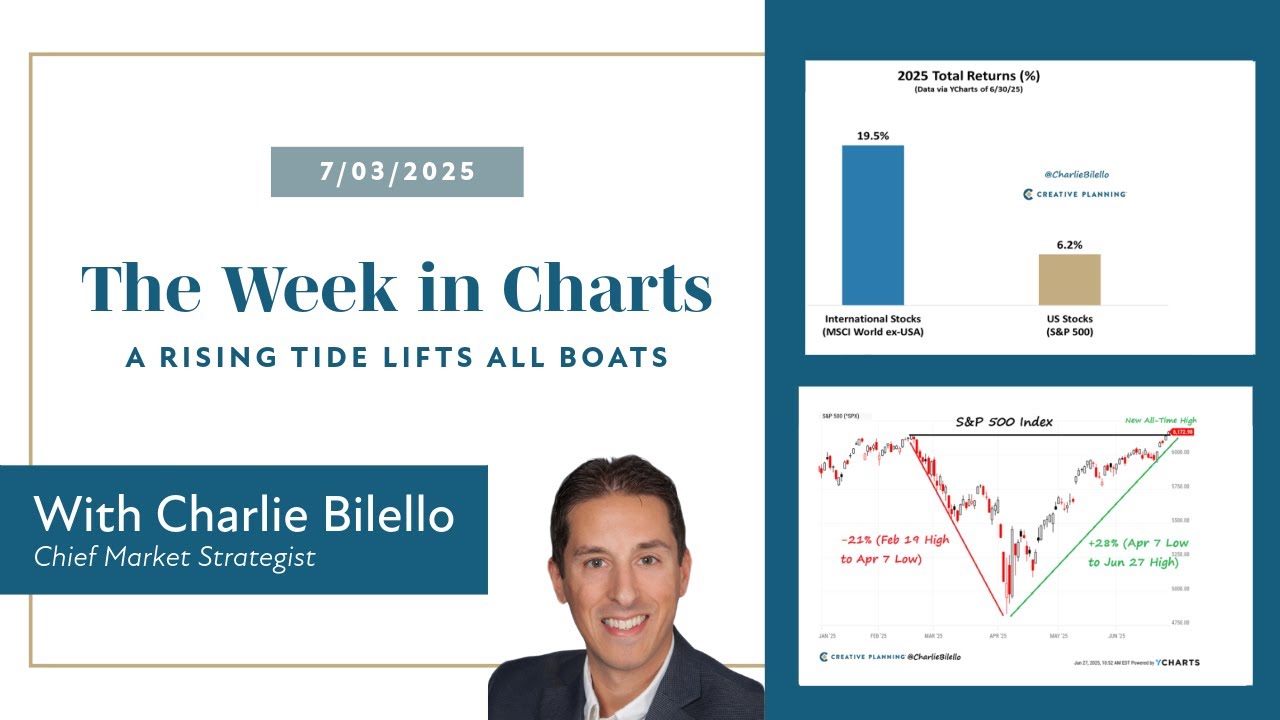

- V-shaped recovery broadens: The S&P 500 is up +30% off the April 8 lows, fully retracing the tariff drawdown. Small caps and broader sectors are now contributing. Yardeni sees S&P 6,500-7,000 as plausible in a melt-up driven by valuation expansion and AI-led growth momentum. (Ed Yardeni, Charlie Bilello)

- Weakening dollar shifts leadership – but Yardeni dissents: The DXY dollar index is down ~7% YTD, fueling an 8.4% FX boost to non-U.S. equity returns and helping drive a *19% YTD return for MSCI ACWI ex-U.S. JPMorgan sees structural risks to U.S. capital flows and further downside in the dollar. Yardeni disagrees, arguing that deep U.S. capital markets, global reserve demand, and competitive advantages still provide fundamental support; he is not bearish on the dollar despite the consensus. (J.P. Morgan AM, Charlie Bilello, Ed Yardeni)

Sources:

Wells Fargo Weekly Economic & Financial Commentary

BlackRock Weekly Commentary

J.P. Morgan: The Investment Implications of a Falling Dollar

Merril Lynch: Capital Market Outlook

Weekly Macro Brief Ending July 14, 2025

- Tariff impact is a slow-fuse risk, not fully priced in: Wells Fargo estimates effective U.S. tariff rate is set to jump from around 16% to around 22% by August 1, driven by new country and sector-level hikes. CPI effects are just beginning; full passthrough could hit by Q3–Q4.

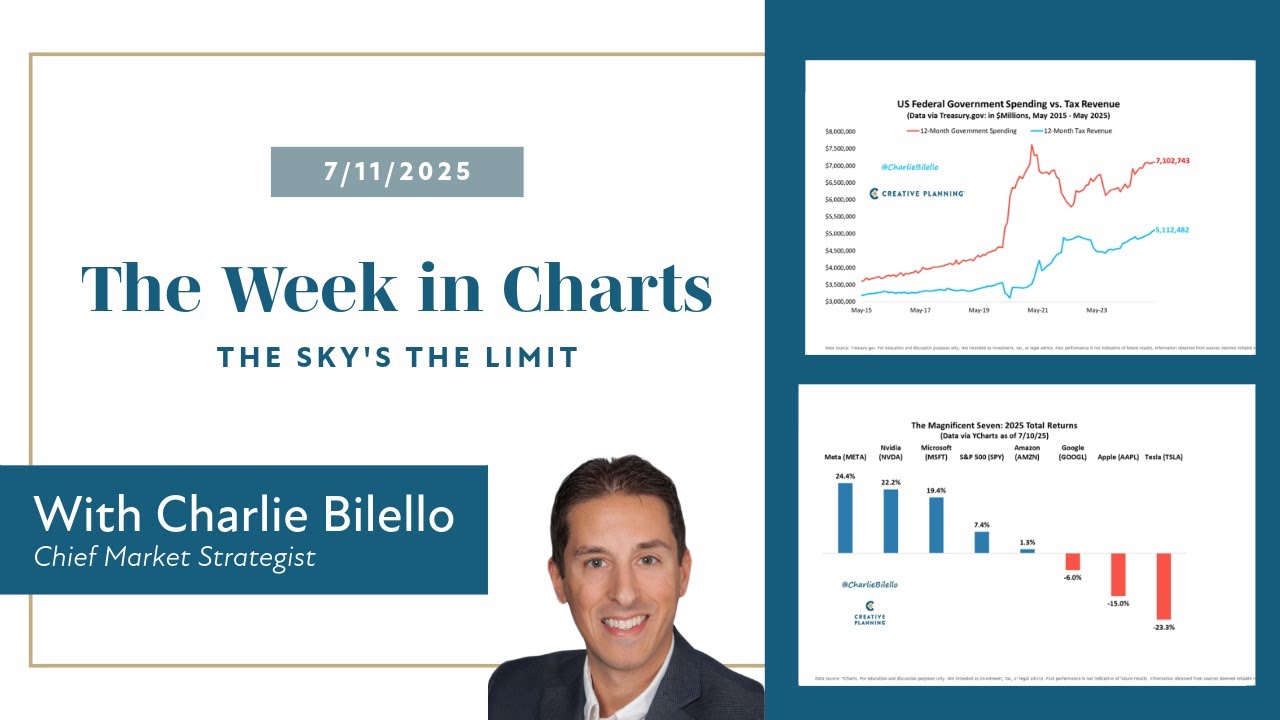

- The fiscal picture is worsening despite rising tariff revenues: The deficit is rising faster than expected. Charlie Bilello and Ed Yardeni highlighted that U.S. debt surged $410B in one week post-OBBB Act passage, and that much of the Treasury’s new financing is concentrated in short-term bills, resembling quasi yield-curve control. Bilello estimates interest costs could push the total impact of the bill above $4T.

- Markets are rallying into a fragile melt-up: Despite tariff escalation and fiscal risks, the S&P 500 hit its 8th ATH of the year and the VIX dropped to 15. Charlie Bilello and J.P. Morgan Wealth Management noted that investors are heavily focused on AI, resilient earnings, and the potential for Fed easing, but this optimism could prove vulnerable to inflation or earnings disappointments.

- Capex and AI spending are the bright spot, but could overheat: J.P. Morgan Wealth Management highlighted the impact of 100% expensing in the OBBB Act, fueling a data center construction boom. Ed Yardeni warned that this surge in AI infrastructure could eventually lead to overcapacity if actual productivity or AI returns disappoint.

Sources:

https://wellsfargo.bluematrix.com/links2/html/e286061b-a6a4-41b0-833f-fbeca38ba0f7

Weekly Macro Brief Ending July 22, 2025

-

Tariffs as stealth fiscal policy. The Trump administration brought in $88B in tariffs over the past 3 months (~$300B annualized at 10%), and Trump is now floating a 20% baseline- potentially doubling that haul. Markets still assume a rollback, but a lasting 20% regime would materially raise inflation and compress margins. [WF][CB][EY]

-

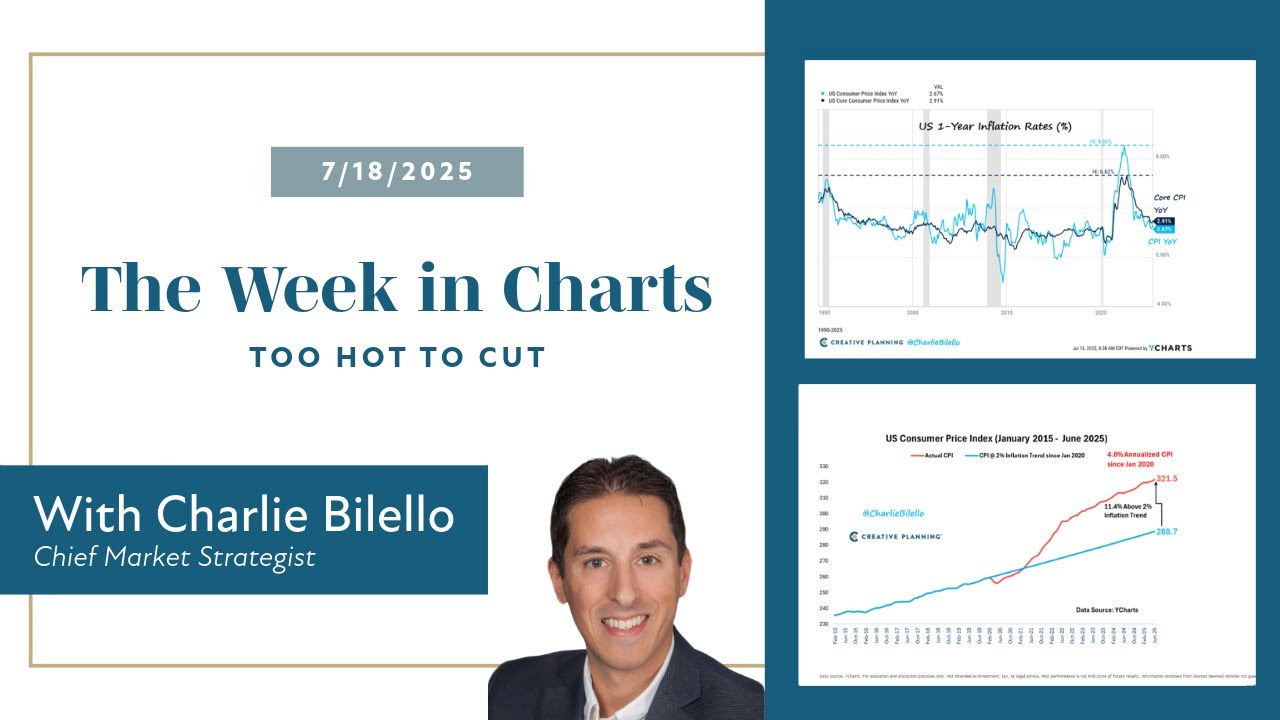

Fed stuck in neutral. Core CPI ticked up to 2.9% y/y in June, the highest since February. Markets now assign <5% probability of a July cut and remain split on September. Powell under fire, but Fed unlikely to act unless job market rolls over. [WF][CB]

-

Earnings may surprise to the upside. Q2 earnings bar has been lowered amid tariff-related guidance fog. Yardeni notes earnings forecasts for 2025–26 have stabilized near $260–300/share, consistent with a 6,000–6,500 S&P. [EY]

-

Inflation risks reawaken. Real-time CPI pressures are re-emerging as front-loaded Q1 imports run out. Tariff passthrough is now visible in goods CPI ex-autos (up 0.2% m/m), with July CPI tracking 3.0%. There is tariff pass-through risk of around 0.6–1.0 ppt boost to core CPI by Q4. Shelter CPI easing, but transportation, food, and insurance costs remain sticky. [WF][CB]

-

Fiscal saturation point in sight. U.S. issuing ~$500B of debt weekly. Long-end yields steady near 5% but vulnerable to supply/demand shifts, especially if foreign demand falters. [BLK]

Sources:

https://wellsfargo.bluematrix.com/docs/html/c66e7c1f-e74e-436c-b868-89d5362ea841.html

Weekly Macro Brief Ending July 28, 2025

- Tariff pass-through still loading. J.P. Morgan WM estimates the effective tariff rate was around 8% as of June, well below the announced tariff rate of around 17%, as U.S. firms and consumers share the cost burden. Core goods CPI (ex-autos) rose +0.2% m/m, with broader July CPI tracking around 3.0%. [JPM WM|CB]

- Fed likely on hold, tone may soften. Charlie Bilello notes markets assign a 97% probability of no rate change on July 31. Ed Yardeni expects Powell to avoid dissent by signaling openness to a September rate cut, depending on inflation and labor data. [CB|EY]

- Earnings outperform muted expectations. Yardeni notes analysts are maintaining 300 EPS forecasts for 2026, implying S&P 6,600 at a 22x forward multiple. Q2 earnings are tracking +7–8% y/y, with 79% of firms beating estimates. [EY|JPM WM]

- Foreign demand for U.S. assets remains strong. Yardeni highlights $1.7T in net private foreign purchases of U.S. securities over 12 months through May, including $600B in equities and $540B in Treasuries, easing concerns over U.S. funding risks. [EY]

Sources:

Weekly Macro Brief Ending August 5, 2025

- Fed division emerges: The FOMC held rates at 4.25% to 4.50%, but Waller and Bowman dissented in favor of a cut, marking the first dual dissent since 1993. Markets now price in 50 basis points of cuts by year-end, though Powell remains noncommittal. [WF][MER]

- Tariffs face legal threat: Trump’s 33-agreement tariff regime, now with an effective rate of around 15 to 18 percent, risks being invalidated if the Federal Circuit Court rules against his IEEPA authority in a pivotal hearing on August 8. A ruling is expected by September. [EY][JPM-WM]

- Labor market softening: July payrolls disappointed with a 73,000 gain, and revisions slashed prior job gains by over 250,000. Participation is falling, especially among immigrants, signaling tighter labor supply and long-term inflation pressure. [WF][JPM-AM]

- Weaker dollar cushions tariff blow: A 7 percent Q2 decline in the dollar index boosted multinational earnings. S&P 500 EPS is up about 8 percent year over year, with firms like Meta, Microsoft, and Netflix revising guidance higher. [MER][BLK]

- Growth clearly decelerating: Q2 headline GDP rose 3.0 percent annualized, but core domestic demand grew just 1.1 percent. ISM Manufacturing fell to 48.0. Wells Fargo and Merrill see resilience, but fading momentum. [WF][MER]

Sources:

https://wellsfargo.bluematrix.com/docs/html/a81913d1-14cc-40b0-a9c5-4b0dde98dd26.html

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_07-28-2025_ada.pdf

Weekly Macro Brief Ending August 12, 2025

- Tariffs shift from shock to slow-burn risk: Trump’s August 1 “Liberation Day 2” reset raised reciprocal tariffs to 10-41% across 60+ countries, with carve-outs for strategic firms. Average effective tariff rate now around 18% [WF], but could rise to around 25% if semiconductor and pharma duties materialize. Markets are largely shrugging, betting on carve-outs, reversals, or court intervention [JPM-WM][CB][EY]. A delayed inflation impact is likely once Q1 front-run inventories deplete [WF][JPM-AM].

- Labor market soft patch may flatter productivity: July payrolls +73k with -250k in revisions; 3-month average down to around 35k. Weakness partly tariff/policy uncertainty on demand side and tighter immigration on supply side [WF][EY]. Real GDP in Q2 still +3% [EY]. Yardeni sees potential for strong Q2 productivity rebound (2–2.5%) acting as an inflation cushion.

- Inflation set to re-accelerate modestly into year-end: JPM-AM sees core CPI rising from 2.8% (July) to 3.5% by Q4 2025 as tariffs pass through, dollar weakens, and fiscal stimulus kicks in. Tariffs alone could add around 1 ppt to the consumption deflator through mid-2026 [JPM-AM]. Shelter and energy trends are temporary offsets.

- Fed easing likely despite data ambiguity: Futures price ~90% chance of 25bp September cut and at least one more in 2025 [JPM-WM][CB]. Political pressure and weak jobs print push toward easing, even though inflation expectations are moving up [JPM-AM][EY].

Sources:

https://wellsfargo.bluematrix.com/links2/html/bb290147-24b2-40a3-85cf-a4f6030988e7

I finally had the time to watch both videos of the week.

Both are good.

Yardeni is more in-depth and commenting on recent developments. I found it quite useful for getting an impression on what happened and I liked his detailed interpretations and focus areas e.g. on the strengths of the consumers. He was overall more deeply focused on the economy and shares concrete projections and opinions.

The discussion between Charlie Bilello and Peter Mallouk was focused more on high level and larger trends. While it lacked the depths and projections of Yardeni it provided an interesting overview.

Going forward I will likely watch Yardeni when I have some time and explore if the discussion format between Bilello and Mallouk can provide enough value over time to consistently have a look.

Weekly Macro Brief Ending August 26, 2025

- Fed easing bias intact, but risks rising: Powell’s Jackson Hole speech kept a September cut on the table, citing labor-market weakness, but inflation is edging back up toward 3%. Markets price an 85–90% chance of a cut; dissenters warn of bond-vigilante pushback. [WF][EY][CB]

- Housing drag intensifies: U.S. housing affordability gap at record 57% (income vs median home cost). Inventories back to 2019 highs, price growth stalling. Housing-related weakness risks spilling into consumption and jobs. [WF][CB]

- Refund surge: JPM estimates $100bn+ in 2026 tax refunds due to backdated OBBBA provisions, adding around 0.5 to 0.8 ppt to Q1 GDP. Supports near-term growth, but is temporary stimulus and risks prolonging inflation above 3%. [JPM-AM]

- Tariffs are sticky: Effective U.S. import tariff rate has jumped to 18.6% from 2.5% long-run average; U.S. deficit likely to hit 50th consecutive year. [MER]

- Earnings resilience continues: S&P 500 Q2 EPS growth tracking around 11% y/y vs 3.5% expected. Forward EPS at record highs; valuation stretched (S&P 500 forward PE 22.5), but 493 ex-Mag7 still at ~19x. [EY]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_08-18-2025_ada.pdf

Weekly Macro Brief Ending September 2, 2025

- Fed cut likely, but inflation risk remains: Powell’s dovish Jackson Hole speech has markets pricing around 90% chance of a September rate cut, even though core PCE is still rising at 2.9% y/y. The danger is that if the Fed eases too soon, investors could lose confidence, driving long-term yields higher. [WF][JPM-WM][CB][EY]

- Growth holding up, but consumers are under pressure: Q2 GDP was revised up to 3.3%, driven by a surge in tech and equipment investment. But consumer confidence slipped to 97.4, the weakest labor sentiment in 4 years, and households are cutting back on discretionary services. [WF]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_08-25-2025_ada.pdf

Weekly Macro Brief Ending September 9, 2025

- Jobs are slowing, but Fed cuts may not help much: The U.S. added only 22,000 jobs in August and unemployment rose to 4.3%.Wells Fargo now expects three 25 bp cuts (Sep/Oct/Dec) to 3.50–3.75%. Yet JPM-AM warns that rate cuts may dampen demand via income and expectations effects, pointing more to a weaker USD than stronger growth. [WF] [JPM-AM] [JPM-WM]

- Tariff court case could shake markets: A U.S. appeals court ruled that most of Trump’s tariffs are illegal, and the issue will likely go to the Supreme Court. Depending on how judges handle the case and possible refunds, inflation numbers, supply chains, and company profits could all swing sharply. [EY]

- Tariffs are raising business costs: Surveys show that both factories and service companies are seeing higher prices because of tariffs. Some firms even placed early orders before tariffs rise further. Wells Fargo says tariffs are keeping financial conditions tight, even if the Fed cuts rates. [WF]

Sources:

Weekly Macro Brief Ending September 16, 2025

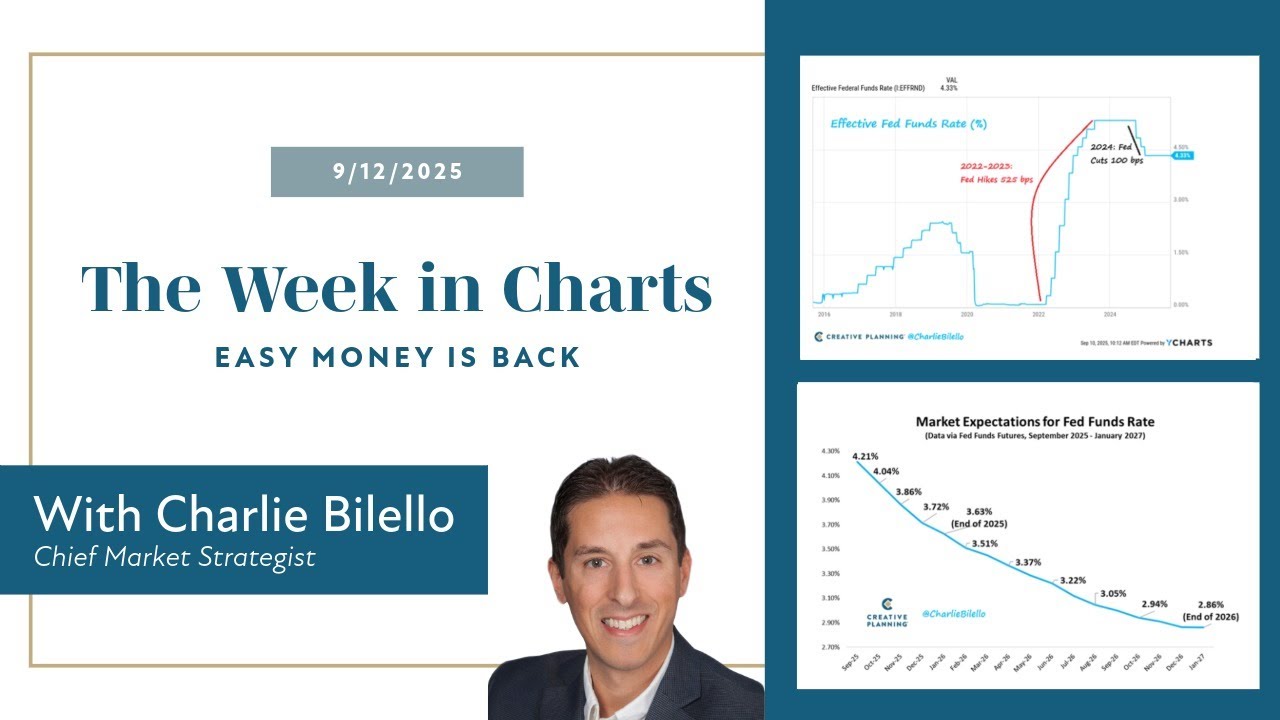

- Fed cuts into tension: A September rate cut (25 bps) is now a near certainty, with markets expecting 75 bps more by year-end. Yet inflation is running closer to 3% than 2%, and payrolls have been revised down by a record –911K. The Fed is prioritizing labor market weakness over inflation credibility. [WF][JPM-AM][CB]

- Mania risk: U.S. equities hit fresh highs (S&P >6,600), valuations stretched (27× P/E, price-to-sales record), and credit spreads near 1998 tights. The Fed is effectively easing into a mania. [CB][MER]

- Productivity versus labor: Yardeni highlights that weak payroll gains may not signal recession: productivity growth is accelerating (Q2 revised to +3.3%) and real wages still positive. [EY]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_09-08-2025_ada.pdf

Weekly Macro Brief Ending September 22, 2025

- Fed’s “Risk-Management” Pivot: The Federal Reserve’s September 25 bp cut marked a policy shift toward prioritizing the labor market over inflation. Powell described it as a “risk-management cut,” and both Wells Fargo and J.P. Morgan Wealth Management highlighted that while more easing is likely, inflation remains sticky around 3%, raising the risk of over-easing. [WF][JPM-WM]

- Consumers Steady, Housing and Capex Soft: Despite labor-market cooling, the consumer continues to spend, with retail sales up 0.6% month-on-month in August, driven by e-commerce and auto demand. At the same time, Wells Fargo stressed that housing is weakening—starts fell 8.5%—and capital spending is narrowly concentrated in autos, aerospace, and tech, leaving growth uneven. [WF]

- Valuation Stretch Meets Term-Premium Risk: J.P. Morgan Asset Management warned that the long U.S. bull market has leaned heavily on expanding margins and multiples, with P/Es stretched well above averages and market cap now 363% of GDP. Both Ed Yardeni and BlackRock flagged that the U.S. 10-year Treasury yield, currently near 4%, remains vulnerable to fiscal deficits and a potential bond-vigilante episode, keeping term-premium risk alive. [JPM-AM][EY][BLK]

- Small-Caps Back in the Spotlight: Merrill pointed out that small-caps are finally showing signs of life, with the Russell 2000 posting its first positive EPS growth since 2022 and historically outperforming after Fed cuts. Charlie Bilello added that small-caps have reached new highs and trade at historically cheap valuations versus large-caps, though he cautioned that past rallies quickly faded. [MER][CB]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_09-22-2025_ada.pdf

Weekly Macro Brief Ending October 6, 2025

- Data blackout, not demand collapse: The U.S. government shutdown has paused the release of key reports like jobs and inflation data, making it harder for the Federal Reserve to decide what to do next. However, private data (like ADP job reports, job openings, and unemployment claims) still show that the job market is slowing down but not crashing. [WF][JPM-AM][JPM-WM]

- Risk assets ride “AI + easing”: Stocks hit new all-time highs as markets expect two more small Fed rate cuts in 2025. We remain cautiously positive on risk assets like equities, but valuations are getting very expensive (the CAPE ratio is above 40), and only a few big companies are driving most of the gains. [BLK][JPM-AM][CB]

- Growth resilient, productivity story alive: U.S. growth was stronger than expected — the economy grew 3.8% in Q2, and Q3 looks close to 3–4%. Even though hiring has slowed, companies are becoming more productive, which is helping profits and earnings. [EY][MER]

- Tariff mechanics matter: Changes in tariffs and ongoing court decisions could make inflation rise by about 0.7–1.4 percentage points, depending on how much of the extra cost companies pass on to consumers. Gold prices are at record highs, and bonds with inflation protection are attractive as hedges against higher inflation. [JPM-AM][BLK]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_09-15-2025_ada.pdf

Weekly Macro Brief Ending October 14, 2025

- Tariffs causing confusion, not crisis: The big “Liberation Day” tariff hike looked scary, but because of legal delays and loopholes, companies are actually paying about 11%, not the full 18%. Still, every new tariff headline can move markets. [JPM-WM]

- Dollar down, but not broken: The U.S. dollar has weakened this year, but for normal reasons — markets expect the Fed to cut rates, and investors now demand more return for holding long-term bonds. It’s not because the dollar is losing its reserve-currency power. Gold is rising simply because other major currencies have also weakened. [BLK]

- Growth still solid; productivity helping: Company profits keep growing, and investments in factories and AI are boosting the economy. Economist Ed Yardeni remains optimistic. He thinks the S&P 500 could reach 7,000 by year-end — even though job data has softened. [JPM-WM][EY]

- Government debt piling up: U.S. deficits are running around 6–7% of GDP, and total debt is about 100% of GDP and still rising. If courts strike down tariff revenues, the gap could get worse. Investors continue to demand higher yields on long-term bonds. [JPM-AM]

Sources:

Weekly Macro Brief Ending October 21, 2025

- Shutdown fog, but Fed easing bias intact: The U.S. government shutdown has delayed key data (CPI, jobs, retail sales), leaving the Fed reliant on limited information; Powell hinted QT runoff may end soon and Waller backs a 25 bps Oct rate cut, with another possible rate cut in December.

- Tariff brinkmanship, not full-scale trade war (yet): China’s rare-earth export ban and Trump’s 100 % tariff threat raised headline risk, but BlackRock and Yardeni view this as leverage before November talks—economic limits make a lasting escalation unlikely. [WF][BLK][EY]

- Earnings resilience and AI build-out drive sentiment: Q3 results are beating early fears; S&P 500 2025 EPS forecasts have been revised up to ~11% year-over-year growth, with AI-linked capex broadening beyond mega-caps. Utilities and industrials now benefit from data-center power demand. [BLK][MER][CB]

- Valuations and concentration stretched, breadth improving: S&P 500 CAPE near 40 and top-10 holdings ~39 % of index—highest since 1980—yet small/mid-cap and non-Mag7 earnings growth are narrowing the gap, hinting at gradual broadening. [CB][BLK]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_10-14-2025_ada.pdf

Weekly Macro Brief Ending October 28, 2025

- Fed likely to cut again: Inflation rose only +0.2% in September, keeping it around 3% year-over-year, which supports another 25 bps rate cut at this week’s meeting. Because the government shutdown delayed new data like CPI and PCE, the Fed will rely more on its guidance to shape expectations.[WF][BLK][CB]

- Inflation still sticky: The three-month inflation trend is still running around 3.6% annualized, showing that prices aren’t cooling quickly. New tariffs are still feeding into goods prices, and both Wells Fargo and Yardeni expect inflation to stay near 3% through mid-2026, keeping the Fed cautious after December. [WF][EY]

- Gold’s wild ride: Gold is up over 50% this year, driven by debt concerns, heavy central-bank buying, and speculative trading. Analysts say it’s now overbought and could face sharp swings. Treat it as a short-term trade, not a long-term inflation hedge. [BLK][MER][CB]

- Growth slowing, not crashing: The U.S. economy remains resilient: housing sales ticked higher as mortgage rates eased, and global activity in Europe and China surprised to the upside. Growth is cooling but far from recession. [WF][EY]

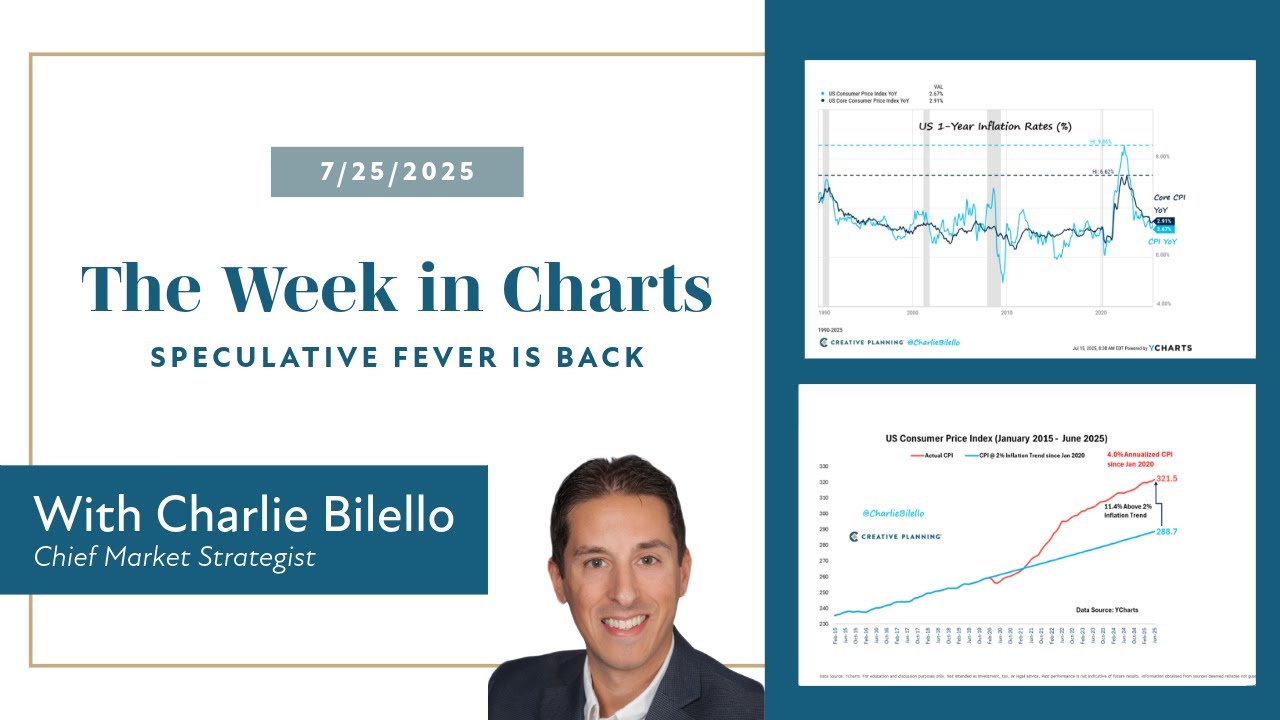

- Markets still upbeat: Stocks keep rising thanks to expected Fed cuts and strong corporate earnings, especially from AI-related firms. BlackRock and Yardeni highlight strong productivity and AI investment trends, while Bilello notes signs of speculative enthusiasm typical of bull markets. [BLK][CB][EY]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_10-20-2025_ada.pdf

@Aron i think important to get a briefing here. Especially with potentially deteriorating economy.

Weekly Macro Brief – week of 10–17 Nov 2025

-

Fed cuts are no longer a done deal – and the data are fuzzy: A hawkish wave of Fedspeak and a shutdown-driven data blackout have pushed December cut odds down to a coin flip (~40–60%). Powell called a December cut “far from” a foregone conclusion, and several voting members argue policy should stay put “for some time,” even as others still push for a 50 bp move. [WF][BLK][EY]

-

Consumer & credit: bifurcation, not collapse (yet): Alternative datasets still show a “no hiring, no firing” labor market – cooling but not cracking – with real wages positive for 28–29 months. But sentiment is near multi-decade lows, credit-card 90+ day delinquencies are the highest since 2011, and subprime auto delinquencies are now worse than during the Global Financial Crisis (GFC). Consumption strength is increasingly concentrated among wealthier, equity-rich households, while lower-income borrowers strain under cards, autos and student-loan restarts. [BLK][JPM-AM][CB][EY]

-

Tariffs and fiscal policy have become genuine macro swing factors: Monthly tariff collections have jumped from ~$7B in January to ~$34B in October, with ~$750B expected through mid-2026. Meanwhile the Supreme Court is reviewing Trump’s broad IEEPA authority; an adverse ruling could cut the effective tariff rate from ~16% to ~6.5%, remove ~$556M/day in revenue and force tariff rebates, complicating deficits and inflation. Parallel proposals for $2,000 “tariff dividend” checks would recycle tariff income directly into household demand, raising upside risk to 2026 inflation and long yields. [MER][CB][JPM-AM]

-

Earnings and AI capex still drive the bull market – but financing and accounting are under scrutiny: S&P 500 earnings are again running double-digit y/y, with forward EPS now roughly double the 2020 level; almost the entire post-Covid price gain is explained by earnings, not multiples. Hyperscalers are pushing AI data-center capex to ~94% of operating cash flow in 2025–26, funded by record debt issuance (~$75B in Sep–Oct) and vendor-financing structures. Meanwhile, Michael Burry flagged concerns that AI data-center asset lives are being depreciated too slowly, inflating margins just as S&P 500 profit margins hit new highs (~13.8%). [MER][BLK][JPM-WM][CB][EY]

-

Global backdrop: U.S. still outperforms, while “3 mega forces” reshape the regime: The U.S. expansion continues (JPM-AM sees ~1.6% in 2025, 2.0% in 2026) with unemployment anchored in the 4.0–4.5% range and inflation drifting toward 2% by end-2026. Europe grows slowly under structural productivity constraints; earnings beats there are mostly multiple-driven and euro strength is a headwind. China’s data continue to soften, reflecting policy limits and structural drags. JPM-WM frames 2026 as dominated by AI, fragmentation and structural, more volatile inflation, with tariffs touching ~70% of U.S. imports, gold +40% YTD and crypto’s market cap above $4T. [JPM-AM][BLK][MER][WF][JPM-WM]

Sources:

https://mlaem.fs.ml.com/content/dam/ML/ecomm/pdf/CMO_Merrill_11-10-2025_ada.pdf