Valuation model update

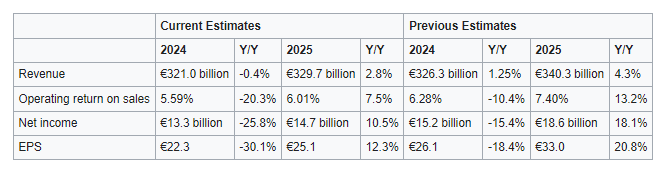

Following recent management update on the 2024 guidance, new restructuring measures, and rising competition coupled with the 2025 CO2 regulation, I have lowered my estimates for 2024 and 2025 as shown in the table above. I believe that until we are more confident on how demand and pricing will develop next year, it’s best to have conservative estimates. At the moment, I believe that prices in 2025 will be lower than in 2024 due to the CO2 regulation and rising competition. Automakers will likely try to sell more EVs next year so as to meet the CO2 targets. Additionally, before the regulation enter into force in July 2025, automakers will likely attempt to sell as many ICEs as possible. These actions will probably drive down prices.

Here are the changes in the valuation model;

- I slightly lowered my 2024 pricing estimates for the Brand Group Core leading to a revenue headwind of 4 billion euros.

- I slightly lowered my 2024 pricing estimate for Audi leading to a revenue headwind of 500 million euros.

- I lowered my 2024 pricing estimate for Traton leading to a revenue headwind of 650 million euros.

- I reduced the 2024 operating result estimate for Volkswagen Financial Services by 900 million euros.

- I lowered the Brand Group Core’s 2024 operating result estimate by 1.6 billion euros.

- I also lowered the 2025 pricing estimate for Brand Group Core leading to a revenue headwind of 9 billion euros.

- I lowered my 2025 pricing estimate for Audi leading to a revenue headwind of 1.2 billion euros.

- I lowered my 2025 pricing estimate for Traton leading to a revenue headwind of around 700 million euros.

- I considered 4 billion euros restructuring costs in 2025 at the Brand Group Core.