This topic will discuss Volkswagen’s most important markets and establish the main competitors in those markets.

-

Volkswagen’s breakdown of revenue in 2022 is as follows; Europe/Other markets(55%), North America(21%), Asia-pacific(18%), and South America(6%).

-

Asia-Pacific(mainly China) is the main market for Volkswagen Passenger Cars, accounting for 2.5 million or 55.4% of the vehicles in 2022, followed by Europe/Other markets(1.3 million vehicles or 27.7% of the vehicles).

-

Asia-Pacific(mainly China) is also the main market for Audi, taking up 710,248 or 44% of the vehicles in 2022, followed by Europe/Other markets(660,208 vehicles or 40.9% of the vehicles).

-

Volkswagen has a leading market share in Europe(24.7%), followed by Stellantis(18.2%), Renault Group(9.4%) and Hyundai(9.4%) but is losing its market share in China, which currently stands at 10.2% to BYD(11.16%) and other Chinese auto brands.

-

It has a small market share in North America(4.6%), a market dominated by General Motors(17.09%), Toyota(15.17%), Ford(13.92%), and Stellantis(11.66%), but plans to grow it to 10% by 2030.

Full article: Volkswagen: Most Important Markets - InvestmentWiki

The reason why China accounts for only 18% of revenue despite being Volkswagen largest market in terms of numbers is due to the fact that Chinese regulation forces Volkswagen to form joint ventures with local producers.

Those joint ventures are majority controlled by the joint venture partners (slightly more than 50%).

Revenues are therefore not consolidated in Volkswagen Group P&L and profits are accounted for using the equity method.

As far as I know this situation applies for 100% of Volkswagen Brand cars.

Audi produces in China as well and should therefore also be accounted for using the equity method. (@Aron can you confirm this?)

Porsche cars are imported into China and should be accounted for regularly.

True. Volkswagen noted in 2022 annual report that " The sales revenue and operating result of the equity-accounted companies in China are not included in the consolidated figures."

94% of Audis delivered to Chinese customers in 2022 were produced locally.

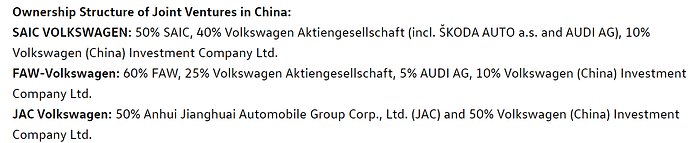

Here is the ownership structure of its joint ventures in China;

I=7

- Volkswagen targets to increase its annual sales by 23% from 2023’s total to 4 million by 2030 in China, representing a 15% market share -an increase from around 14.5% market share last year.

- The sales target will result in a proportionate operating result of more than 2 billion euros by 2027 (-23% from 2023’s number) and around 3 billion euros by 2030 (+15% from 2023’s number).

- Volkswagen said it plans to reach cost parity in the compact-car segment by 2026, aided by its localy developed China Main Platform (CMP) which is expected to reduce costs by 40%.

- In the next three years, Volkswagen plans to launch 40 new models in China, half being fully-electrified.

- At the Beijing Auto Show, Volkswagen teased a number of upcoming models including ID.UX, Porsche Taycan, Audi Q6L-etron, Bentley URUS SE and Bentley Batur, which have been designed to meet the Chinese needs which are smarter, more intuitive design and more localised vehicles.

- Volkswagen wants to bring at least 30 fully-electric vehicles by 2030.

- Volkswagen said its China-specific Porsche Taycan will have 380 horsepower, a range of 670km, acceleration from 0-100km in 3.9 seconds and battery capacity of 107kwh while the Q6 L-etron will come with a range of 700km and a battery capacity of 107kwh.

I=3

Neutral, €120: JP Morgan said there were excellent details on all divisions during the China Capital Market Day.

I=5

-

Volkswagen told analysts during its China Capital Markets Day that it expects price wars to continue for the next two years.

“Prices are going faster down than the cost improvements,” CEO Volkswagen China Ralf Brandstaetter said. “We expect in the next years, the next two years especially, that this price war will continue.”

-

Cit praised Volkswagen’s current strategic move.

“The implicit admission of previous non-performance and new accountability, in our view, are huge steps in the right direction strategically, and miles away from VW’s historical culture,” Citi wrote. “This builds on our view that VW is changing. At least in China, it has had no choice.”

Volkswagen CEO Oliver Blume said they are very well position in China in the luxury segment, adding that Taycan has a market share of over 30% in the luxury electric segment there (min 12:35).

I=4

- Morgan Stanley lowered Volkswagen and Posrche shares to underweight over rising tensions between the EU Commission and China.

- He expects their shares to react negatively should Beijing slaps tariffs on them.

I=4

Neutral, €136: Analyst Stephen Reitman of Bernstein thinks the threats of increased tariffs is not as great as the headline suggests. He added that Volkswagen only imported around 5% of vehicles sold in China in 2023.

I=6

- Porsche in discussion with its Chinese retailers for a way forward amid a slump in demand for EVs.

- Chinese media have reported that some Porsche dealers in China are asking for compensation for selling EVs at a loss and have objected to this year’s sale targets.

- A quarter of Porsche cars went to China customers in 2023.

I=4

Volkswagen plants to reduce production costs by 20% over the next three years in China, Yicai reported citing internal documents.

I=4

- Volkswagen plans to double its market share in the US by 2030, from the current 4%, a dampened ambition from their previous target of 10%.

- CFO Arno Antlitz said to do so, they need to increase investments there.