This topic examines Volkswagen’s competition particularly in Europe. Though Volkswagen is expected to maintain its European market share over the short-term, a number of Chinese EV makers are rapidly expanding to the region. The tariffs imposed by the EU will likely reduce their expansion rate but some of them such as BYD, Xpeng and Chery have plans to set up production plants in the region, hence avoiding those tariffs and even winning over government subsidies. Here is our Wiki article on the same: Volkswagen:Competition From China EVs - InvestmentWiki

@moritz Based on my research, I would rate the threat from Chinese-made EVs in Europe as low to medium between now and 2030. That said, I agree with Alixpartners that Chinese share of European automarket could increase from the current 6% to 12% by 2030. That is an increase of around 680,000 vehicles (based on 11,294,502 units sold in Europe in 2023). Given that Volkswagen controls around 25% market share, it means that it could lose around 170,000 units (around 30,000 units per year) to Chinese rivals. But that will depend on how it executes from now going forward. Here is my supporting evidence;

Positives

- Prices of a number of Chinese-made EVs sold in Europe doesn’t deviate much from that of European-made EVs implying that they are not interested in market share. For instance, BYD’s Dolphin compact car starts at 35,990 euros in Germany, around 1,000 euros less than VW ID.3.

- European vehicle customers are loyal to European brands and most of them are currently unaware of Chinese EVs sold in the region. A March 2024 Bloomberg survey of European consumers established that 74% of the respondents would have an issue buying an imported vehicle while 62% said they would prefer buying the same marque.

- The likelihood that Chinese EV makers will reduce prices in Europe to gain market share is low. This is because BYD and Li Auto are currently the only profitable Chinese EV makers. Reducing prices in Europe coupled with EU tariffs will increase their losses and liquidity risks. According to AlixPartners, only 19 of the current 137 Chinese EV makers will be profitable by the end of 2030.

- Some Chinese automakers such as MG Motor, one of the leading Chinese exporters to Europe will likely lose incentive to export to Europe following a 36.3% additional tariff by the EU Commission.

- The first major Chinese-owned plant in Europe is set to start productions in 2026 when European OEMs are set to launch more low-priced EVs. Other Chinese-owned plants will probably start production later since decisions on their locations are still being made.

- Only BYD (which sold around 14,000 units only in Europe in 2023) looks like a major threat. Its vertically integrated supply chain enables it to make 75% of EV components in-house. The result is a 15% cost-advantage over other Chinese EV makers.

Negatives

- The advantage enjoyed by Chinese EV makers in Europe is as a result of having the right architecture and using cheaper batteries and not due to subsidies. Majority of the subsidies (87%) provided by the Chinese government goes to sales exemption which doesn’t influence European sales. Also, around two-third of Chinese EV makers use LFP batteries unlike European OEMs which mostly use NMC batteries. LFP batteries were 32% cheaper than NMC batteries in 2023. The cost of the battery is important in that it makes up about 40% of the cost of an EV.

- Reviews indicate that the quality of Chinese-made EVs are almost at par with that of European made EVs. Additionally, Chinese-made EVs provide additional tech features as standard compared to its European rivals.

- A number of Chinese exporters will still have an incentive (though reduced) to export to Europe, but it will likely take some time for their deliveries to pick up. Again, BYD will still make a lot of profit by exporting to Europe despite the 17% additional tariff.

- Chinese EV makers could still enjoy lower production costs compared to the likes of Volkswagen by producing in low-cost regions in Europe such as Hungary and Poland. The cost of labor and energy in Hungary is around six times lower than in Germany.

- I think the possibility of European OEMs producing a B-segment 25,000 euros profitable EV needed by the European market is low at current efficiency and technology levels. According to BCG estimates, it would cost a European OEM 36,000 euros to make a profitable B-segment. That means to make a 25,000 euros EV, they would have to reduce production costs by almost 50%. We should, therefore, examine the possibility of Volkswagen producing a 25,000 euros EV.

I=5

Chinese EV makers such as BYD and MG Motors don’t plan to increase prices of their European EVs this year following the EU tariffs.

https://europe.autonews.com/automakers/eus-china-ev-tariffs-automakers-avoid-price-rises

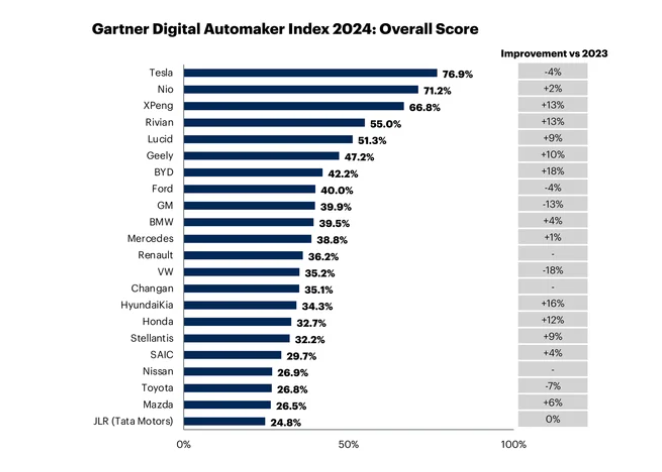

Volkswagen ranked 13th in global digital strength, its partners Xpeng and Rivian comes in the top five

- A recent report by Gartner ranked Volkswagen at the thirteenth position when it comes to digital strength, with a sharp decline of 18% in the overall score compared to 2023.

- However, it’s good to see its partners, Xpeng and Rivian in global top five.

According to Stifel analyst Daniel Schwarz, Volkswagen brand’s products are competitive in Europe.

“The VW brand has been market leader in Europe every year since 2005 … its cars are competitive. The problem is not the product, but the costs,” he told Reuters.

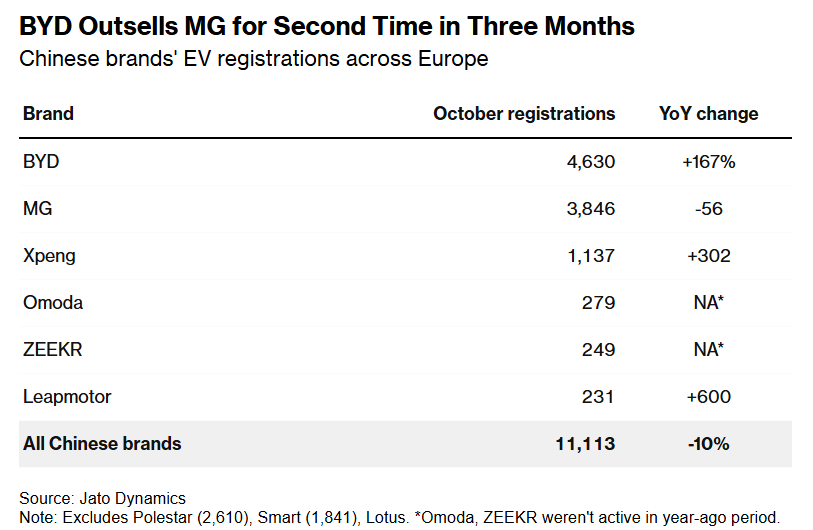

Sales of Chinese EVs in Europe declined further during October in the run-up to new tariffs

- The market share of Chinese EVs in Europe fell to 8.2% in October from 8.5% in September, marking the fourth month of continuous decline as tariffs came into effect.

- However, sales by BYD continue to grow year-over-year.

Chinese EV makers increase sales of PHEVs in Europe to counter the EV tariffs

- Chinese EV makers are increasing sales of PHEVs in Europe in order to counter the effects of tariffs.

- From July to October, export of Chinese PHEVs to Europe more than tripled to 65,800 units, compared to the same period in 2023.

- BYD recently debuted the Seal U DM-i in Europe, a PHEV meant to compete with Volkswagen’s PHEV Tiguan. Seal U DM-i starts at 35,900 euros, 700 euros less than Volkwagen’s counterpart.

- The EU EV tariffs don’t apply to PHEVs imported from China.

Volkswagen Group models are competitive

I compared Volkswagen Group main models (20 in total) with those of rivals and what stood out to me is that they are competitive (confidence level: 80%). The main issues noted relates to tech, fuel economy, modernity, and residual values. For instance;

- Porsche Taycan is facing high depreciation rate caused by reliability issues. Its sales were down almost 50% in the nine months of 2024 mostly due to reliability issues. Though a fix for its reliability issues will arrive this quarter, the damage on the model’s image could already be done. This could flow down to the newly launched EV Macan, which in my opinion is very competitive.

- A number of Audi models such as the Audi Q4 e-tron, the Audi A6, Audi Q5, and Audi Q3 are said to be less intuitive and have less responsive infotainment system compared to rivals. Similarly, the likes of Golf, Tiguan, and Atlas have been criticized for lacking the much-liked physical buttons and knobs for adjusting climate and volume. Luckily, the partnership with Rivian and Xpeng, two of the world’s top digital companies will fix the software issues.

- Volkswagen models have been hyped as aging. While this is true, it only affects few major models. The major models that are dated compared to rivals or alternatives include the iconic Porsche 911, the Audi A6, the Volkswagen Atlas, and the Volkswagen Pollo. The upcoming all-new Audi A6 e-tron will probably turn the tide for the aging Audi A6.

- The major Volkswagen Group models that have less fuel economy compared to rivals include the Porsche Cayenne, Porsche Panamera, Audi Q3, Audi Q5, Skoda Kamiq, Tiguan, and Golf.

Volkswagen sales boss says their ID models are competitive, adds that the ID2 will be a game changer

- Martin Sander, Volkswagen head of sales said their ID models are competitive. He cited the ID3 which has better range than Tesla Model Y and charges faster than the BMW i4.

- He added that they are EV market leader in Germany, citing the ID7 which he says it’s filling up orders faster than the Passat.

- He also pointed out that the ID2 will be a game changer for the company.

A post was merged into an existing topic: Volkswagen Cost-Cut Measures