The VIX (CBOE Volatility Index) is a real-time measure of the expected volatility of the S&P 500 over the next 30 days. It is often referred to as the “fear gauge” because it reflects market uncertainty and investor sentiment. The VIX is calculated using S&P 500 index options (both calls and puts) and represents the market’s expectations of volatility, not actual past volatility.

Why is the VIX Important

- Market Sentiment Indicator

- A rising VIX suggests increasing fear and uncertainty in the market.

- A falling VIX indicates confidence and stability.

- Portfolio Hedging & Risk Management

- Investors use the VIX to hedge portfolios against downturns.

- A high VIX may signal a good time to reduce exposure to risk assets.

- Macro and Liquidity Insights

- Extreme VIX levels (high or low) can reflect broader macroeconomic concerns, such as central bank policy shifts or geopolitical tensions.

- A persistently low VIX could signal complacency, making markets vulnerable to sudden shocks.

- Correlation with Market Movements

- The VIX generally moves inversely to the S&P 500.

- When stocks sell off, volatility usually rises, pushing the VIX higher.

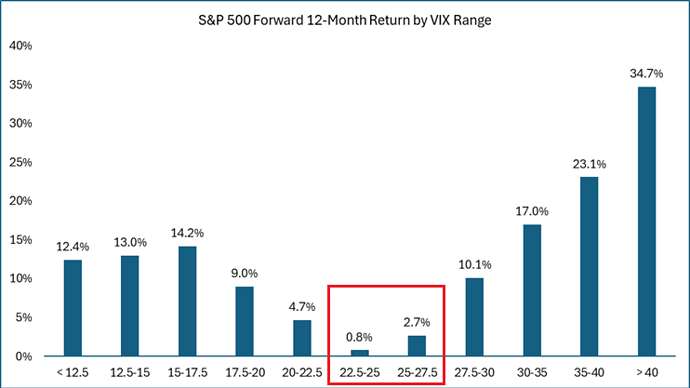

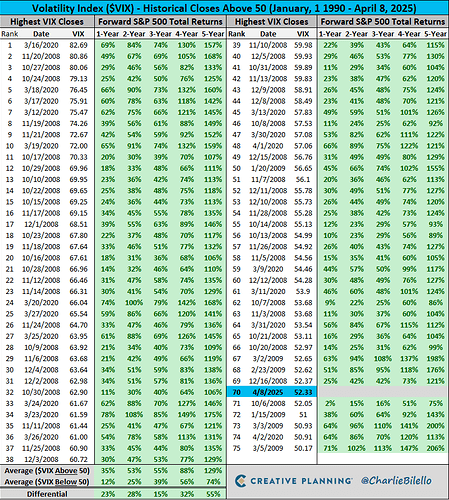

- A high VIX does not necessarily mean a continued downtrend, as extreme VIX spikes often signal market bottoms.

What Do VIX Movements Signal

1. Low VIX (<15) – Complacency & Risk-On Environment

- Market optimism and stable conditions.

- Investors expect low volatility and strong economic performance.

- Risk assets (stocks, high-yield bonds) tend to perform well.

- Potential risk: Overconfidence could lead to a sudden market correction if unexpected bad news arises.

2. Moderate VIX (15-25) – Normal Volatility

- Typical market environment where stocks move up or down within normal ranges.

- Healthy levels of risk-taking and market uncertainty.

3. High VIX (>25) – Fear & Uncertainty

- Indicates market stress, uncertainty, or crisis.

- Often seen during financial crashes, recessions, or geopolitical events.

- Investors hedge aggressively, leading to higher options premiums.

4. Extreme VIX Spikes (>40) – Market Panic & Capitulation

- Historically signals potential market bottoms (e.g., 2008 Financial Crisis, March 2020 COVID crash).

- Investors rush to hedge or liquidate positions, leading to oversold conditions.

- Contrarian investors may see this as a buying opportunity.

How to Use the VIX for Investing

- Contrarian Indicator:

- Extremely high VIX levels may suggest buying opportunities.

- Extremely low VIX levels may suggest overbought conditions.

- Options Trading & Hedging:

- Traders use VIX futures, options, and ETFs to hedge portfolios.

- A rising VIX benefits volatility-related instruments.

- Macro & Interest Rate Analysis:

- Rising VIX alongside rising bond yields may signal liquidity stress.

- A falling VIX with low bond yields suggests a stable, low-volatility regime.

Notion Page: