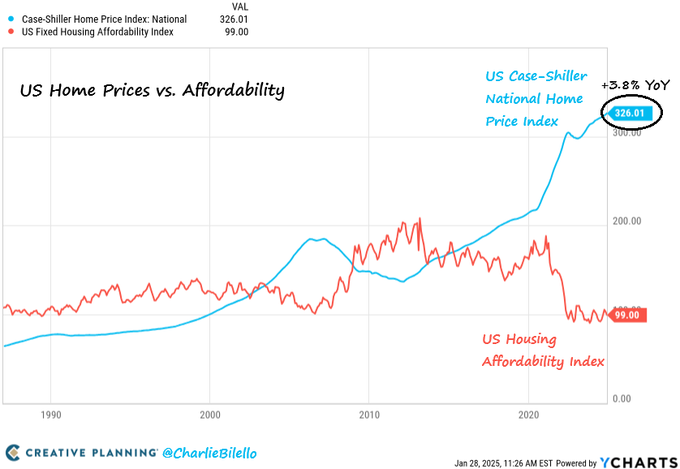

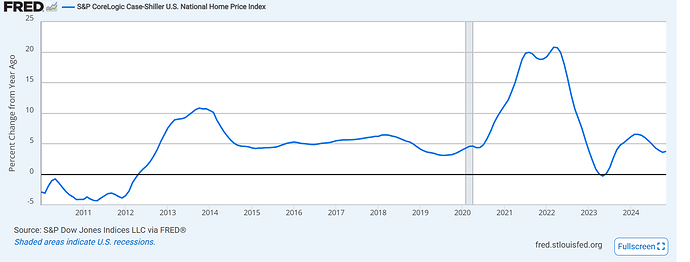

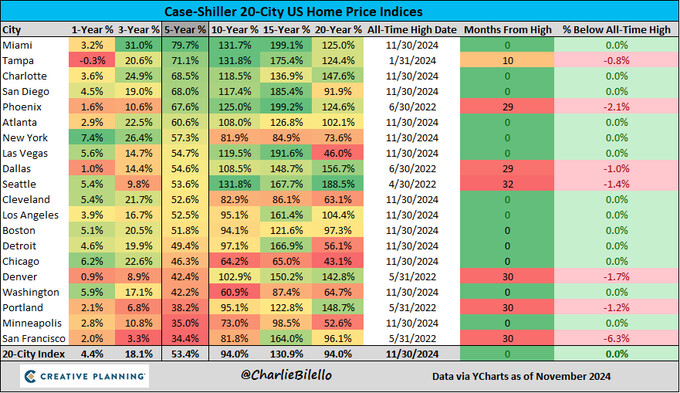

US housing prices are a critical indicator for understanding inflation dynamics due to their substantial influence on consumer spending and overall price levels (over 30% of the CPI and approximately 15% of the PCE).

Changes in housing prices also affect consumer wealth and confidence, influencing demand-side inflation pressures.

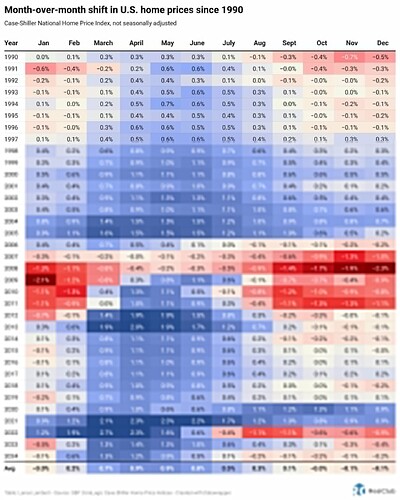

Housing prices and rents are “sticky,” meaning they adjust slowly over time, making them a persistent driver of inflation trends.