Developments, arguments, and opinions about the trajectory of long-term bond yields in the US.

Strategists at Citigroup Inc. upgraded Treasuries to overweight

Joining Goldman Sachs, Barclays, Royal Bank of Canada and Societe Generale who already cut their year-end forecasts for 10-year Treasury yields.

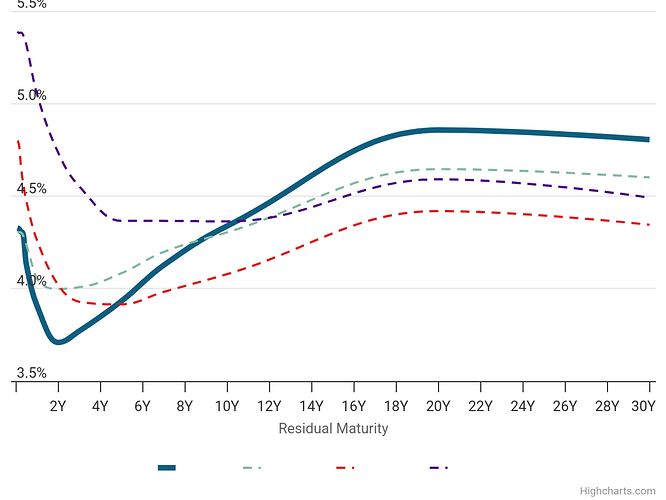

JPM’s rates team drops 2025 forecast for the yield on the 2yr note to 2.7% from 3.65% and the 10yr to 3.65% from 4.15% previously.

They also see the FOMC cutting to 3.0% starting in June. “Even though we have lifted our full-year core PCE inflation forecast” by 1.4 percentage points to 4.4%, “we continue to expect a first Fed easing in June,” they wrote. “However, we now think the committee cuts at every meeting through January, bringing the top of the funds rate-target range down to 3.0%,” the analysts said, referring to the Federal Open Market Committee.

Ed Yardeni also lowered 10 year target

Yardeni: “The data out this week are likely to add to Trump Tariff Turmoil (TTT) fears and keep stocks on the back foot. We are lowering our range for the 10-year Treasury bond yield to 3.75% to 4.25% (from 4.25% to 4.75%) for the rest of the year as a result of TTT (chart).”

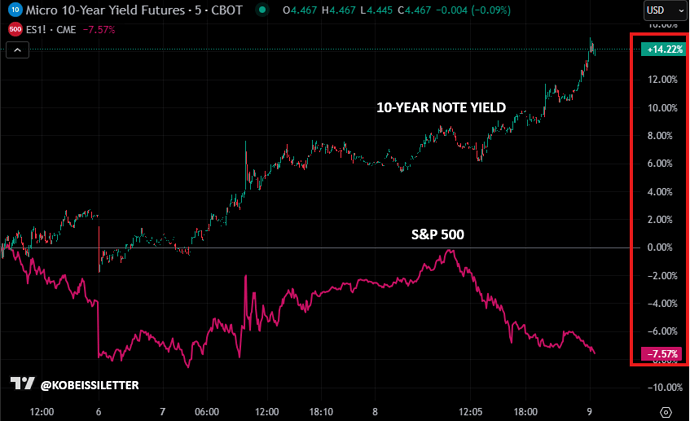

Treasury yields are now up +15% since April 3rd while the S&P 500 is down -10%, at 4.5% current

This is not the typical flight to safety response when markets start to priced in a recession and have brutal sell offs

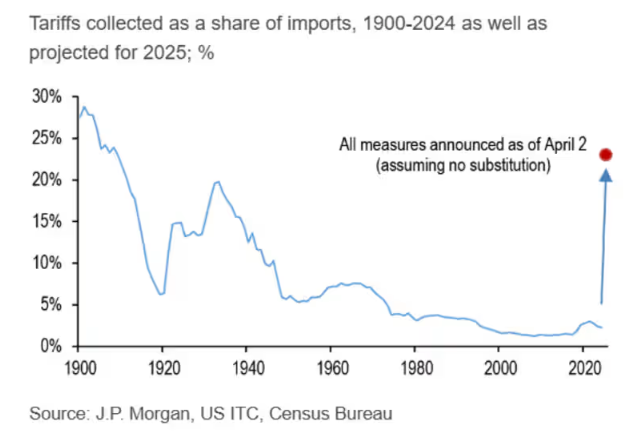

Tariffs inflationary pressures, deglobalization, huge fiscal deficits, fears foreigns nations could start to sell their treasuries as retaliation, are probably among the reasons creating this atypical response this time

This is also the complete opposite direction that the government is after.

Bob Michele, global head of fixed income at JPMorgan Asset Management, says he’s seen “a complete deleveraging of positions” that’s put downward pressure on treasury prices.

I=9

10-year and 30-year Treasury yields jump more than 6 basis points following Friday’s Appeals Court ruling against the tariffs

-

10 -year Treasury yield and 30-year bond yield rose more than 6 basis points to 4.287% and 4.978% respectively on prospects that the US government may have to refund tariff money.

-

This comes after a U.S. Court of Appeal ruled against Trump’s tariffs on Friday.

-

Yields on long-term government bonds in several of Europe’s largest economies also climbed to their highest point in over ten years, driven by growing investor worries about the fiscal stability of France and other key nations.