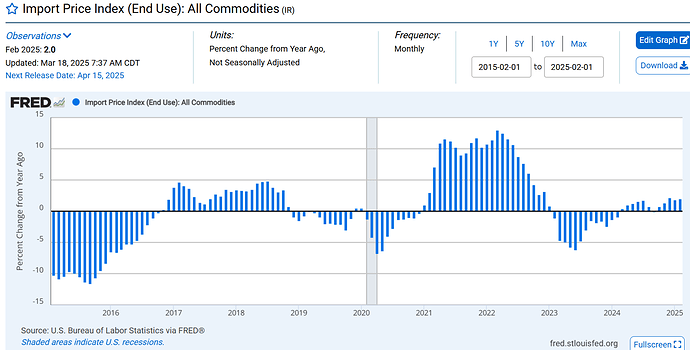

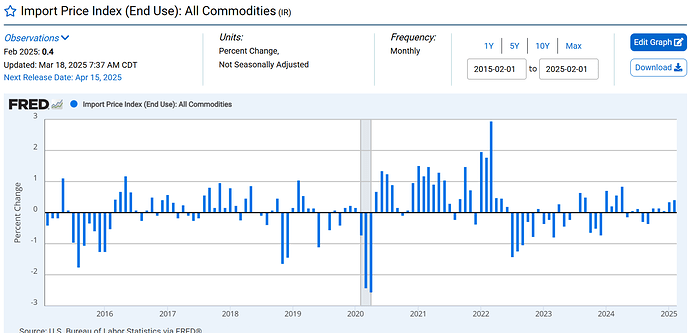

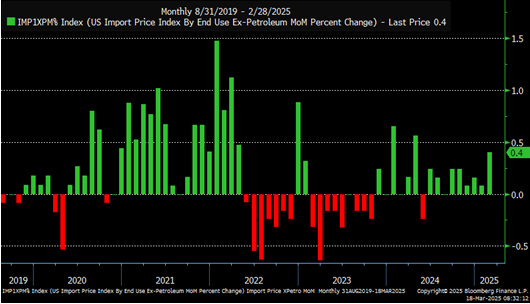

Due to the current proposed new tariffs threats by the US and possible retaliatory measures, import prices have become a important component to follow. Any significant price increase in import prices will be first seen here.

Signance of Import Price on PCE

Import prices have an indirect but meaningful impact on the U.S. Personal Consumption Expenditures (PCE) price index, but their direct weight isn’t explicitly isolated in the official PCE data. Instead, the influence of import prices flows indirectly through consumer goods and services purchased by U.S. consumers.

Here’s how import prices factor into PCE inflation:

1. Indirect Transmission through Consumer Goods:

- Goods Consumption (approx. 33% of total PCE):

Imported goods constitute a significant portion of consumer goods consumption—especially durable goods like electronics, automobiles, and nondurable goods like apparel and fuel. Therefore, fluctuations in import prices, driven by global commodity prices, exchange rates, or global supply chains, directly affect the goods component of the PCE price index. - Energy Prices:

Import prices significantly influence energy-related goods—primarily oil and petroleum products. Although energy spending accounts for around 4–5% of the total PCE basket, volatility in imported energy prices can heavily influence short-term movements in headline PCE inflation.

2. Indirect Impact via Input Costs:

- Higher import prices raise costs for domestic producers using imported raw materials and intermediate goods. These increased costs can indirectly feed into broader consumer prices, affecting the core PCE index indirectly.

Quantitative Estimates:

- While the exact direct weight of import prices isn’t separately reported by the U.S. Bureau of Economic Analysis (BEA), several studies and Federal Reserve analyses have quantified the passthrough effect:

- According to a Federal Reserve Board (2015) analysis, about 13–15% of consumer spending is directly or indirectly on imported goods.

- The passthrough effect varies by product type. For example, imported energy products have rapid and near-complete passthrough to consumers, while imported consumer goods have a slower and less complete passthrough.

Approximate Influence:

- Broadly, changes in import prices can contribute notably to short-run volatility in headline PCE inflation. A rough estimate:

- Imported energy products can cause short-term spikes or drops, substantially affecting headline inflation.

- Non-energy imported goods typically have smaller, more gradual impacts.

Policy Considerations:

- The Federal Reserve closely monitors core PCE (excluding food and energy), which reduces the volatility from imported energy prices. However, persistent increases in import prices (due to tariffs, supply chain disruptions, or currency depreciation) may gradually feed into core inflation through sustained higher input costs.

Bottom line:

- Import prices indirectly influence U.S. PCE inflation via consumer goods, particularly energy, and input cost effects. While the precise direct weighting is not explicitly reported by official statistics, imported goods directly or indirectly affect around 13–15% of consumer spending within the PCE framework, making them an important driver of inflation dynamics, especially in the short term.