Main Article: US Equity Valuations - InvestmentWiki

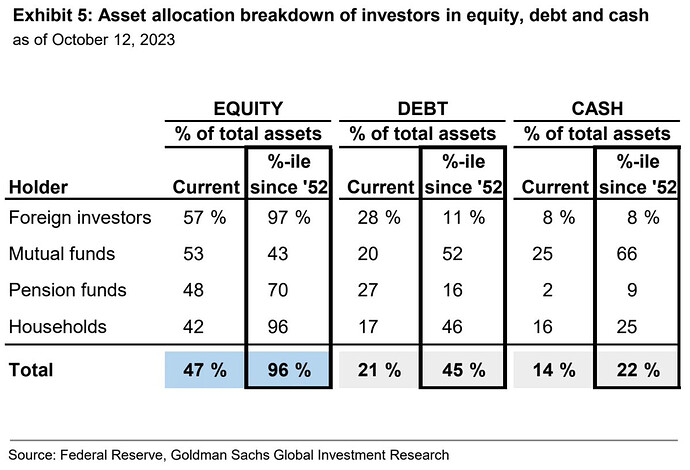

I found the current allocation between assets, which seemed interesting

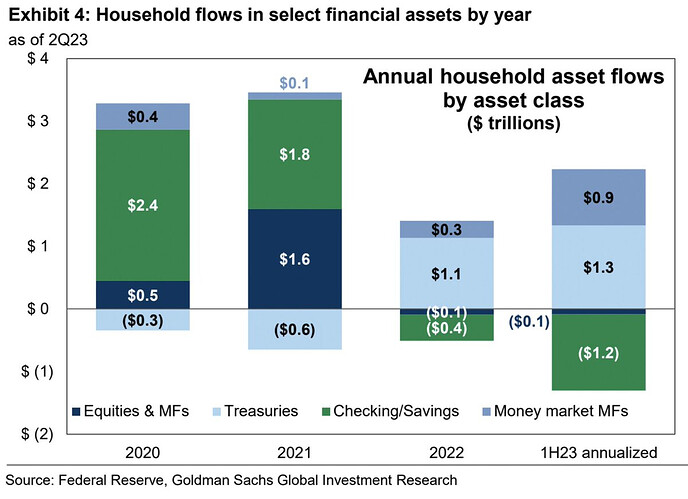

https://twitter.com/dailychartbook/status/1714232284662878573/photo/1

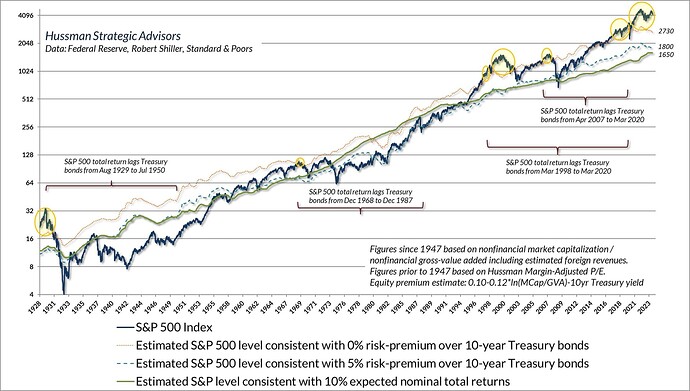

1 of the charts I found more interesting and longer timeframe

https://twitter.com/hussmanjp/status/1709248732141609154/photo/1

I have added to some opinions in the article, I am having difficulty finding opinions for optimistic people on valuations to be honest.

Will continue adding as I found them.

Some of what has stood out for me:

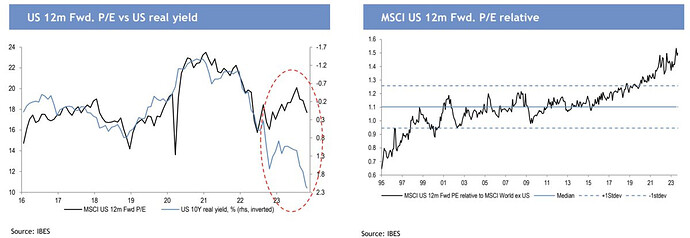

- Valuations currently seem pretty overvalued on basically all metrics/ratios for stocks, even with current earnings estimates being very high for 2024/2025. How valuations are going to look like if those estimates have to come down?

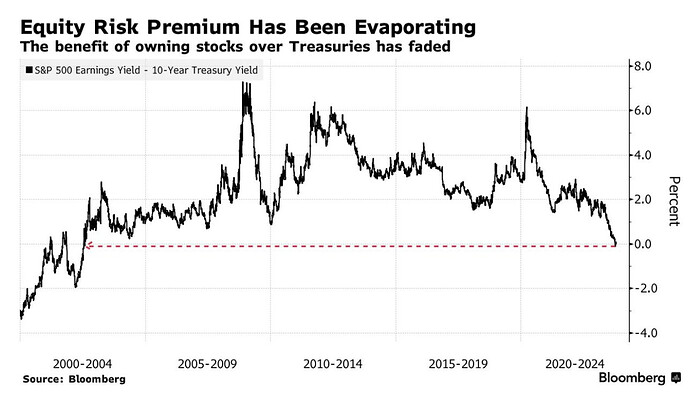

At the moment the ERP over 10 year treasury is basically zero. - Valuation metrics are not the best to use to predict short-term movements since markets can remain overvalued/undervalued for even longer than expected, or get even more overvalued/undervalued, but they are pretty good for predicting returns in the next 5-10 years.

- The market is acting as if valuations are ok because they think low rates or yields/QE/low inflation will still be the normal as the past decade+, so higher yields are temporary. They are also relying on a productivity boom due to AI.

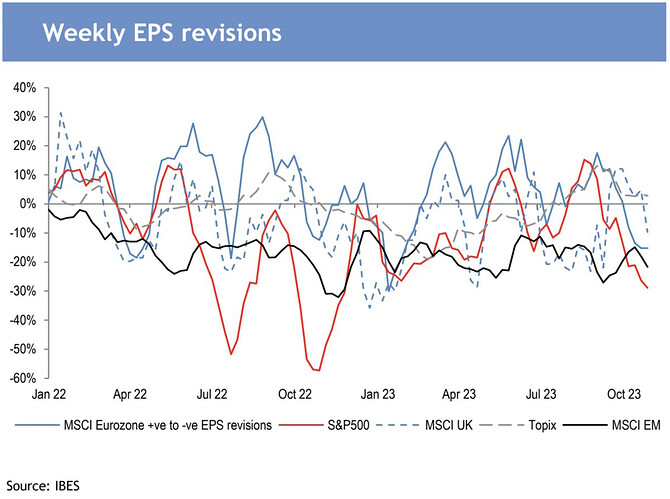

I do agree that earnings expectations still seem to high

“EPS revisions are falling again… consensus earnings growth expectations for next year are likely too high.”

- JPMorgan

https://twitter.com/dailychartbook/status/1722342222937424064

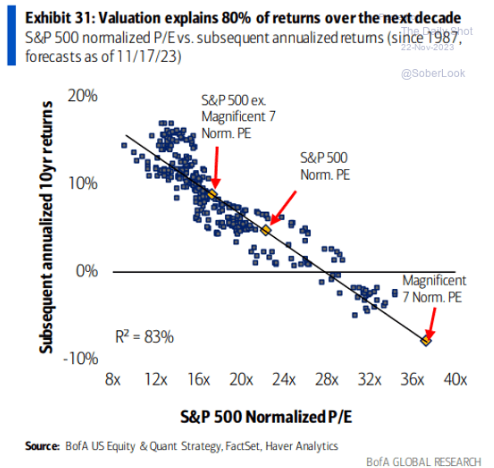

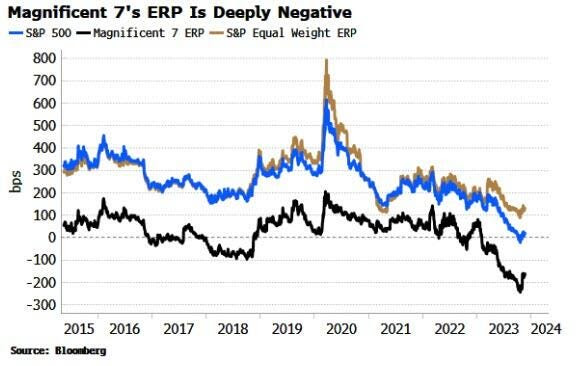

Interesting, even without the weight of those 7 stocks, the ERP is still low and falling, but closer to what have been since 2015

This is taking that analyst earnings are accurate too

https://twitter.com/dailychartbook/status/1728093872197423277?t=v1bvVHVDLSSDNdnTVB5hog&s=19

I guess major factors here are

- Perception of risk in treasuries might have changed. Is it really risk free given the speed in which new debt is added?

- Medium/Longterm Inflation expectations are changing (Are there survey to quantify that?) That means real yields in treasuries are only 1-2%. Equities might offer better inflation protection or at least there is hope that they will.

- A lot of growth priced in esp. for magnificent 7.

- Given that the economy kept performing well, equities overperformed.

! All of this this might change in the near future as the economy might finally weaken and hurt earnings. In this kind of scenario bonds might start overperforming in anticipation of rate cuts. !

Mm, I agree with some of your points, at least I agree this is how the markets are assessing stocks currently.

I would just add that markets are pricing a lot of cuts in 2024 already, starting from June. They probably hope yields will come down, and the ERP will get better due to this, and not due to a repricing on stocks.

-

While treasuries might be seen as riskier now, imo the probability that they are seen as more risky than stocks is very low to say that ERP should be zero or negative. I just think we continue to be in a very risk-on environment, the sentiment is very positive since mostly everyone is expecting high EPS growth, a growing economy, inflation falling, the FED cutting rates soon, and the treasury issuing less duration.

It will continue to be this way like you said until there is a significant catalyst that might change this perception. -

Inflation expectations have increased slightly, but they are still close to 2%. This is one of the goals of the FED, and they mention constantly that they continue to be well anchored to the target. And while real rates might be only 2-3%, is still higher than what it was for years. So this for me is creating more competition for stocks than the opposite.

I sometimes can’t really justify some valuations, but I also have learned during this time, that markets can get even more extreme than we expect. And in the short term is very difficult to know what the catalyst will be that could cause a correction. So trading based on valuation alone is probably not a good idea.

I also found this interesting regression from BofA, where the correlation since 1987 between valuation and returns is high, and the current long term forecast based on it is not the best.