According to WSJ and Washington Post, White House aides have drafted a proposal to impose tariffs of around 20 percent on most imports to the United States

- First scenario: 20% universal tariff on virtually all imports

- Second Scenario: an across-the-board tariff on a subset of nations that likely would not be as high as the 20% universal tariff option, after pushback from option 1

The announcement will come tomorrow at 4pm ET (after hours)

I have read today’s analyst saying the market is not expecting a very adverse announcement and for uncertainty to come down after tomorrow, hence there could be a negative market reaction to more negative than expected news

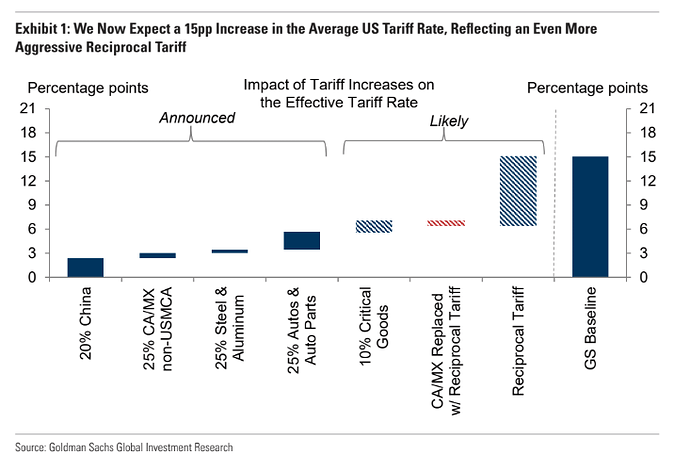

- Goldman expects U.S. tariffs to initially rise by 15 percentage points—matching their previous “risk case”, but anticipates that product and country exclusions will trim the effective increase to 9 points.

More Details

“A realization of our new tariff baseline would likely come as a negative surprise to markets. Our recent survey of market participants indicated that the average investor expects the effective tariff rate to increase by roughly 9pp this year, while only a very small share (4%) expect an increase of 15pp or more.”

- Mike Wilson (Morgan Stanley)baseline is for higher tariff on China goods, product specific tariffs on European and Asia ex-China goods, and de-escalation on Mexico and Canada. But market could sell of to lower end of firm forecast (5500) if tariffs news are more restrictive than expected.

More Details

He sees the announcement as “likely a stepping stone for further negotiations, as opposed to a clearing event,” with upside capped at 5,900 even in a better-than-expected announcement absent “clear reacceleration in earnings revisions breadth, something we are currently not seeing at the index level,” which could take it to 6,100 he says.

A worse than expected announcement likely takes the index back to the 5,500 level.

- BBG columnist Simon Flint Agrees with Goldman that equity risks are tilted lower and believes the projected 6pp tariff hike now and 8pp in 2025 are likely underestimated.

More details

He says because of recent news reports investors believe “tariffs may be applied with a scalpel rather than a sledgehammer,” but he says there are many risks:

- the opening numbers on April 2 may be larger than markets expect

- the assumption that tariffs will be revised down significantly may be wishful thinking.

- even if they are walked back, the constant flip-flopping is itself a drag.

- while the rest of the world may be playing nice for now, don’t mistake politeness for weakness.

- the damage to global cooperation, norms, and institutions could be long-lived and hard to reverse

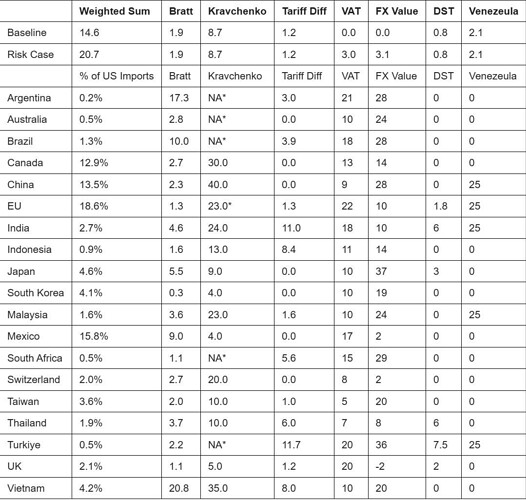

He says current expectations for a “modest ~6 percentage point increase in tariffs due to reciprocal duties, and an 8 percentage point hike for 2025 as a whole” will likely prove to be too low. He builds off of Goldman’s work and comes up with his own table of expectations assuming all non-tariff barrier’s are taken into account.

If so, “we get an eye-watering 20.7 percentage point increase (as per the second row), drastically greater than the current expectations ‘priced in’.”

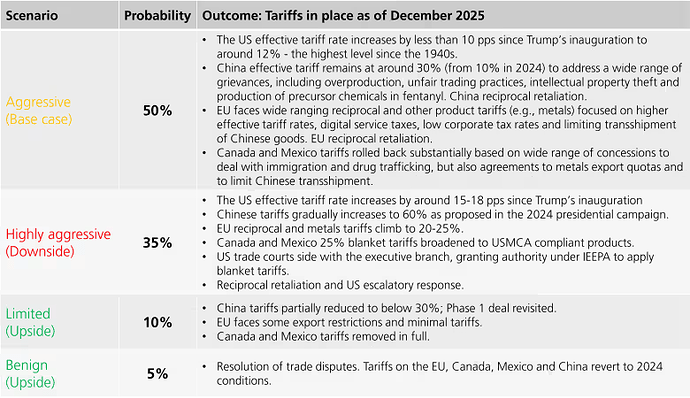

- USB Probabilities: Aggressive (50%) = tariff effective rate to 12%, Highly aggressive (35%) = tariff rate to 17-20%