This topic will be focused on developments on the global supply chains, and its implications on the economy and inflation

The recent surge in Shipping rates is something to keep monitoring for some time because it could have an impact on inflation eventually.

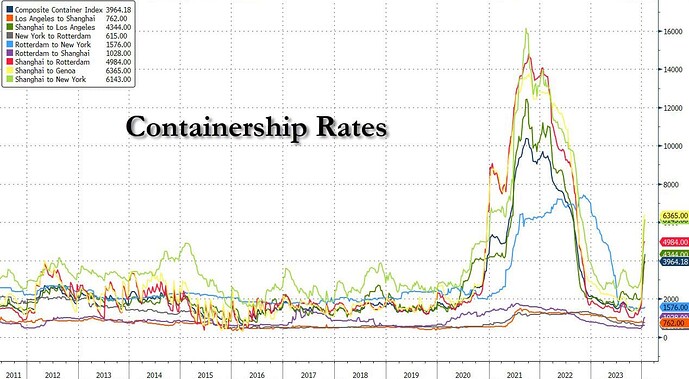

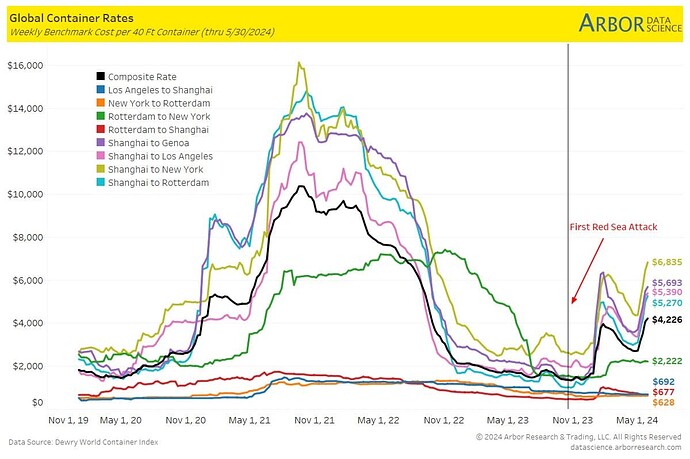

Short-term rates for container shipping between Asia, Europe and the US are climbing on reduced capacity caused by the threats to cargo vessels in the Red Sea.

- In the 10 days through Jan. 2, the number of Suez transits was down 28% from a year earlier. That’s consistent with 3.1% of global commerce being diverted away from the Red Sea, according to the data.

- Prices surged almost 200%

- Services from Asia to northern Europe and to the Mediterranean both cost more than twice their levels in January 2019, but are still well below their peaks during the Covid-19 pandemic, said Judah Levine, head of research at Freightos.

https://www.bloomberg.com/news/articles/2024-01-04/spot-container-shipping-rates-soar-173-on-red-sea-diversions?utm_source=website&utm_medium=share&utm_campaign=twitter

Great topic! Do you have longer charts on shipping rates?

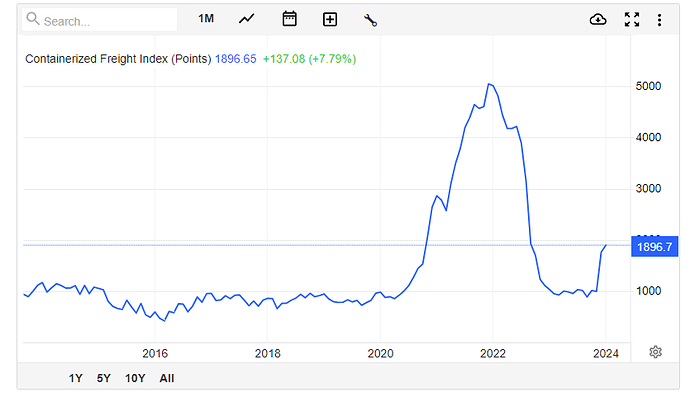

I did not find the actual shipping rates, but I found the Containerized Freight Index

Here you can find old rates from 2022, but is not updated: World Container Index (WCI)

I finally found a chart with a longer view. And from what I can see, it has continued to get worse since the last time I shared it.

https://twitter.com/zerohedge/status/1750903115992232204/photo/1

It would be interesting to somehow determine the relationship between shipping rates and inflation.

Maybe it is not even that relevant in case shipping rates make up only a small part of costs for physical products that get imported? (which is a small subsection of gdp)

This is from a research IMF did in March 2022:

A doubling of freight rates could increase inflation by 0.7%.

Right now is more than 100% increase, on the way to 200%

Studying data from 143 countries over the past 30 years, we find that shipping costs are an important driver of inflation around the world: when freight rates double, inflation picks up by about 0.7 percentage point. Most importantly, the effects are quite persistent, peaking after a year and lasting up to 18 months.

While the pass-through to inflation is less than that associated with fuel or food prices—which account for a larger share of consumer purchases—shipping costs are much more volatile. As a result, the contribution in the variation of inflation due to global shipping price changes is quantitatively similar to the variation generated by shocks to global oil and food prices.

They said the pass-through to the consumer is more gradual than oil and food shocks. Peaking at 12 months.

Higher shipping costs hit prices of imported goods at the dock within two months, and quickly pass through to producer prices—many of whom rely on imported inputs to manufacture their goods.

But the impact on the prices consumers pay at the cash register builds up more gradually, hitting its peak after 12 months. This is a much slower process than what is seen after a rise in global oil prices, which drivers feel at the pump within a couple of months.

The inflation impact also depends on how much the country imports, how integrated its supply chains are, how strong its monetary policy is, and how well-anchored inflation expectations are.

Update for shipping costs.

I=6

Strikes affect shipping activities at U.S East Coast and Gulf Coast

- Dockworkers at the U.S East Coast and Gulf Coast have gone on strike demanding an increase in wages and a rollback on automation agreements.

- The two ports handle nearly half of containerized cargo entering the U.S.

- JPMorgan estimates that the economy will lose between $3.8 and $4.5 billion a day due to the strikes.

- The strike is expected to impact container cargo and auto shipments.

I=5

U.S dockworkers have agreed to end their strike following a tentative deal that will extend their contracts to January 15.