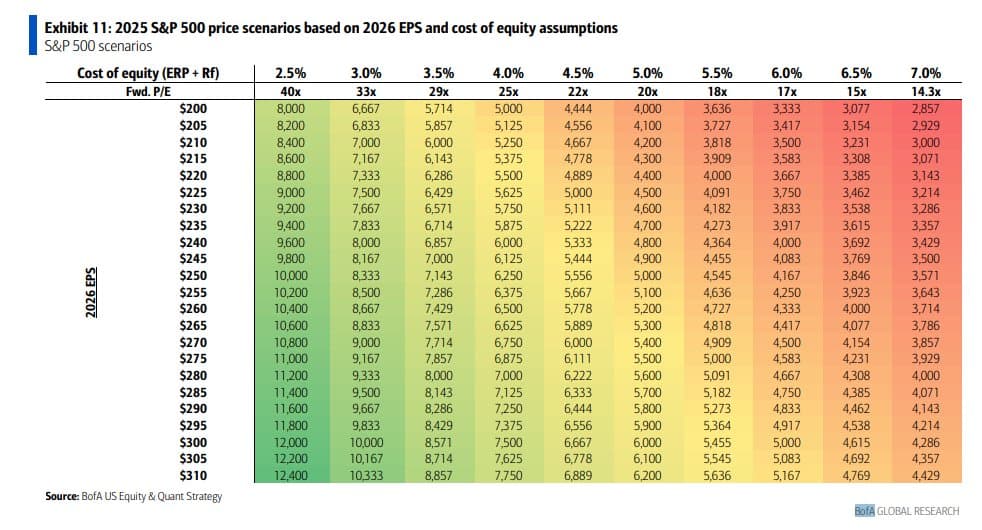

BoA’s Savita Subramanian cuts her 2025 SPX estimate to 5600 on the back of a cut to 2026 EPS estimates to $257 ($250 for 2025)

This drops their “fair value” model to 5,411 along with a 50bps increase in cost of equity estimate.

"The range of expected earnings across scenarios is wide based on different macro scenarios: a recession could hit earnings by 20%, the typical recessionary drop, yielding earnings of $200.

"Stagflation would likely be milder given the nominal benefit to earnings, but would pose risks of 10% to 20%.

“Goldilocks and boom scenarios would likely represent 10% to 20% gains from here (where trailing EPS as of 1Q25 assuming current 1Q25 consensus is ~$250). The cost of equity (equity risk premium + risk-free rate) is also a big swing factor.”