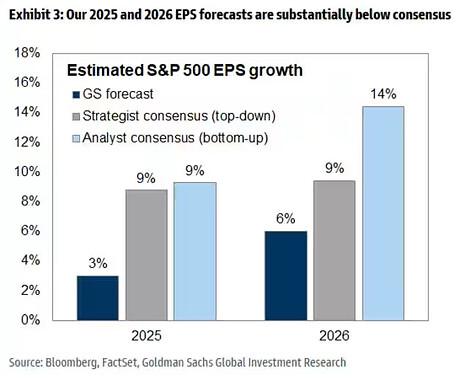

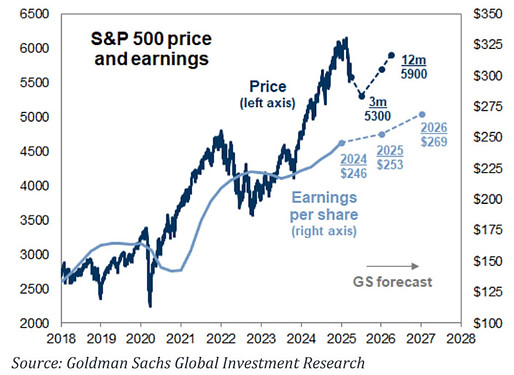

Goldman slashed their S&P 500 earnings per share growth target for 2025 by more than half, from plus 7% to plus 3% ($253 per share)

Consensus continues to be ~269 EPS, but I think we could start to see additional revisions going forward, after the down revisions we are starting to get for 2025 US GDP.

- Earnings per share (EPS) growth in 2026 is reduced slightly from 7% to 6%.

- Estimate each 5 pp incremental increase in the effective tariff rate would weigh on S&P 500 EPS by roughly 1-2%

- Strategist now expects the benchmark to end the year around 5,700 points versus his previous estimate of 6,200, citing a [higher recession risk and tariff-related uncertainty.

“If the growth outlook and investor confidence deteriorate even further, valuations could decline much more than we forecast,” Kostin wrote in a note. “We continue to recommend investors watch for an improvement in the growth outlook, more asymmetry in market pricing, or depressed positioning before trying to trade a market bottom.”

https://www.bloomberg.com/news/articles/2025-03-31/goldman-slashes-s-p-500-target-for-second-time-on-growth-risk?sref=E10pTi1i

https://x.com/neilksethi/status/1906705037553725578