Topic to be able to discuss assessment about the market phase for Solana based on its on chain and sentiment metrics

Assessment as of February 25, 2025

With declining active addresses, TVL, open interest, fees, and DEX volume, none of which show signs of stabilization or reaccumulation, there is no clear indication for Solana direction yet. It would be prudent imo to wait for improvements in some of these metrics while prices remain low before considering any positions.

Observations:

- Solana’s daily active addresses have gone from 6.6 M at the end of November to 3.5M currently, almost a 50% decline.

- Solana’s new addresses went drom 6.5M in november to 2.7 M currently, a 58% decline

- Solana TVL has declined 42%, from $12.19B at the peak in January to $7.19 B currently.

- Solana fees have also declined 86%, from ~73.5K daily SOL at the peak in January to 9.75k currently.

- Transaction has not declined as much yet at ~ -28%, probably due to all the selling pressure still happening.

- Solana funding rates are currently negative, signaling a cooling off of demand for long speculative positions, and opening of short positions.

- Solana’s open interest has declined 50%, from $6.5 B at the peak in January to 3.25B currently. Signaling a reduction in speculative activity and lower cash and carry yields.

- Solana whales seems to be negative and still shorting currently, signaling negative sentiment still present

- The march 1 token unlock on also weighting on sentiment currently

- Solana’s Hot Capital (1d–1w + 24h Realized Cap, tracks recent capital flows) has also declined -25.44%, from $15.82B to $11.80B

1 Like

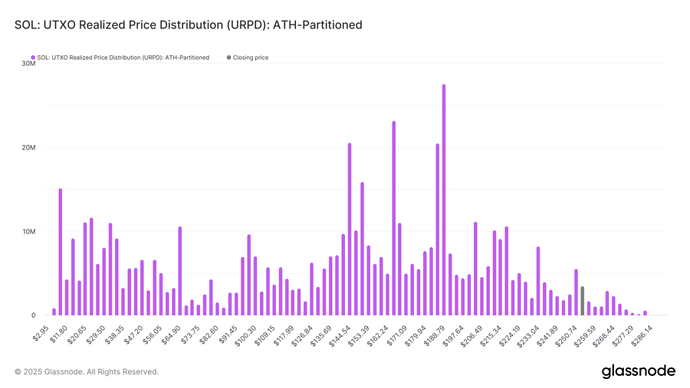

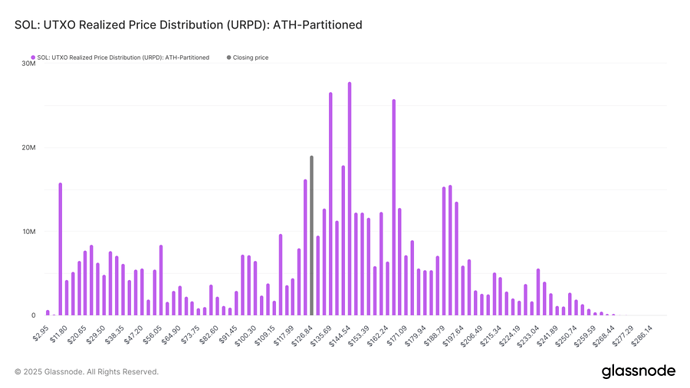

SOLs URPD chart highlights key price levels where SOL supply has concentrated, offering insight into potential support and resistance levels.

URPD shows how much of the supply was last moved (i.e., acquired or transferred) at each price level.

- A key area of interest is $112.10, where 9.7M SOL, is concentrated. This level held 4M SOL on Jan 19 already, indicating long-term investors have added to their cost basis.

- Below, $94, $97, and $100 collectively hold nearly 21M SOL (3.5% of supply). If these levels fail, downside risk increases significantly, with little supply between $94 and $56.

- Significant resistance appears at $135 (26.6M SOL) and especially at $144, where 27M SOL - nearly 5% of supply - is concentrated. On Jan 19, this level already held 20.6M SOL, meaning many investors may look to exit at break-even, creating selling pressure.

https://x.com/glassnode/status/1902346960796856446