High-Level Overview for Q4 2024 Indexes Earnings

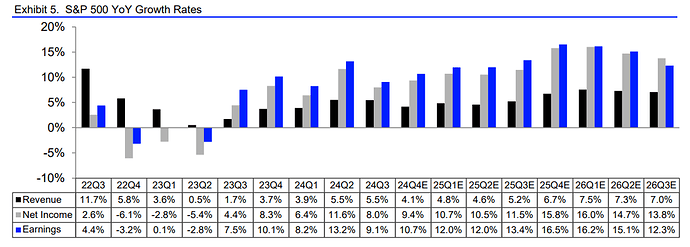

Q4 2024 SP500 Net Income Earnings at 9.3% y/y vs 8% in Q3 2024

From what I have noticed covering the index earnings, most quarters’ actual results come out better than expected (eg. 3.1% expected in Q3 2024 vs 8% actual), so we could see another quarter of double-digit earnings growth in the final quarter of 2024, which is one of the highest growth rates in recent years. Until now, there is nothing indicating earnings will instead underperform significantly, including banks’ strong earnings.

Currently, my only concern comes from 2025 expectations being already too high at 13.8% (an acceleration from 10.4% in 2024), meaning significant growth is already priced into the markets, in an economy that while still performing well, is still slowing a bit on nominal terms. Hence, any underperformance against these expectations could cause negative reactions in the markets.

While earnings expectations in the short term (current quarter) tend to be more accurate and underestimating actually. More long-term horizons are not as accurate always, especially with a lot of uncertainty, and are prone to constant revisions.

- Earnings are projected to reach $528.08 billion with a growth of 10.7%.

- Revenues are set to achieve $4,092.5 billion, reflecting 4.1% YoY growth.

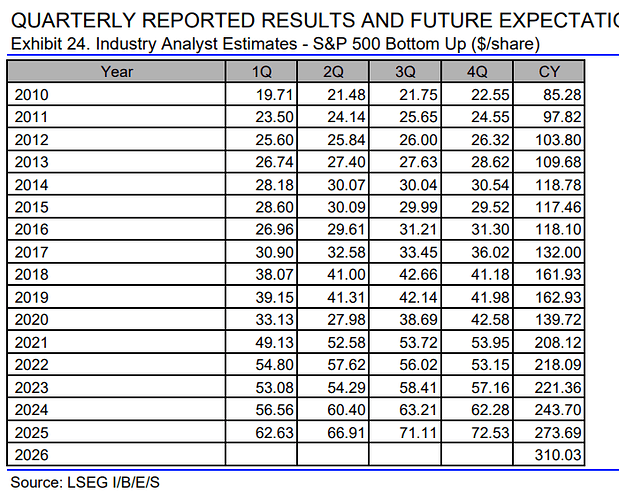

- EPS projected at 62.28 in q4 2024, an 9% y/y. All of 2024 is expected at 243.70, a 10% growth (at the beginning of 2024 expectations were 243.5, so pretty accurate this year)

Strong Earnings Growth Expected in 2025

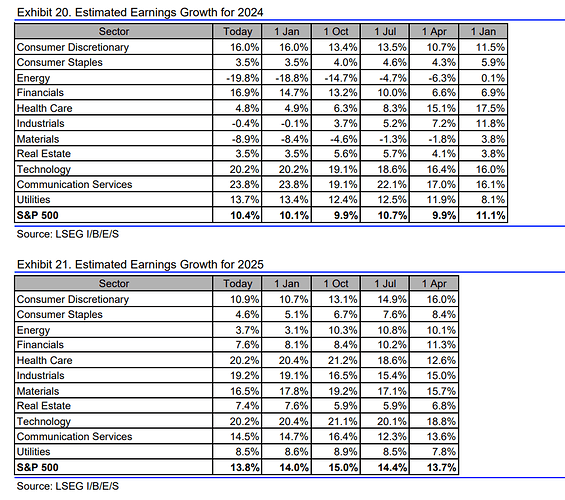

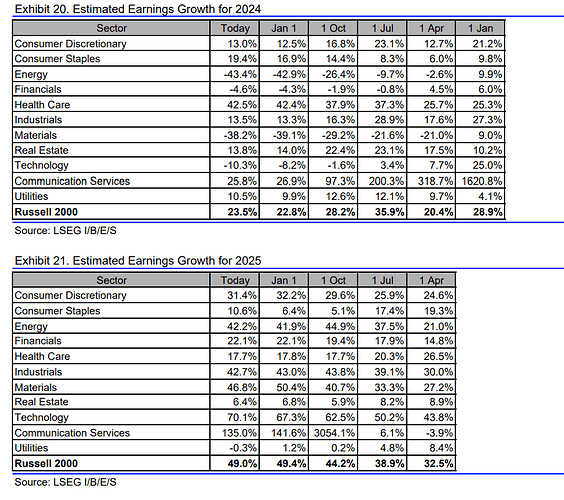

- Earnings are projected to grow 10.4% in 2024 and 13.8 in 2025.

- Energy, health care, industrials, materials, and real state expected to have earnings recovery or acceleration in 2025

- Consumer discretionary, communications services, and utilities are expected to see a deceleration in earnings

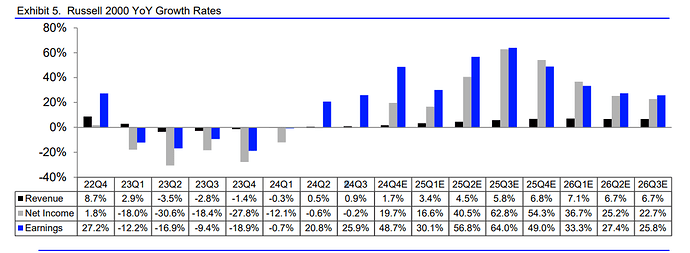

Russel 2000 net income expected at 19.7% y/y, a recovery after quarters being declining.

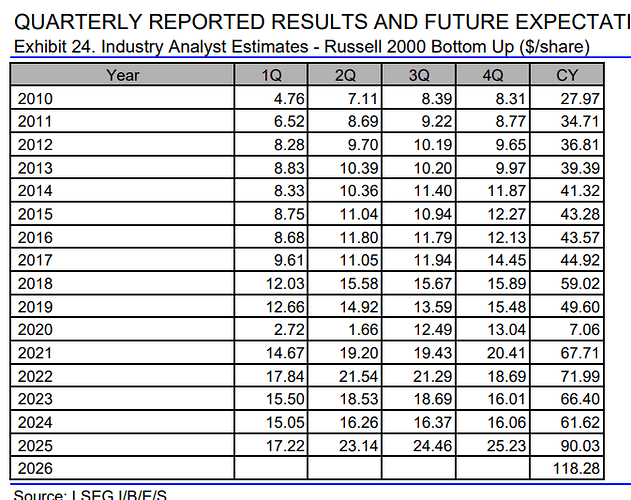

Small caps contrary to the SP 500 have been underperforming expectations in the last quarters

The expectation is that changes under the Trump administration and lower rates will benefit small caps mostly, that’s why expectations so high for 2025 currently.

- Earnings are projected to reach $19.54 billion with a growth of 48.7%.

- Revenues are set to achieve $461.9 billion, reflecting 1.7% YoY growth.

- EPS projected at 16.01 in q4 2024, basically flat from 2023.

- 2024 expected at 61.62, a -7.2% growth, and 2025 at 90.03, a 46.10% expansion.