This topic discusses the upcoming 1&1 Q4 2024 earnings. It contains our earnings outlook and a summary of the results. Here is our Wiki article on the same:

Vodafone’s Q3 2025 earnings signals that 1&1 could have added a lower than expected number of customers in Q4 2024

-

In its Q3 2025 (quarter ended December 2024) earnings, Vodafone said the pace of migration of 1&1 customers to their network is progressing slower than expected partly due to stiff competition.

“During Q3, 1&1 began migrating their customers onto our network as part of our long-term national roaming agreement, however this has been slower than expected. We expect the migration to ramp-up in the following quarters and reach full run-rate during H2 FY26,” Vodafone said.

“So if I start from pricing and the overall competition environment in Germany, the answer to your question on the numbers is very simply back to what I said earlier, which is it’s big moving elements, both 1&1 in terms of the pace of the migrations and, of course, mobile pricing,” Vodafone CEO Margherita Della Valle said in the earnings call.

-

In the call, analyst Joshua Mills of BNB Paribas flagged Deutsche Telecom which recently reduced prices by 20% through March.

-

Vodafone’s service revenue in Germany declined 6.4% y/y to €2.7 billion driven by a 3.8% impact from the TV regulation and a lower broadband customer base and lower mobile average revenue per user (ARPU). Analysts were expecting service revenue to decline by 5.3%.

I=10

1&1 Q3 2024 service revenue slightly missed estimate, customer contracts added were below the mid-point guidance and agreement for compensation for network outage in June has not been reached

-

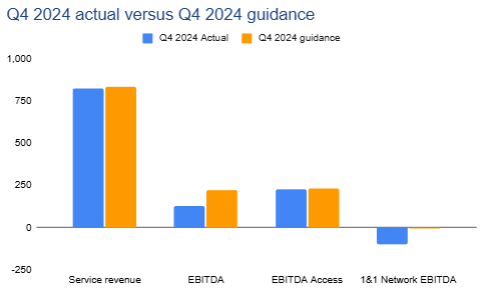

1&1 Q4 2024 total revenue fell 1.7% y/y to €1.05 billion euros (calculated), service revenue was flat y/y at €824 million euros, slightly below management guidance of €831 million euros, hardware revenue fell 7.4% to €223 million, EBITDA rose 22% to €128 million (guidance: €223 million), 1&1 start-up cost was down 7% to -€98 million (guidance: -€7 million) due to higher than expected increase in network costs and lack of compensation from the network partner while EBITDA in the access segment rose 7.4% to 226 million (guidance: €230 million).

-

The company increased the number of customer contracts by 130,000 to 16.39 million (guidance: 100,000 to 200,000) in 2024.

-

2024 capex came in at €353.4 million, significantly lower than €460 million guided by the management due to phasing effect.

-

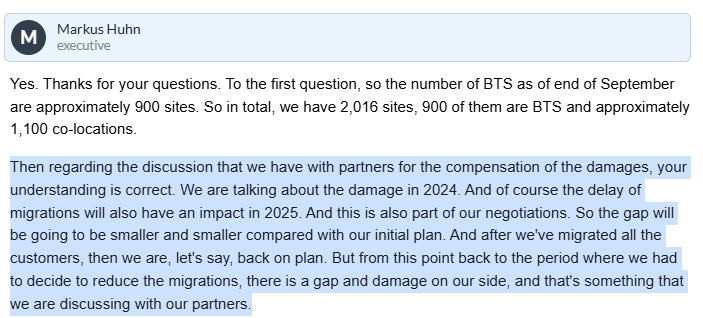

1&1 said an agreement with the partner responsible for the network outage between June and August 2024 has not been reached.

“The negotiations with the partner responsible for the outage and the undersizing, which should lead to compensation payments, could not yet been completed. From today’s perspective, the negotiations are expected to take some time, and an agreement will presumably not be reached before the publication of the 2024 fiscal results scheduled for 27 March 2025.”

Assessment

Overall, the core business was stable during the quarter despite stiff competition. However, it’s not good that the investment volume was lower than expected as it signals the network expansion is likely progressing slower than planned. The increase in network costs is due to lack of compensation from the partner responsible for the network outage. The shares are down almost 4% probably due to these reasons.

Here are the analysts opinions following the preliminary earnings release:

- Buy, €20: UBS said 1&1 has made some operational improvements, but the costs of setting up the network are above expectations. Analyst Polo Tang said the news is not good for the moods but much of it is probably priced in.

- Buy, €15: Analyst Andrew Lee of Goldman Sachs said 1&1 has landed below market consensus due to problems with the network expansion. He added that investors are increasingly questioning these plans but there is immense potential if they move away from this.

- Buy, €19.5: Analyst Keval Khiroya of Deutsche Bank cautioned that 1&1 could rethink its plans to build its own network, especially due to the increase competition in Germany. He added that abandoning its network plans could cause the shares to double.

- Underperform, €10.6: Analyst Ulrich Rathe of Bernstein said the figures were accompanied by a de facto profit warning.

1&1 guides 2025 EBITDA below market expectations and capex above market expectations

- 1&1 is guiding 2025 EBITDA to decline 3.4% to €571 million, below market expectations due to one-time payment to Telefonica when their contract expires and service revenue at the previous year’s level (2024: €3,303.1 million).

- 1&1 said the contract with Vodafone doesn’t provide for such one-off payments and the switch won’t affect EBIT since the impact on EBITDA is offset by an equal amount of depreciation.

- Despite expecting a further slight increase in cancellations as a result of customer migration, it expects contract base to remain stable.

- It’s guiding cash capex in the amount of €450 million (2024: €290.6 million), above market expectations.

- 1&1 shed 8% following the announcement.

Assessment

I think the market is overreacting to the guidance, probably the cash capex. In Q2 2024, 1&1 guided capex in the amount of 360 million for 2025. However, this excluded the 100-150 million capex savings from selling passive infrastructure to a partner. Therefore, the 450 million being guided could signal that a partner to buy the passive infrastructure has not been found.

They could also be reacting to the accounting change as a result of the end of Telefonica contract.

Otherwise, the core business is stable. Analysts were guiding revenue of €4 billion, which is unchanged from last year and EBITDA of 652 million.

My initial instinct was also to think the market over-reacted, but i changed my mind on it.

I did not know, that the previous CapEx guidance was in the 460-510 million range (excluding selling the towers to a partner) - so it’s good that you highlighted it. The fact that the guidance is somewhat lower than expected is not positive as it might indicate somewhat slower network progress, and a deal to sell the towners would probably be preferable if it could be done on good terms.

I like that the transition to Vodafone looks to be going relatively smoothly and that the contractual terms with Vodafone lead to similar margins than the one with Telefonica but the fact that EBITDA is down again is not good as 1&1 justified the lower EDBITA in 2024 with the fact that there was no compensation for the fall out of datacenters. Considering this special factor from last year means that while 1&1 network cost look stable y/y they will be up substantially in 2025 instead. I think this could be one major factor why the stock is down. (If you want have a closer look into this. This is based on my first impression but I don’t have the time to go through all the details as of now). In addition i think this is the first year in a long time in which they don’t project growing EBITDA driven by the core business.

The marketscreener consensus looks a bit outdated. They still have the EBITDA 652m consensus for 2024. (Results came in at 591m) and for 2025 they have currently even 706m.

I won’t use the reduced capex guidance to signal limited progress in the network buildout. Remember last year a large part of the capex (around 200 million euros) went to data centers. Now that the data centers are complete, the capex for this year will go to the antenna sites. 360 million on antenna sites doesn’t sound a small feat in my opinion.

United Internet says the EBITDA headwind from changing the roaming provider is around €20 million. That will bring the 2025 guidance to €591 million, unchanged from last year. According to 1&1 investor relations, the 2025 guidance does not include the expected compensation from the partner responsible for the network outage last year. I will point out that the network outage last year is also expected to impact the 2025 results, hence there will be compensation for the 2025 headwind as well. That means with the compensation, the EBITDA will be higher. According to reports, the compensation could be in the high double digit millions. But you are right on the performance of the access segment, this is the first time that they are not growing EBITDA in the access segment. In 2024, EBITDA access was up 9%, in 2023, it was up 5%. This probably has to do with intensifying competition, which impacts pricing.

Thank you for the additional details on compensation. Obvs. it might happen that there is no compensation as well, but I currently assume there will be some sort of compensation.

Yes fair point. That 20 million is only a one-time payment.

In addition, I think it’s important that the accounting for network cost changes with the change to Vodafone, which results in lower EBITDA and lower depreciation, and EBIT is the same. (which is what matters)

I also agree that Capex overall does not look so bad. How do you conclude that the 360 million are for antennas? To me it sounds like the 100-150 million in potential saving refers to passive infrastructure = antenna costs. That said I am very tight on time and cannot afford to have a deeper look into matters myself. I think, in general, therefore, our workflow always needs to be that I only catch up briefly or, at maximum, share a few thoughts, but it will always be your responsibility that we understand things fundamentally and in depth well. (And it is always worth it to invest time to reach those deep understandings and translate them into our valuation models and company knowledge in Notion/Wiki)

Analysts criticized the weak outlook

- Underperform, €10.40: Analyst Ulrich Rathe of Bernstein said 1&1’s targets for 2025 fell significantly short of market expectations. He said what’s new is the stagnation in contract portfolio and service revenue expected for 2025, adding that previous consensus for both metrics indicated an increase. He added that the statements regarding the decline in EBITDA and higher investments were disappointing.

- Buy, €19.10: Simon Stippig of Warburg research said the outlook is below expectations but the company’s stated ability to acquire frequencies independently in the future is positive.

- Andrew Lee of Goldman Sachs criticized the outlook but said it might not be significantly below estimates as it might appear at first glance since the market expectation has not been updated since the company issued weak key figures for 2024. Lee pointed out that the shares could rise more than 200% if the company slows its network expansion.

1&1 had 2,309 antenna locations at the end of 2024, below 3,000 target

- 1&1 says at the end of 2024, they had 2,309 antenna locations, that’s below the 3,000 that they had targeted.

- It added that it currently has 6,000 antenna locations that are operational or being targeted.

- At the end of Q3 2024, it had 2,016 antenna locations.

Assessment

While the number of antenna locations at the end of 2024 were below the target, the number of antenna locations in the pipeline is solid. I think at the end of the day what matters is coverage that it will have at the end of 2025. The Federal Network Agency requires 1&1 to achieve [25%](https://This looks possible considering the antenna sites pipeline.) coverage at the end of 2025. To achieve this, it needs around 6,000 to 6,500 antenna sites. This looks possible considering the antenna sites pipeline.

Q4 2024 1&1 earnings call summary

- CFO Sascha D’Avis said he is optimistic about extending the 2,600 MHz lease from Telefónica, as it’s based on an existing contract. However, he cautioned that negotiations can be unpredictable, citing the two-and-a-half-year national roaming talks. In 2019, 1&1 leased two 10 MHz blocks in the 2,600 MHz band, set to expire in 2025. BNetzA has asked Telefónica to extend the lease (min 42:00).

- Dommermuth expects negotiations for low-band spectrum to be “intense and tricky,” based on his past experience (min 42:00).

- He pointed out that frequency pricing is clear. Hypothetically, if 1&1 uses 20% of an incumbent’s spectrum to generate €10 million annually, paying €2 million for it would be fair. However, he warned that incumbents may resist using justifications like low capacity or critical usage (e.g., in hospitals) (min 42:00).

- 1&1 is guiding flat access contract growth in 2024 due to churn from the large-scale migration of customers. Migration is expected to peak in Q2, slow in Q3, and conclude in Q4. Q1 contracts are forecasted to be 10,000–20,000 lower YoY, with a return to 200k–300k net additions expected in 2026 (min 27:00).

- 2025 capex is driven by phasing effects: 2024 cash capex was €160M lower than book capex. Additional investments are planned for capacity and network expansion (far-edge data centers, antenna sites), with phasing effects also expected in 2025/2026 (min 32:00, min 67:00).

- The company has not yet decided whether it will sell its own passive infrastructure (min 40:00).

Assessment

I think the possibility that they will save 100-150 million on capex by selling the passive infrastructure is now low. In the earnings call they couldn’t remember when they said they will save this amount. While they still look forward to selling the passive infrastructure and leasing back, their language indicates that they are satisfied with the capex level.

I would say the customer churn as a result of migration is understandable. However, in the earnings call they didn’t mention the current state of competition and if it is one of the headwinds. Based on my understanding, competition is currently intense (Deutsche Telecom and Telefonica are offering more attractive offers) and this could lead to more churn. However, last quarter, 1&1 had said it will bring an attractive offer in Q1 as well, so maybe they are starting to withstand competition with it.

Based on Dommermuth comments on the low-band spectrum, it looks like we are facing another delay on that front.

Buy, €19.50: Analyst Robert Grindle of Deutsche Bank said 1&1 is likely to stick to its network expansion plans but given the ongoing difficulties in this area and a deteriorating competitive situation, it could also go for other options which could bring significant potential.

Wow i think the requirement to extend the lease is something we completely have missed when reporting about it here?

In a lot of cases I started to completely rely on your summaries and don’t read the original source (Esp. if my workload is too high)

Therefore it will be super important in the future that you highlight key developments like this. Can you remind me what this 2.6MHZ lease is and why/how it is important?

Is it separate from the NRA with Telefonica? If you described this before e.g. in the Wiki you could also link to that.

What happens if negotiations on that front take longer?

The Telefonica 2.6 GHz frequency band and the Telefonica national roaming contract are largely unrelated. However, they both stem from a self-commitment by Telefónica during its merger with E-Plus in 2014 to divest some of its radio frequencies and sell up to 30% of its merged network capacity to one or several MVNO(s). 1&1 leased the Telefonica 2.6 GHz frequency in December 2019 and entered into national roaming with Telefonica in May 2021.1&1 also acquired two frequency blocks of 10 MHz in the 2 GHz band during the 2019 auction but this will only be operational in January 2026. At the time, 1&1 said it was going to use the Telefonica 2.6 GHz frequency as a bridge until their own frequency in the 2 GHz can be used. However, it now says the more of these frequencies, the better.

High-band frequencies (2.6 GHz and 2 GHz) are largely deployed for capacity coverage such as in urban centers and are largely incapable of penetrating through walls. On the other hand, low-band frequencies are capable of penetrating through walls and are good for rural coverage. 1&1 stated that with 12,000 antenna sites, it expects to achieve 60% traffic coverage with low-band spectrum and 50% without it. Looking at the gap in traffic coverage, it’s evident that the high-band frequencies are as important as the low-band frequencies.

1&1 pointed out that we can say the high-band frequencies (2.6 GHz and 2.0 GHz) are in “safe territory” while the low-band frequencies are still not in “safe territory”.

Given that 1&1’s network buildout is still at an early stage, the 2.0 GHz spectrum, which becomes available next year, should be able to offset the loss of the 2.6 GHz band as negotiations continue.

Cool thanks for the details and great initiative to have this call.

In your notes of the call you say that national roaming costs would increase 30-50% per year in Germany.

Do you have more color on that? Obvs. in case this is true the whole strategy for 1&1 would not work because no business can afford costs to increase by this rate each year esp. in an environment in which prices they charge from costumers are stable.

I couldn’t find external research or data backing up his comment that roaming costs have been growing by 30%-50% in Germany. However, the executive used cost/gigabytes (GB) in his illustrations, which I think is irrelevant for 1&1 given that its contract with Vodafone stipulates fixed cost per network capacity.

“The calculation basis is a so-called capacity model, under which 1&1 will pay a fixed price per percentage point for such percentage of the Vodafone network which is used by its customers. Such fixed price changes from time to time in line with the cost development of the Vodafone network,” 1&1 had said while announcing the start of the negotiation.

“The cooperation between Vodafone and 1&1 is designed for the long term and includes mechanisms that protect both companies financially against rising costs and data volumes,” 1&1 said while announcing the signing of the agreement."

While the cost/capacity will likely grow due to the continued development in Vodafone’s network, I don’t think the year over year growth will be that significant, especially given Vodafone has already achieved 93% 5G coverage of German households.