This topic discusses the upcoming Q4 2023 Upwork earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki:

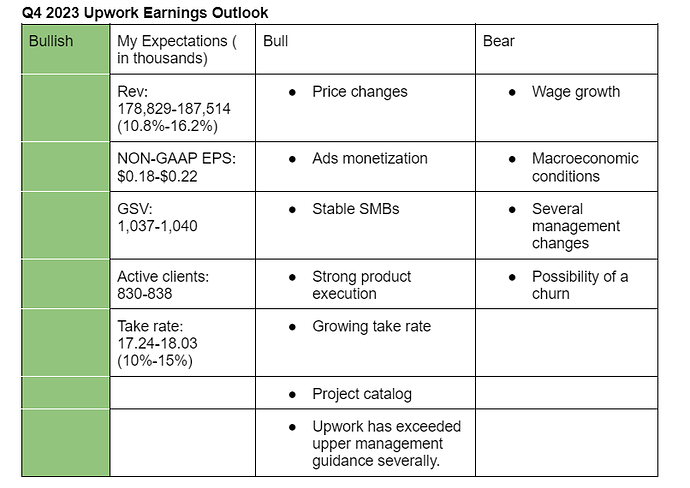

I am bullish on Upwork’s upcoming Q4 2023 earnings. My forecasts are based on the following assumptions.

-

I expect the shift to flat fee, ads monetisations and the increase in price of connects in 2023 to have aided the take rate growth just like in Q3 2023.

Total revenue growth was the result of take rate expansion driven by strength in our ads products and our move in 2023 to a simplified flat fee pricing structure," CFO Erico Gesert had said in the earnings call.

However, the full benefits of the flat-tier fee will start showing up in Q1 2024 when freelancers who paid 5% fee will start moving to 10%. As a result, the management guidance for Q1 2024 will be the most important item in the earnings release.

-

Upwork’s take rate has been growing sequentially since Q1 2022.

-

SMBs who are the majority spenders in Upwork are stable.

-

Upwork has topped its upper management guidance in the past four quarters.

-

The number of project catalogs at Upwork is growing.

-

The large number of users in the platform enables Upwork to reliably execute its products and forecast their impacts. Hence, their expectations for ad monetisation tools to aid the take rate in the quarter could be reliable.

Some of the risks to the Q4 earnings include;

- Wage growth is still declining.

- Macroeconomic conditions could still be a drag on the GSV.

- The management changes carried out in 2023 could affect business performance in the quarter.

- Client-freelancer relationships that were looking forward to a 5% fee may have started leaving the platform.

If these things get worse, Upwork’s Q4 2023 revenue could come in between $170 and $175 million (growth of 5-8%). Though, I view such a scenario as highly unlikely.

N/B:

-

I also expect Upwork’s management to give a positive guidance for Q1 2024 due to reasons mentioned above. I expect Q1 2024 revenue guidance to come in between 187 million and 191 million (+17% at the midpoint). Below are analysts’ estimates and management guidance for Q4 2023;

Management Guidance (Revenue): 175-180 million.

Management Guidance (Non-GAAP EPS): $0.16-$0.18.

Analysts’ estimate (Revenue): 178.4 million

Analysts’ estimate (Non-GAAP EPS): $0.17

Analysts’ estimate (GSV): 1.04 billion

- Upwork’s Q4 revenue grew 14% y/y to $183.9 million, topping management upper guidance of $180 million (+11.5%), adjusted EBITDA and Non-GAAP EPS of $30.5 million and $0.20 also execeeded upper management guidance of $28 million and $0.18, respectively.

- Upwork’s active clients grew by 5% y/y 851,000 while GSV was up 4% y/y to 1.072 billion (analysts’ estimate: $1.04 billion).

- Its take rate was up 150 bps y/y to 17.2% while profit margin grew to 9% from -10% in the previous year.

- Upwork is guiding Q1 2024 revenue of $183-$188 million (+15.3% at the midpoint) and Non-GAAP EPS of $0.17-$0.19, both coming above analysts’ estimates of $181.63 million and $0.14, respectively.

https://investors.upwork.com/static-files/3c3081d4-468b-40ac-8c48-2251fbc527bc

Assessment

Although Upwork exceeded estimates in all the key areas, the main contributor was the GSV that benefitted from an additional week at the end of the quarter. Excluding this extra week, the quarter might have been weaker. The growth in take rate in the quarter was also not as impressive as we had forecasted. Also, considering that Upwork is set to reap the full benefit of its shift to a flat fee in the current quarter, we view their guidance as weak. However, its good to see its performance marketing doing well and its active clients growing.

Worrying results and outlook from Upwork.

Even though Upwork saw its strongest addition of active clients in two years they only guide for very modest GSV growth in 2024. At the same time they are seeing declines in the average spending levels per client.

In my opinion, that points to churn of existing client workloads that is likely caused by their 5/10 percent fee increase.

As a consequence, their Q1 and FY 2024 outlooks came in significantly below our expectations.

This endangers the entire investment thesis.

It remains to be seen if most clients are going to accept paying an aggregate of 15% of total transaction volume to Upwork in the long run compared to the very reasonable 3% transaction fee for clients and 5% fee for freelancers 2 years ago.

In the meantime, I took a step back and liquidated my entire position in after-hours and premarket trading at an average weighted price of $15.76.

- Fiverr Q4 2023 revenue grew 10.1% y/y to $91.5 million, in-line with management’s mid-point guidance of $91.6 million (+ 10.2%) and lower than analysts estimate of $92.38 million (+11.1%).

- Its annual active buyers declined by 5% y/y to 4.1 million, lower than analysts estimate of 4.16 million (-3.2%) while spend per buyer was $278, higher than analysts estimate of $276.79.

- Its take rate was 31.8%, above analysts estimate of 31.4% aided by promoted gigs which were up 80% in revenue and Seller Plus which rose 2.5x in revenue.

- Fiverr is guiding Q1 2024 and FY 2024 revenue of $92.5 million at the midpoint (+5% y/y), lower than analysts estimate of $97.4 million (+10.7%) and $383 million, short of the $408.6 million expected.

https://investors.fiverr.com/static-files/29ad13ef-764e-47f7-89f7-75eee7d4a596

Assessment

Fiverr’s Q4 2023 results and revenue guidance for Q1 2024 is worse compared to that of Upwork.