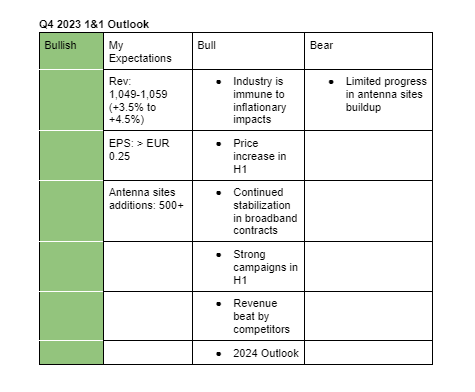

I am positive on 1&1 Q4 2023 earnings. My expectations are guestimates based on the company’s past performance and its business trends. Here is the description of the bullish and bearish sentiments.

Bullish:

- 1&1 operates in an industry that allows for price increases without losing customers.

- Q4 2023 will benefit from the price increases introduced in the first half of 2023.

- Q4 2023 will benefit from the strong campaigns initiated in the first half of 2023 and stabilization in the broadband business.

- 1&1 competitors reported Q4 2023 revenue that came in-line if not beat analysts’ estimates.

- The 2024 outlook announced in December last year could indicate that the company is experiencing positive trends in its core business.

Bearish

- 1&1’s network buildup continues to progress at a slow pace. Notably, the number of active antenna sites is still low. Any negative comments regarding the network buildup in the conference call could cause a sharp drop in the share price. However, I view the current progress as better than last year and I don’t expect any major negative announcements during the call.

Here is what analysts are guiding for Q4 2023:

Revenue (analysts): €1,045.9 million (+3.2% y/y)

EPS: €0.32 (-20.4% y/y)