This topic discusses the upcoming 1&1 Q4 2023 earnings. It contains our earnings outlook and a summary of the results as well as the earnings call. Here is our Wiki article on the same:

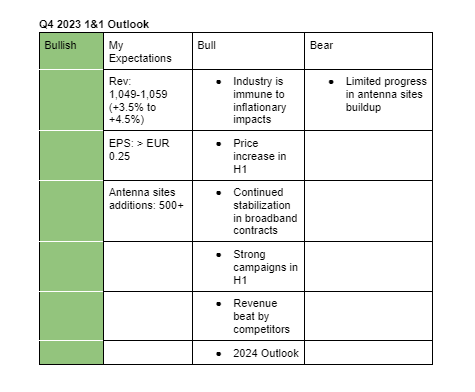

I am positive on 1&1 Q4 2023 earnings. My expectations are guestimates based on the company’s past performance and its business trends. Here is the description of the bullish and bearish sentiments.

Bullish:

- 1&1 operates in an industry that allows for price increases without losing customers.

- Q4 2023 will benefit from the price increases introduced in the first half of 2023.

- Q4 2023 will benefit from the strong campaigns initiated in the first half of 2023 and stabilization in the broadband business.

- 1&1 competitors reported Q4 2023 revenue that came in-line if not beat analysts’ estimates.

- The 2024 outlook announced in December last year could indicate that the company is experiencing positive trends in its core business.

Bearish

- 1&1’s network buildup continues to progress at a slow pace. Notably, the number of active antenna sites is still low. Any negative comments regarding the network buildup in the conference call could cause a sharp drop in the share price. However, I view the current progress as better than last year and I don’t expect any major negative announcements during the call.

Here is what analysts are guiding for Q4 2023:

Revenue (analysts): €1,045.9 million (+3.2% y/y)

EPS: €0.32 (-20.4% y/y)

Here is a summary of the fourth-quarter results;

- Revenue was up 5.1% to 1.065 billion (analysts estimate: 1.046 billion or +3.2% y/y), service revenue grew 4.5% y/y to 824.3 million (estimate: 818.7 million or +3.8% y/y), EBITDA fell by 1.1% y/y to 142.7 million (analyst estimate: 145 million or +0.5%) as a result of increased network startup costs, while EPS came in 0.35 vs analysts estimate of 0.34.

- 1&1 said they are making progress with the construction of antenna sites, that they closed 2023 with 1,062 antenna sites (addition of 597 antenna sites in Q4, higher than my estimate above) and reiterated that they plan to close 2024 with around 3,000.

- 1&1 said its network is now functional and can now be used by more than 500,000 customers three months after its lauch.

- In 2023, access contracts grew 3% y/y to 16.26 million (addition of 150k in Q4), missing analysts estimate by 20,000; mobile contracts were up 4.9% y/y to 12.25 million, also missing analysts estimate by 20,000

while broadband contracts fell by 2.2% y/y to 4.01 million, in-line with estimates. - 1&1 confirmed its guidance for 2024 that was given in December 2023.

Assessment

1&1 shares shed 6% after the release of the full annual report probably due to the slower customer migration. In the past calls, CEO Ralph Dommermuth has always touted that migration would be easy. Maybe the market interpreted otherwise after the company said it has migrated 500,000 customers so far. 1&1 expects to have migrated all the customers by the end of 2025, with 40,000 migrations per day possible.

The decline in share price may have also been caused by EBITDA that was lower-than estimate due to higher mobile network costs.

Here are the main insights from the webcast call;

- CEO Ralph Dommermuth said they expect to have 1,000 active antenna sites at the end of 2024 and 200 at the end of Q1 2023.

- CFO Markus Huhn said they expect customer contracts to grow at the same level as last year in 2024 but they will lose some customers that are hard to quantify due to migration to own network, leading to net additions of 200-300k, with the lost customers having relatively no impact on result and revenue since they are old and less valuable.

- Ralph said the migration of customers to own network is not easy but once they have data centres 3 and 4, they could do 50,000 migrations per day or a million per month.

- Moving to their own network, even with limited number of antenna sites will save them money since they will use their own data centres.

Assessment

In my opinion, the call was more optimistic than the previous one, particularly on the progress with antenna sites. A 1,000 active locations or 4% household coverage is good progress given it had only 100 at the end of 2023.

However, I see a risk with customer churn as migration continues though they experienced a small churn in the past months. There is also a risk that the migration continues to progress slowly leading to more costs than projected.

Buy, € 21: Deutsche Bank analyst Keval Khiroya said 1&1 performed expected and that what’s more important now is what happens with the frequency spectrum.