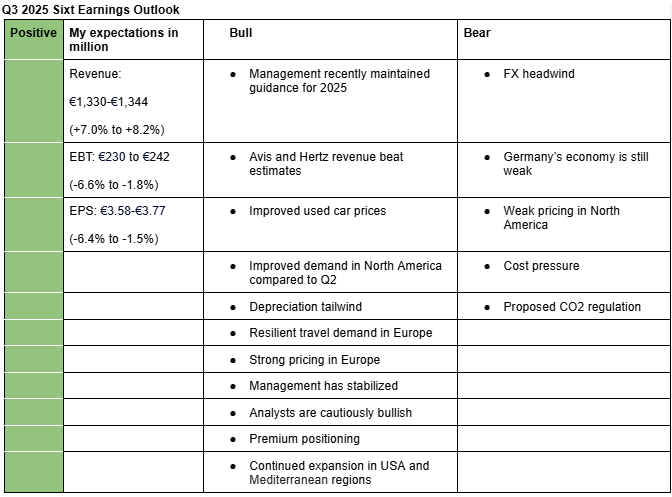

I am positive on Sixt’s Q3 2025 earnings. My estimates (Valuation Model) take into account resilient car rental demand in Europe, recent management guidance update, revenue beat by Avis and Hertz, continued expansion in USA and Mediterranean regions, premium positioning, FX headwind, etc. Given this positive outlook, I have a buy rating on Sixt shares. Here is a description of my bullish and bearish points.

Bullish arguments

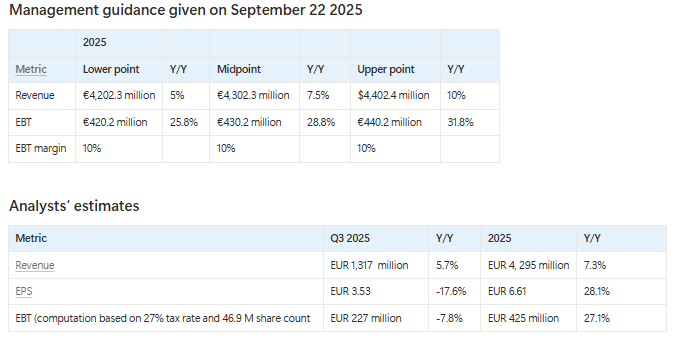

- Management recently maintained guidance for 2025: During Sixt’s investor presentation held on September 22, 2025, management reiterated that it expects 2025 revenue to grow in the range of 5%-10% y/y and EBT margin of around 10%. In the past, Sixt could update its guidance a few weeks to the earnings if it expected results to develop badly. As such, I expect that Sixt is on track to meet its annual targets (Sixt’s September 22 Investor Presentation (page 20)).

- Avis and Hertz beat revenue estimates: Avis’s (Notion-Avis Q3 results) and Hertz’s (Notion-Avis Q3 results) Q3 revenue were $60 million and $50 million higher than estimates respectively, sending a positive signal for Sixt.

- Improved used car prices: Used car prices continue to rise y/y in Europe (forum) and USA (forum). Europe used car prices rose by an average of 2.9% y/y in Q3, according to Auto1 Group. Similarly, U.S. used car prices rose by an average of 2.2% y/y, according to Manheim Used Vehicle Value Index. Improving used car prices help Sixt get better terms when selling vehicles, hence reducing depreciation rate.

- Improved demand in North America compared to Q2: Hertz pointed out in the earnings call that travel demand improved in Q3 compared to Q2 (Notion-Avis Q3 earnings call). Similarly, Delta Airlines and United Airlines pointed out that demand picked up in Q3 and that premium segment were the main driver of revenue growth in Q3 (forum).

- Depreciation tailwind: Sixt completed the sale of vehicles that were impacted by weak used car prices in Q1 2025 (forum). As such, Q3 2025 depreciation should also drop significantly. Avis (Notion-Avis Q3 results) and Hertz (Notion-Hertz Q3 results) also reported a 16% and 48% drop in depreciation per unit per month (DPU), respectively.

- Resilient travel demand in Europe: According to ACI, Europe passenger traffic rose 3.9% in Q3 2025. However, this was a deceleration from the 4.5% and 4.6% registered in Q1 and Q2 respectively (forum). Travel demand in Mediterranean regions remains strong. According to Greece’s business magazine ekathimerini, searches for short-term rentals in countries, such as Spain, Italy and Greece, rose 35% y/y in the 9 months of 2025 (Notion-insights on travel demand in Mediterranean regions)

- Strong pricing in Europe: Avis (Notion-Avis Q3 results) and Hertz (Notion-Hertz Q3 results) reported a 9% and 2% growth in international revenue per day (RPD), respectively. Given that majority of their international revenue comes from Europe, it signals that pricing in Europe was strong during the quarter. Additionally, Deutsche bank analyst Michael Kuhn pointed out that daily prices were strong in Europe in Q3 (Notion-Analysts opinions).

- Management has stabilized: Overall, senior executive turnover has been low in 2025 following elevated churn in 2023–2024. While employee reviews remain largely negative, criticism now focuses mainly on high pressure and understaffing rather than widespread turnover. The persistent intensity appears consistent with Sixt’s high-performance culture rather than a new deterioration (forum).

- Premium positioning: Sixt’s 57% share of premium vehicles should help it withstand macro pressures (forum)

- Analysts are cautiously bullish: Analysts largely expect Sixt to meet its 2025 guidance but flag some issues such as cost pressure and subsdued economic situation in Germany(Notion-Analysts opinions)..

- Continued expansion in USA and Mediterranean regions: Sixt is continuing its expansion in the U.S., particularly across major airport locations, while also adding new stations in key Mediterranean markets. For instance, in Q2 2025, the company opened five new locations in Italy (Sixt LinkedIn post). These additions are expected to be revenue-accretive in Q3 2025.

Bearish arguments

- FX headwind: I expect FX to be the major headwind for Sixt in Q3. In Q2 2025, Sixt reported FX headwind of around 6.2% due to the strengthening of the Euro against USD (forum). I expect FX headwind of 7.6% in Q3 due to further strengthening of the Euro against USD (FX headwind estimate-Google Sheets).

- Germany’s economy is still weak: Germany’s economy growth rate was flat in Q3 2025 (Q2 2025: -0.2%), signaling continued weakness in one of Sixt’s largest markets (forum).

- Weak pricing in North America: Avis (Notion-Avis Q3 results) and Hertz (Notion-Hertz Q3 results) reported a 3% and 5% drop in America revenue per day (RPD) respectively, indicating that while demand improved, overall revenue growth rate may not improve much.

- Cost pressure: Sixt personnel expenses rose 8% in Q2 2025 due to wage and salary increases and higher ancillary personnel costs (Valuation Model-Google Sheets). It seems like my expectations for improvement in personnel expenses due to ongoing digitalization may take a while to materialize. I have also come across analysts flagging cost pressure e.g. from additional vehicle features (Notion-Analysts opinions). Some press reports also flag gross margin pressure (Notion-ekathimerini article).

- Proposed CO2 regulation: The EU Commission is drafting a regulation that would ban rental companies from purchasing internal combustion engine (ICE) vehicles starting in 2027 or 2030. Although the likelihood of it passing is low, the surrounding uncertainty could weigh on the share price in the short term.

Here are analysts estimates for Q3 2025 and FY2025: