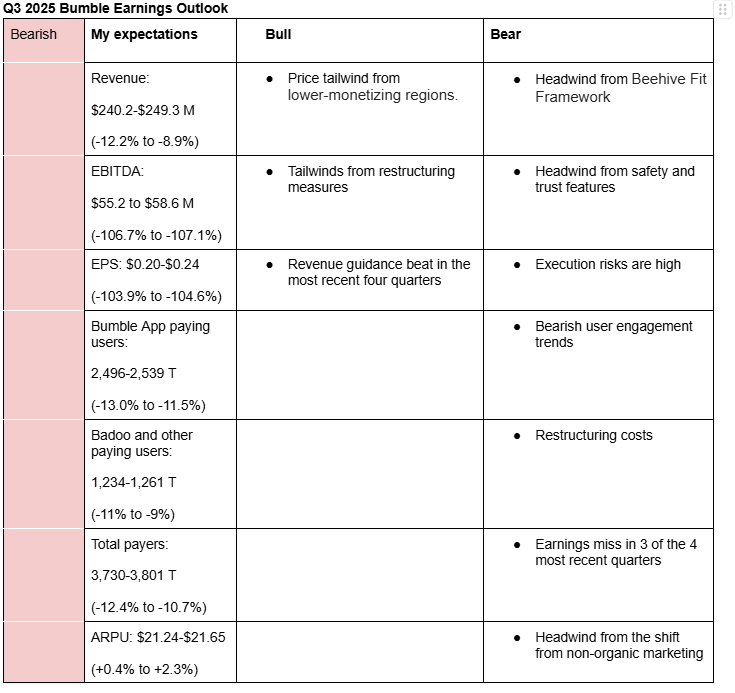

I am bearish on Bumble’s Q3 2025 earnings. My estimates (Valuation Model) are mainly based on user and pricing trends. Here is a description of my bullish and bearish sentiments:

Bullish arguments

- Price tailwind form lower-monetizing regions: Bumble’s average revenue per user (ARPU) rose 1.5% in Q2 2025 due to optimization of pricing in lower-monetizing regions (Q2 Bumble Earnings). I expect this strategy to also play out in Q3 2025.

- Tailwinds from restructuring measures: Bumble expects to generate annual savings of $40 million, beginning as early as the second half of 2025 from the 13% workforce reduction. It expects to save around $100 million from the whole restructuring process (Notion). The cost-savings will help offset the headwinds associated with the turnaround process.

- Revenue guidance beat in the most recent four quarters: Bumble has beaten mid-point revenue guidance by an average of 1.9% in the most recent four quarters (Google Sheets).

Bearish arguments

- Headwind from Beehive Fit Framework: Bumble is assessing payer quality through its Beehive Fit Framework, which classifies daters into three groups: approve (high-quality daters), improve (daters showing effort to enhance their profiles), and remove (low-quality users who make no effort to improve and should be removed). Remove payers make up less than 10% of the payers or less than 425,000 based on Q3 2024 total payers. If Bumble removed these payers in Q3 2025, then the decline in payers may be material.

- Headwind from safety and trust features: Bumble launched a number of safety and trust features including phone and ID verification, and mandatory selfie checks in August. These features are expected to cause friction when signing in/up leading to user churn (Notion).

- Execution risks are high: Almost every senior executive at Bumble is new. 8 out of 10 members of the executive management and around 40% of other senior executives have been with the company for less than 1 year (Notion). This could cause cultural shock, leading to slow rollout of new features.

- Bearish user engagement trends: According to Apptopia data reported by Global Dating Insights, Tinder’s daily active users (DAUs) in the US dropped by 6.4% y/y (Q3 2024: +16%). The report also indicates that Gen Z usage of the platform dropped significantly (Notion). A report by Goldman Sachs also indicate adverse user trends for Bumble in Q3 (Notion).

- Restructuring costs: Bumble expect to incur approximately $13 million to $18 million of non-recurring charges related to the 30% workforce reduction announced in June 2025. The charges will be incurred in Q3 and Q4 of 2025 (Notion).

- Earnings miss in 3 or the 4 most recent quarters: Bumble has missed EPS estimates in 3 of the 4 most recent quarters (Google Sheets). I don’t expect this quarter to be an exception, especially with the ongoing volatility associated with the turnaround measures.

- Headwind from the shift from non-organic marketing:The shift from non-organic marketing strategy i.e. the end of performance marketing may cause payer trends to decline in the near-term. This assessment is shared by a number of analysts (Notion)

Here are management and analysts estimates for Q3 and Q4 2025:

Q3 2025 management guidance for revenue: $240-$248 million (-12.3% to -9.4%).

Q3 2025 management guidance for adjusted EBITDA: $79-$84 million (-4.4% to 1.7%).

Q3 2025 consensus analysts estimate for revenue: $244.8 million (-10.5%).

Q3 2025 consensus analysts estimate for EPS: $0.34

Q4 2025 analysts estimate for revenue: $233.3 million (-10.8%)

Recommendation

Given the volatility around the turnaround measures, I don’t expect any significant improvement in revenue and earnings in the near-term. As I result, I recommend a Hold rating as we wait for more insights on the product rollout (and their benefits) as well management’s execution.