High Level Overview for Q3 2024 indexes Earnings

Q3 2024 Earnings Expectations

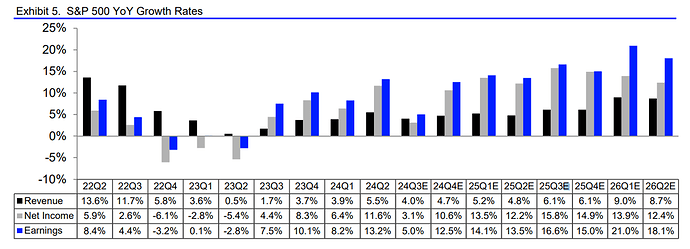

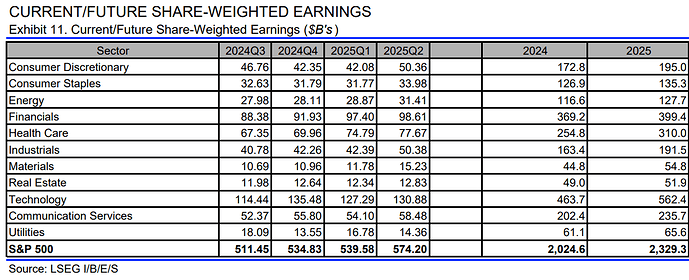

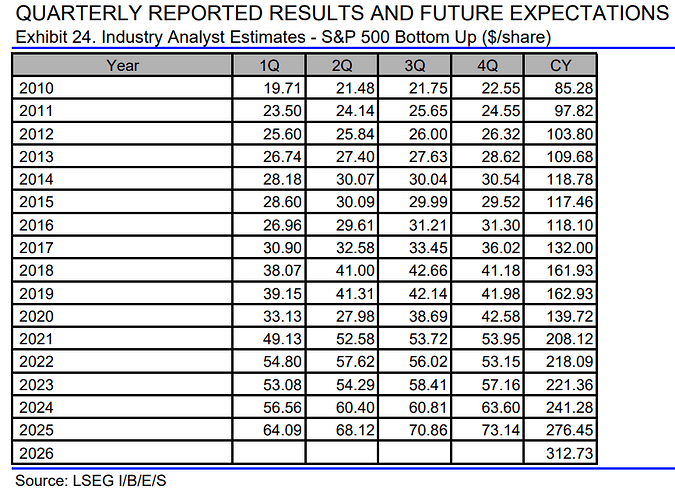

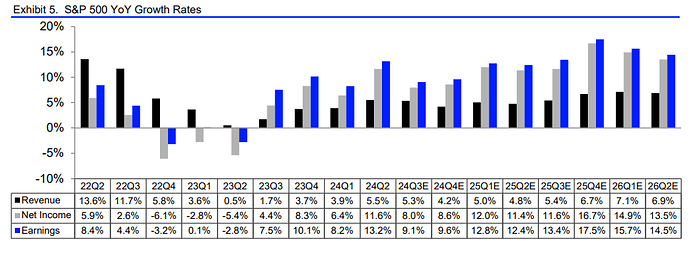

SP500

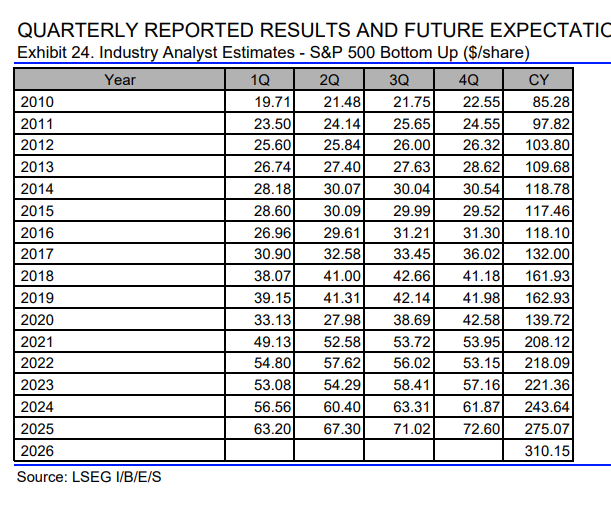

- Current estimate of $511.4 billion in Q3, surpassing last quarter’s actual figure of $504.8 billion

- This quarter’s earnings face tougher year-over-year comparisons, resulting in an expected growth rate of 5.0%, down from the 13.2% seen last quarter. But growth is expected to rebound in Q4 2024.

- EPS expected growth of 4.11% Y/Y, to 60.81 from 60.40 in Q2 2024.

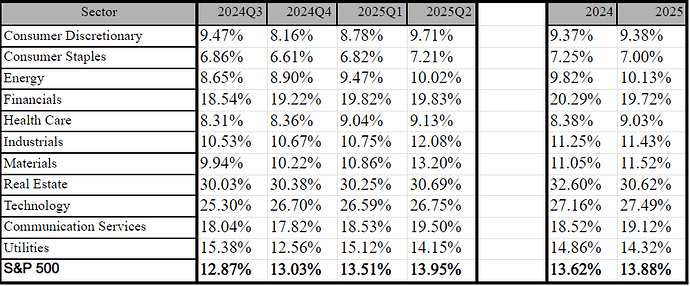

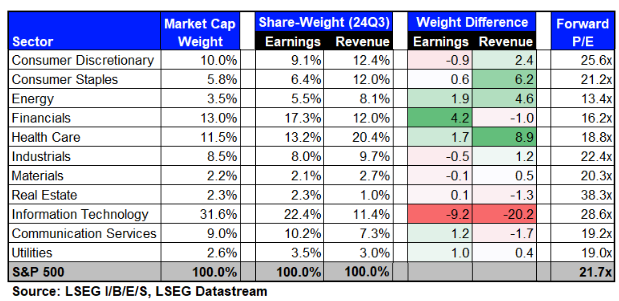

Earnings Margins Expected by Sector, with real estate and tech with the higher margins.

I calculated myself based on Refinitiv numbers, probably not going to be the same as if we calculate it company by company.

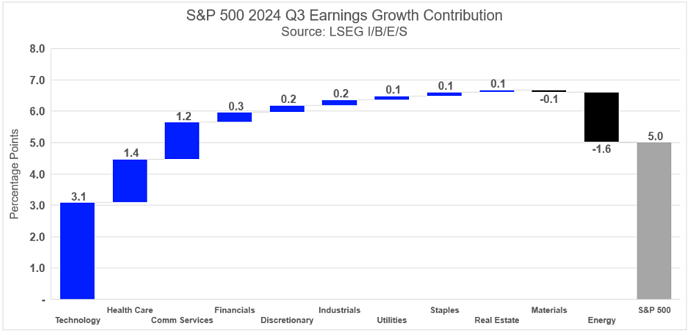

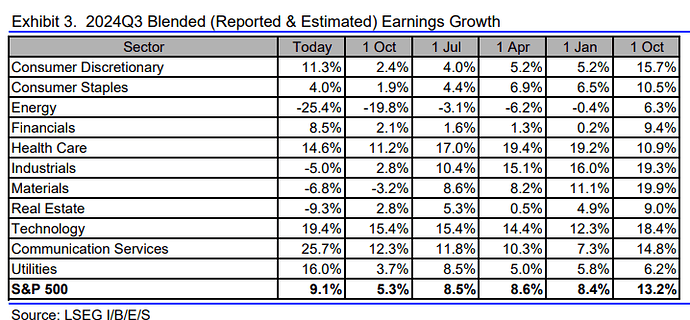

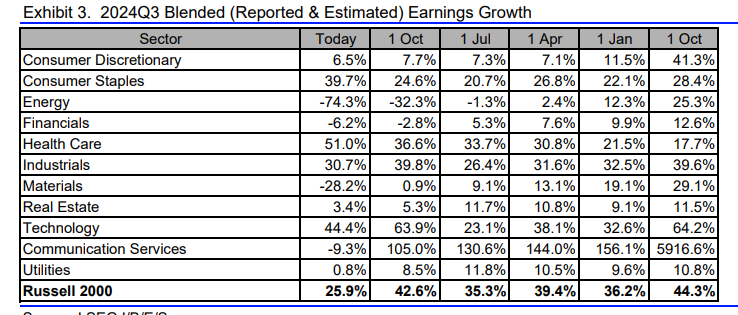

Nine sectors have positive earnings growth contribution, led by Information Technology, Health Care, and Communication Services.

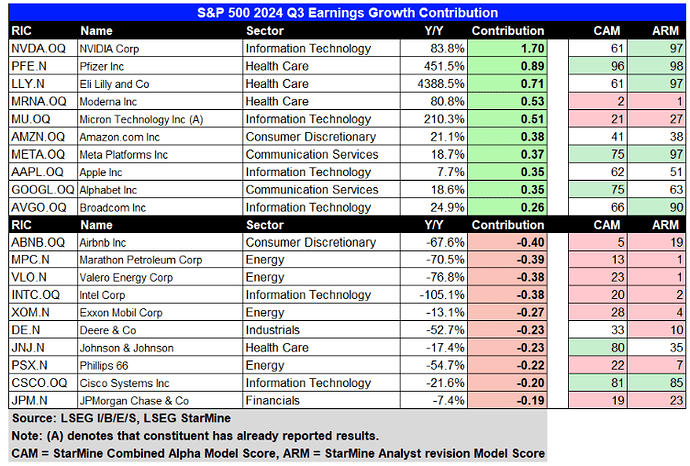

The Magnificent Seven group — Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA, and Tesla has a market cap weight of 31.5% compared to earnings and revenue weights of 19.4% and 10.8%, respectively. The Mag-7 has an aggregate forward four-quarter P/E of 29.6x, a 38% premium to the overall index. When excluding the Mag-7, the forward P/E declines to 19.0x.

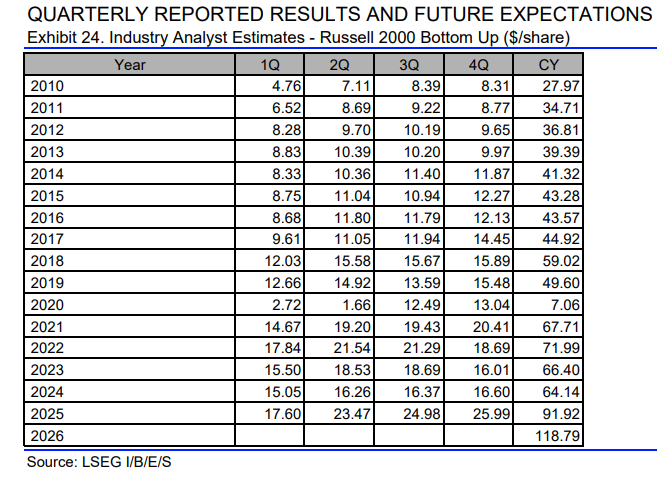

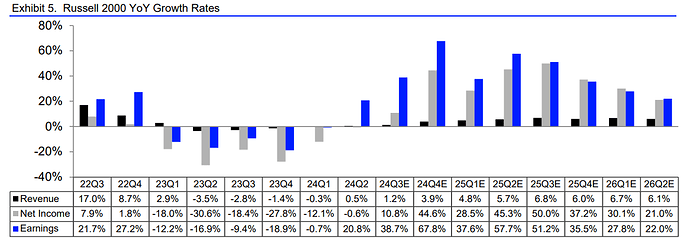

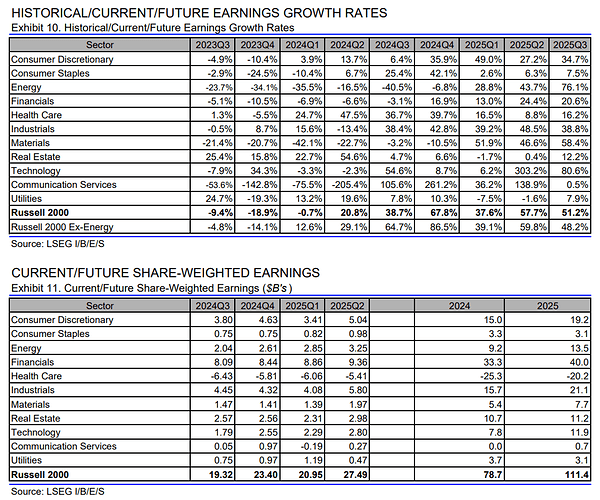

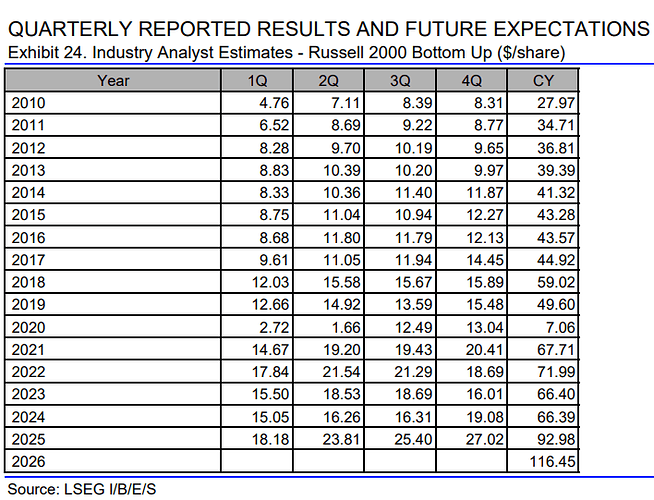

Q3 2024 Earnings Expectations

- The 24Q3 earnings growth estimate is 38.7% y/y to 19.3 Billion. Net income 10.8% y/y expected.

- The 24Q3 revenue growth estimate is 1.2% y/y at 463.4 Billion.

- Russel earnings margin is expected only at 4.16%.

EPS expectations at 16.31, representing a 0.3% q/q and a decline of 12.7% y/y

Q3 2024 Earning Results

SP500 Q3 2024 Net Income is expected to end at around 8% y/y vs 3.1% expected

- Earnings are expected to end at around 9.1% y/y (528 B), compared to the expected 5%.

- Profit margin at 13.12% vs 12.87% expected.

- Earnings per share at ~63.31, an 8.4% y/y. 2024 to end at 243.64 (10%)

- Estimated earnings growth for 2025 currently at 14.3%, and EPS at 12.9%

Russel 2000 Q3 2024 Net Income still with no recovery, at -0.2% y/y vs 10% expected

- Earnings are expected to end at around 25.9% y/y (17 B), compared to the expected 42.6%.

- Profit margin at 3.89% vs 4.16% expected.

- Earnings per share at ~63.31, an -12.41% y/y

- Estimated earnings growth for 2025 currently at 46.4%, and EPS at 43.31%