This topic discusses Volkswagen Q3 2023 earnings expectations and results. We will also discuss briefly the results of Volkswagen’s competitors here:

-

Tesla earnings that missed estimates in key areas, particularly automotive margin of 16.3%, which fell short of 17.5% estimate due to price cuts of about 25%, reflects the current low demand of electric vehicles.

-

In the earnings call, Elon Musk signalled that he plans to double down on his price cut moves.

-

Tesla also maintained its annual production target of 1.8 million cars, indicating that more price cuts will be needed to achieve it.

-

Musk also sounded an alarm on high interest rates.

“I am worried about the high interest rate environment that we’re in,” he said. “if the macroeconomic conditions are stormy, even if the best ship is still going to have tough times. The weaker ships will sink.”

I=10

- Volkswagen now expects FY2023 operating result before special items to be at the same level as last year (22.5 billion euros or 7%-7.3%), down from a range of $ 23.0 billion to $27.3 billion (7.5%-8.5%) previously guided due to negative effects of commodity hedges at the end of Q3.

- Volkswagen preliminary results also indicate Q3 2023 revenue grew 12% y/y to 78.8 billion euros (analyst estimate: € 76.26 or +8% y/y) while operating result rose 14% y/y to 4.9 billion euros (6.2%).

- Automotive net cash flow declined 24.2% y/y to 2.5 billion euros, mainly due to tax payments of past periods amounting to 1.5 billion euros.

- The company continues to expect revenue for the full year to grow 10%-15% y/y to between € 307.2 billion and €321.1 billion, and deliveries to be in the range of 9 to 9.5 million vehicles.

- It noted that the hedging loss of 2.5 billion euros recorded in the first half is no longer expected to be compensated by the end of the year.

“But this may be better than some investors have feared and could spell an end to negative sentiment on the name for now,” Bernstein analysts reacted to the preliminary results.

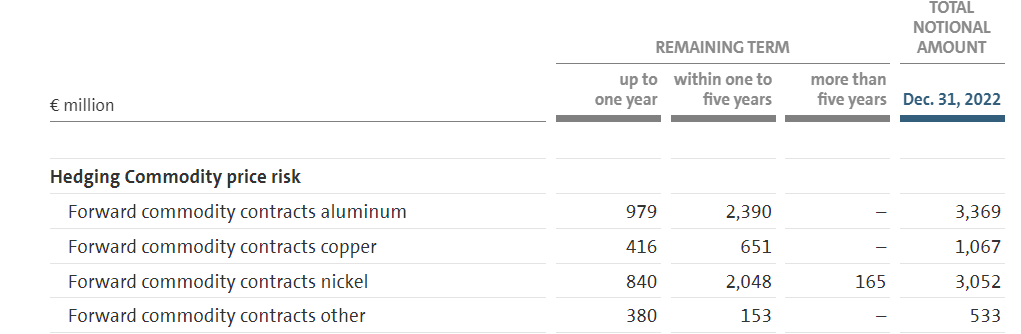

- At the end of 2022, Volkswagen had commodity hedges worth 8 billion euros (notional amount), 42% in Aluminium and 38% in Nickel.

- Volkswagen makes profit when the price of these commodities rises.

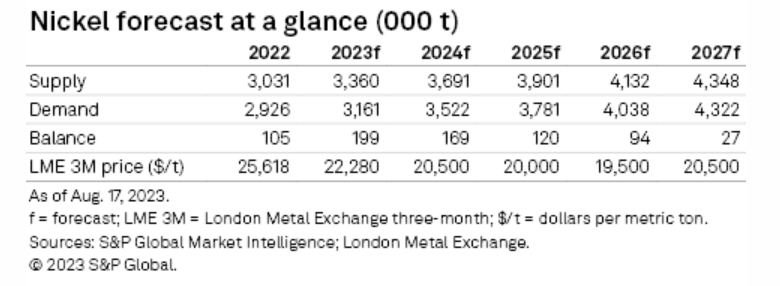

- Nickel futures have been falling, hitting $18,467 in October 20.

- On the other hand, Aluminum futures have been volatile.

- The screenshot below shows S&P Global projection of LME 3M Nickel price from 2022 to 2027.

I=4

- JP Morgan maintained Volkswagen’s preference shares buy rating and price target of 193 euros following third quarter results.

- Analyst Jose Asumendi said Volkswagen’s margin was slightly below market expectations but the new profit outlook for the year indicates the company expects a strong Q4.

- He added that Volkswagen has done something like this before; hence would likely succeed this time too.

https://www.finanzen.net/analyse/volkswagen_vw_vz_overweight-jp_morgan_chase__co__915794

I=4

- Deutsche Bank reiterated its Volkswagen’s buy rating and a price target of 190 euros after the preliminary third-quarter results.

- Analyst Tim Rokossa said many market participants already expected a profit warning since the company expressed the most caution at its events.

- Rokossa sees maintained sales target and revenue for the year as a sign of trust.

Volkswagen management seems confident on hitting their new 2023 target. They are guiding for a robust Q4. However, they didn’t give much details on 2024 other than that product cost will improve. It also seems that logistics environment will continue being challenging, putting pressure on cash flows.Here are some of the main insights from the earnings call;

- Financial Services Division contract volume was stable, credit loss ratio was unchanged from prior year, and operating income declined 28% y/y to 3 billion euros in the 9 months due to normalization of used cars, significant increase in interest rates, and adverse exchange rate trends.

- Financial impact from the Slovenia flood that affected 100,000 units in Q3 and 50,000 units in October is in mid-triple-digit million burden, and is priced into the full-year guidance.

- Product cost that is expected to be a slight headwind in Q4 compared to Q3, is guided to decline by more than 1 billion euros in Q4 partly due to y/y effect, and contracts in place for purchase of cobalt &nickel at a cheaper price.

- Cashflow is expected to improve in Q4 partly due to strong expected sales, room for inventory

improvement towards year-end, and y/y effect. - Q3 (usually a weaker quarter) achieved a margin of 6.2%, 1% lower than seasonall average, half due to flooding and half due to material costs (product& logistics costs).

Full summary of earnings call (Mindmap)

I=4

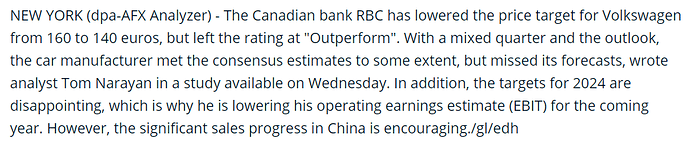

- Outperform, €160 → €140: RBC analyst, Tom Narayan, is disappointed on Volkswagen’s 2024 targets.

- Market perform, €140 → €124: Bernstein Research analyst, Daniel Roeska, is uncertain on whether Volkswagen can achieve its strategic targets.

Volkswagen’s revenue growth rate (12%) was in-line with that of other major players (11%). However, its operating margin of 6.2% underperformed that of other major players (8.6%).