Main Article: Spotify:Quarterly Results/2023 Q3 - InvestmentWiki

Netflix had good results, especially beating subscriber growth. This growth however comes from the cracked down on password sharing having good results.

The stock is up %15+ today.

-

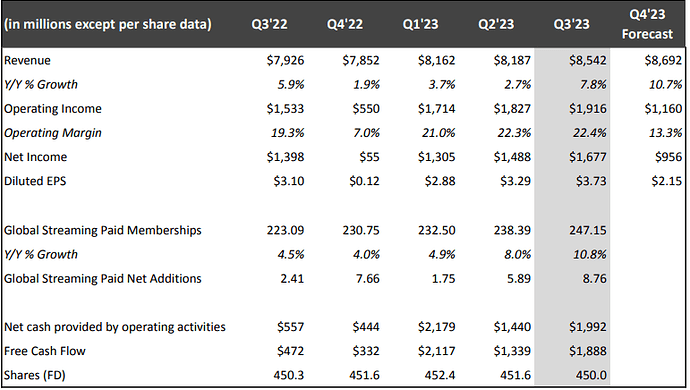

Netflix brought in $8.54 billion of revenue during the three-month period ending September 30 and $3.73 earnings per share, comparing favorably to consensus analyst estimates of $8.54 billion and $3.49, respectively, according to FactSet.

-

The firm reported nine million net paid subscriber adds, exceeding estimates of 6.08 million, bringing its global paid subscriber base to 247.2 million.

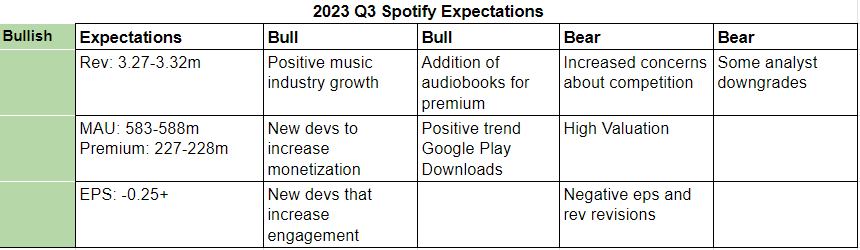

These are my Spotify expectations, which are mostly for a positive quarter.

I think the stock is still in a good position long term, but currently, I would just hold it, due to high valuations.

I don’t have any level of high confidence in my expectations and are just guesses based on Spotify usually underestimating its users’ growth in last quarters, but missing revenues a bit, and downloads data from Google Play.

Summary bullish arguments:

- Global music streams volume growing 22.7% YTD, and 13% in the US.

- The recent inclusion of merch and event tabs, and the potential for a superpremium plan could be a good catalyst for additional monetization.

- Spotify continues to innovate and developments like AI DJ is already showing good results, and other product developments during the quarter are expected to continue driving better engagement and increase the moat.

- 150,000 audiobooks are now available for premium subscribers, with 15 hours per month, which continue to add more value to the offering.

- Data from Google Play Downlowds show there were 93m Spotify downloads during Q3 (Data for Apple store is apparently not available), the highest in the latest 4 quarters.

Some negatives or risks we see:

- There are increased concerns among analysts about competition, especially from YT, Apple and Amazon, due to this and some pricing and margin concerns there have been some downgrades during the quarter. However, most still hold a buy rating.

- Revisions for estimates, especially for revenue, have been mostly negative during the quarter.

- Currently, the stock seems to have already priced in a level of high growth, if growth were to disappoint there are more risks to the downside.

SI=+8%, I=10

- Spotify reported third-quarter results that topped analysts estimates and management guidance.

- Revenue grew 11% y/y to € 3.36 billion (management guidance: € 3.3 billion or +8.7% y/y), EPS was € 0.33 vs. - € 0.20 estimate, MAUs was 574 million vs. 572 million guidance, number of premium subcribers was 226 million vs 224 million guidance, operating income was € 32 million above - €45 million guided, while gross margins was 26.4% vs. 26.0% guidance.

- Operating income was boosted by reduced personel and marketing spend as well as improved gross margins.

- For Q4 2023, management guided revenue of €3.7 billion ( +15.6% y/y), 601 million MAUs (+23% y/y), and 235 million premium subscribers (+14.6%), which are all in-line with analysts estimate.

Here are some of the mains insights from the conference call;

- Management said they will continue to focus on efficiency eg in cloud and customer service.

- They pointed out that the number of premium subscribers in North America grew in-line with expectations, and that the “decline” seen in the report is due to “rounding off”.

- Music advertising is one of the areas they are diving into and which will contribute to revenue in future.

- They expect margins to grow sequentially going forward.

- They are seeing positive development in audiobooks and that audiobooks will result in margin gains in future as users upgrade to paid audiobooks after diminishing the 15 hours, though in Q4 it will be a small drag on margins.

- Audio ads is more expensive, but with AI (which they are experimenting on), they will be able to lower barrier to enter, though early days to see the results.

Preliminary earnings call notes (Mindmap)

I=4

-

Citi Group maintained Spotify price target of $175 and buy rating following the third-quarter results, which they term as modestly ahead of the estimates.

-

Considering the beat in gross margin and slightly better than expected Q4 margin outlook, Citi analyst, Jason Bazinet said he would not be surprised to see shares trade higher today and that they are surpised that the shares were down immediately after the results release.

-

Truist Securities analyst Matthew Thornton maintained Spotify’s buy rating and price target of $176, saying this was a “Net-net good print,” following the results.

-

Wells Fargo also maintained its buy rating and price target of 250.

“We expect out-year profit forecasts to come up on this print, while subs appear largely undisrupted by price increases,” analyst Steven Cahall said.