Main Article: Earnings Overview: 2023 Q3 - InvestmentWiki

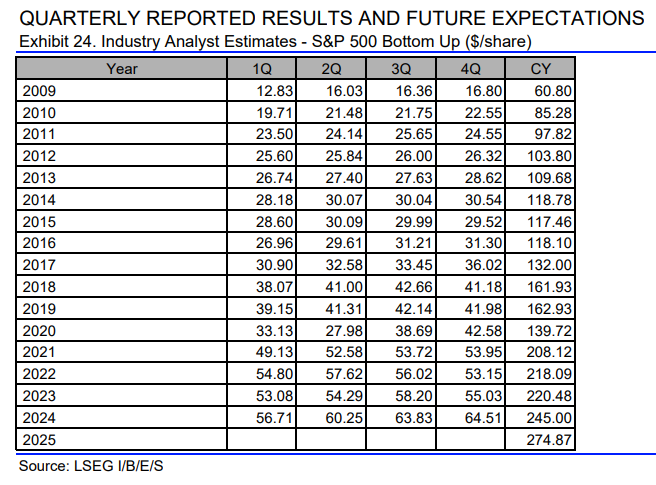

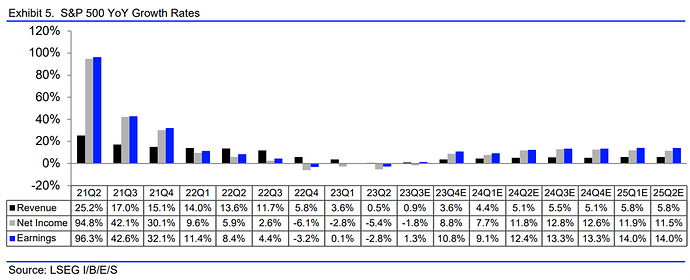

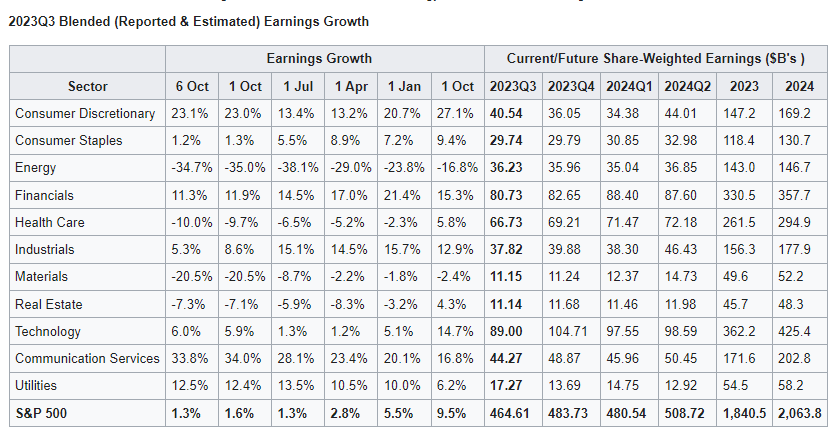

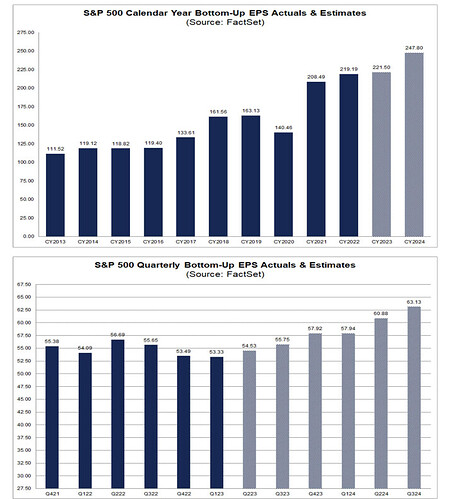

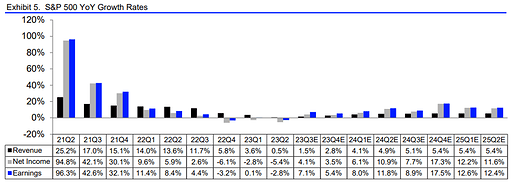

These are the estimates for Q3 2023, according to the market bottom in earnings was Q1 2023, and from now on, we will experience strong growth. In my opinion, 2024/2025 growth estimates continue to look unrealistic, and they were revised even higher since last quarter.

However, if we have that growth, the economy will continue to be stronger than expected, and hence higher rates for even longer.

I am using Refinitiv and Facset, and they are not exactly the same, but both could be eventually wrong. For Q2 2022, they were forecasting -8% and -7% respectively, and the S&P reported growth was around -3%

But at least it serves to know what the market is pricing currently.

Retivitiv:

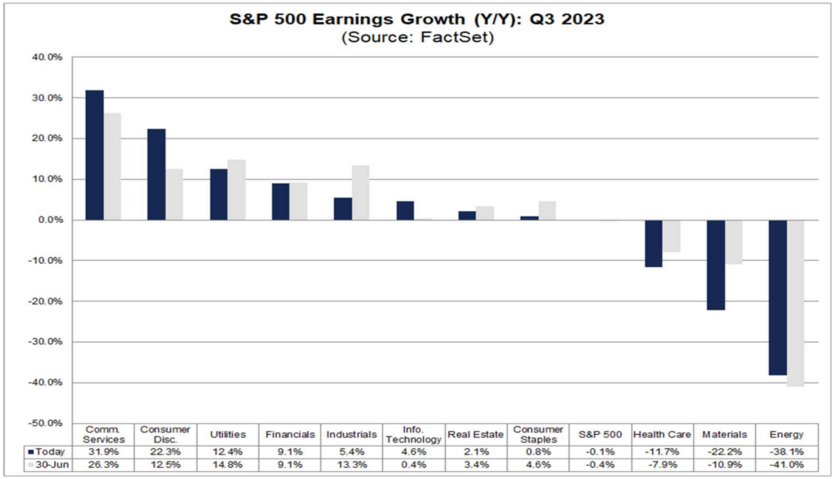

- The 23Q3 Y/Y blended earnings growth estimate is 1.3. If the energy sector is excluded, the growth rate for the index is 6.2%.

- The 23Q3 Y/Y blended revenue growth estimate is 0.9%. If the energy sector is excluded, the growth rate for the index is 3.3%.

Facset:

- Earnings Decline: For Q3 2023, the estimated (year-over-year) earnings decline for the S&P 500 is -0.1%.

- Earnings Revisions: On June 30, the estimated (year-over-year) earnings decline for the S&P 500 for Q3 2023 was -0.4%. Four sectors are expected to report higher earnings today (compared to June 30) due to upward revisions to EPS estimates.

- Earnings Guidance: For Q3 2023, 74 S&P 500 companies have issued negative EPS guidance and 42 S&P 500 companies have issued positive EPS guidance.

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.9. This P/E ratio is below the 5-year average (18.7) but above the 10-year average (17.5).

Wow those high growth assumptions esp. on the button line are pretty interesting. Are any reasons given for it? Is Factset also offering 2024/2025 growth guidance?

Not reasons given in those reports, but maybe I can find commentary.

Most likely most analyses are forecasting a strong economy due to recent data.

This are factset estimates for 2024, similar to about 12% growth

https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_092923.pdf?_gl=1*1xzdq4k*_ga*MjEwNjczNzk3NS4xNjkzODU1ODM1*_ga_2Q3PTT96M8*MTY5Njg3MzkxNC4zLjEuMTY5Njg3NDUzNy4wLjAuMA (pg.29)

With 481 having reported earnings as of November 24, Refinitiv estimates SP 500 Q3 2023 will end with a 7% y/y growth in earnings, above the 1.6% estimated on October 1, 2023.

Q4 2023, has come down from 11% on October 1 to 5.4% today.

- The 23Q3 Y/Y blended earnings growth estimate is 7.1%. If the energy sector is excluded, the growth rate for the index is 12.6%.

- Of the 481 companies in the S&P 500 that have reported earnings to date for 23Q3, 81.9% reported above analyst expectations. This compares to a long-term average of 66%.

- The 23Q3 Y/Y blended revenue growth estimate is 1.5%. If the energy sector is excluded, the growth rate for the index is 3.8%.