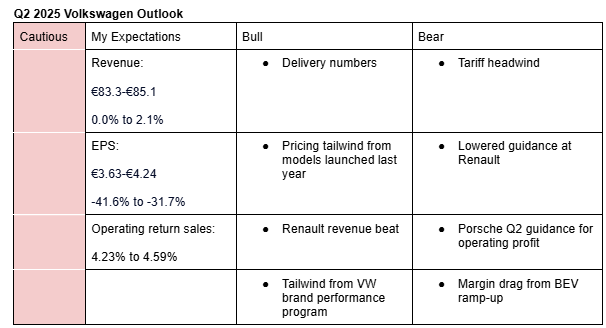

Cautious outlook on Volkswagen’s Q2 2025 earnings amid tariff headwinds and one-off charges

I am cautious on Volkswagen’s Q2 2025 earnings. My estimates take into account Q2 delivery numbers, pricing tailwind from product launches, insights from pre-close earnings call with analysts, tariff headwind, tailwind from performance program at the Volkswagen brand, e.t.c. Here is a description of by bullish and bearish sentiments:

Bullish sentiments:

- Delivery numbers: Volkswagen’s Q2 2025 deliveries rose 1.2% year-over-year to 2.27 million units, keeping the company on track to meet its full-year guidance of 9 million units or y/y flat growth.

- Pricing tailwind from product launches: I expect Volkswagen model prices to benefit further from models launched last year such as Tiguan, Audi A5, Audi Q5, Macan, 911, e.t.c. Its new models tend to carry higher prices than the previous versions due to new features and modernity. CFO Arno Antlitz said in Q1 2025 earnings call that the product launches are expected to be a tailwind in the coming months.

- Renault revenue beat: Renault’s H1 2025 revenue was in line with analysts estimate, suggesting that Q2 demand and pricing held up as expected in Europe.

- Tailwind from VW brand performance program: Volkswagen brand expects to save labour costs amounting to €1.5 billion annually due to the performance program. In Q1 2025, it reduced headcount by around 2,000.

Bearish sentiments:

- Tariff headwind: In Q2 2025, Audi, Porsche and Volkswagen brand absorbed the tariff costs. Porsche booked €300 million charges associated with the tariffs for the month of April and May. This charges should have an impact on Volkswagen Group’s operating profit. Volkswagen’s operating margin guidance of 5.5% for 2025 doesn’t take into account the tariff headwind other than the €300 million booked at Porsche. As such, Volkswagen may lower its guidance for 2025 when it reports its Q2 2025 earnings, especially now that a trade deal between US and EU is taking longer to be reached. I forecast 2025 revenue of €324.3 billion, operating return on sales of 4.80% and EPS of €17.83.

- Lowered guidance at Renault: Renault lowered its 2025 operating margin guidance to around 6.5% from at least 7% previously, citing intensifying competition and declines in the automotive market in Europe. This development could also pressure Volkswagen to reduce its estimate for the second half of 2025.

- Porsche Q2 guidance for operating profit: Porsche told analysts during its Q2 pre-close call that it expects Q2 operating profit would be around break-even due to €500 charges related to Cellforce battery joint venture write-down and €200 million restructuring costs.

- Margin drag from BEV ramp-up: Volkswagen BEVs are margin dilutive. During Q2, Volkswagen Group BEV deliveries rose 38% y/y to 248,700 units.

Here are the analysts estimates and management guidance for Q2 2025 and 2025:

Analysts estimates for Q2

Revenue: €82.12 billion (-1.5% y/y)

Operating return on sales: 4.53%

EPS: €4.05

Analysts' estimates for 2025

Revenue: €325.75 billion (+0.34%)

Operating return on sales: 4.76%

EPS: €18.82 (-11.9%)

Management outlook for 2025 (given in Q1 2025)

Revenue: €340.89 billion (+5.0%)

Operating return on sales: 5.5%-6.5%

Recommendation

I am bullish on Volkswagen’s 2026 and 2027 product pipeline. I believe the upcoming ID.1 and ID.2 models will help the company defend, and potentially expand its market share in Europe. In addition, its forthcoming models for China also appear promising. The shares remain attractively valued. As a result, I recommend holding the stock despite short-term headwinds.