Volkswagen will announce its Q2 2025 earnings on July 25, 2025. This topic contains Volkswagen’s earnings preview. A summary of the results will also be published and discussed here. You can find the full earnings preview and summary of the results in the Wiki:

Renault lowers its 2025 operating margin guidance to around 6.5% from at least 7% due to intensifying competition and declines in automotive market

-

Renault H1 2025 revenue rose 2.5% y/y to €27.6 billion, slightly above €27.5 billion while operating margin came in at 6%, below 6.8% estimate.

-

Renault lowered its 2025 operating margin guidance to around 6.5% from at least 7% previously, citing intensifying competition and declines in the automotive market in Europe.

“Obviously, the retail market has been slow across Europe, and we haven’t seen any positive dynamic at all in competitive positioning and pricing. We have seen things get softer slightly,” Interim CEO Duncan Minto told analysts.

-

Volkswagen shares lost 1% as a result.

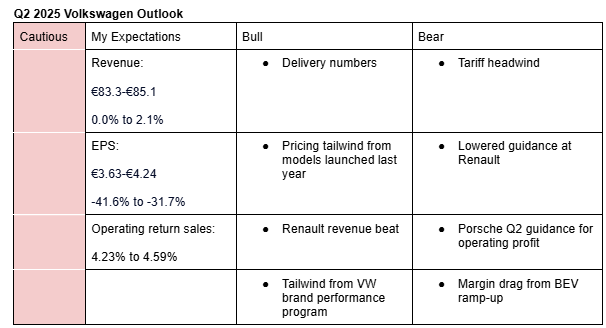

Cautious outlook on Volkswagen’s Q2 2025 earnings amid tariff headwinds and one-off charges

I am cautious on Volkswagen’s Q2 2025 earnings. My estimates take into account Q2 delivery numbers, pricing tailwind from product launches, insights from pre-close earnings call with analysts, tariff headwind, tailwind from performance program at the Volkswagen brand, e.t.c. Here is a description of by bullish and bearish sentiments:

Bullish sentiments:

- Delivery numbers: Volkswagen’s Q2 2025 deliveries rose 1.2% year-over-year to 2.27 million units, keeping the company on track to meet its full-year guidance of 9 million units or y/y flat growth.

- Pricing tailwind from product launches: I expect Volkswagen model prices to benefit further from models launched last year such as Tiguan, Audi A5, Audi Q5, Macan, 911, e.t.c. Its new models tend to carry higher prices than the previous versions due to new features and modernity. CFO Arno Antlitz said in Q1 2025 earnings call that the product launches are expected to be a tailwind in the coming months.

- Renault revenue beat: Renault’s H1 2025 revenue was in line with analysts estimate, suggesting that Q2 demand and pricing held up as expected in Europe.

- Tailwind from VW brand performance program: Volkswagen brand expects to save labour costs amounting to €1.5 billion annually due to the performance program. In Q1 2025, it reduced headcount by around 2,000.

Bearish sentiments:

- Tariff headwind: In Q2 2025, Audi, Porsche and Volkswagen brand absorbed the tariff costs. Porsche booked €300 million charges associated with the tariffs for the month of April and May. This charges should have an impact on Volkswagen Group’s operating profit. Volkswagen’s operating margin guidance of 5.5% for 2025 doesn’t take into account the tariff headwind other than the €300 million booked at Porsche. As such, Volkswagen may lower its guidance for 2025 when it reports its Q2 2025 earnings, especially now that a trade deal between US and EU is taking longer to be reached. I forecast 2025 revenue of €324.3 billion, operating return on sales of 4.80% and EPS of €17.83.

- Lowered guidance at Renault: Renault lowered its 2025 operating margin guidance to around 6.5% from at least 7% previously, citing intensifying competition and declines in the automotive market in Europe. This development could also pressure Volkswagen to reduce its estimate for the second half of 2025.

- Porsche Q2 guidance for operating profit: Porsche told analysts during its Q2 pre-close call that it expects Q2 operating profit would be around break-even due to €500 charges related to Cellforce battery joint venture write-down and €200 million restructuring costs.

- Margin drag from BEV ramp-up: Volkswagen BEVs are margin dilutive. During Q2, Volkswagen Group BEV deliveries rose 38% y/y to 248,700 units.

Here are the analysts estimates and management guidance for Q2 2025 and 2025:

Analysts estimates for Q2

Revenue: €82.12 billion (-1.5% y/y)

Operating return on sales: 4.53%

EPS: €4.05

Analysts' estimates for 2025

Revenue: €325.75 billion (+0.34%)

Operating return on sales: 4.76%

EPS: €18.82 (-11.9%)

Management outlook for 2025 (given in Q1 2025)

Revenue: €340.89 billion (+5.0%)

Operating return on sales: 5.5%-6.5%

Recommendation

I am bullish on Volkswagen’s 2026 and 2027 product pipeline. I believe the upcoming ID.1 and ID.2 models will help the company defend, and potentially expand its market share in Europe. In addition, its forthcoming models for China also appear promising. The shares remain attractively valued. As a result, I recommend holding the stock despite short-term headwinds.

I=6

Traton slashes 2025 outlook amid tariff fears and weak European demand, Q2 operating profit margin slightly misses my estimate

- Traton lowers its operating profit margin guidance for 2025 to a range between 6% to 7% from 7.5% to 8.5% previously, due to uncertainties related to US tariff, continued weak economic situation in Europe and growing challenges in Europe.

- 2025 growth for revenue and unit sales is now guided at 0% to -10%, down from -5% to +5%.

- Its Q2 2025 revenue rose 2.8% y/y to EUR 11.6 billion, in light with my midpoint estimate of EUR 11.4 billion while operating profit margin came in at 6.6%, below my midpoint estimate of 6.9%.

I=10

Volkswagen Group misses Q2 revenue estimate, tops operating margin estimate but lowers guidance for 2025

-

Volkswagen Q2 2025 revenue fell 3.0% y/y to EUR 80.8 billion, below analysts estimate of EUR 82.1 billion while operating return on sales came in at 4.7%, above analysts estimate of 4.5%.

-

The operating result were impacted by higher sale of the low-margin electric models, increased US tariffs and restructuring costs. Excluding these items, operating return on sales in Q2 was around 7%.

-

Volkswagen lowered its operating profit margin guidance for 2025 to between 4% and 5% from 5.5% to 6.5% and now expects revenue to be flat (previously: growth of 5%).

-

Analysts were expecting 2025 revenue of EUR 325.75 billion (+0.3% y/y) and operating return on sales of 4.76%.

-

Its automotive net cash flow stood at EUR 529 million in Q2 2025 (Q2 2024: EUR 2.9 billion), and EUR -1.4 billion in H1 2025 due to EUR 0.9 billion made to Rivian, payments related to restructuring and US import tariffs and lower level of cash tied to working capital.

-

It now guides 2025 automotive net cash flow of between EUR 1 billion to EUR 3 billion (previously: EUR 2 to EUR 5 billion) and net liquidity of between EUR 31 and EUR 33 billion (previously: EUR 34 to EUR 37 billion).

-

The lower-end of the guidances assume US tariff of 27.5% will continue to apply in H2 2025 while the upper end assumes US tariff of 10% will apply.

-

Shares are down 3.2% pre-market.

Volkswagen Group shares rebound 4% after management said the guidance doesn’t include mitigating effects and environment for Volkswagen Group in Europe is stable

- In the earnings call, CFO Arno Antlitz pointed out that if the tariff were to fall to 15%, the operating return on sales target may end up at 4.5%.

- Antlitz said the guidance of between 4% and 5% doesn’t take into account US tariff mitigation effects such as price increases.

- Antlitz pointed out that the demand and pricing for Volkswagen Group is currently stable in Europe due to product momentum.

- Volkswagen sees strong potential in Robotaxis (forecasted $400B market) and expects to launch ID. Buzz AD in the US with Uber in 2026.

Q2 2025 Volkswagen earnings call summary (Wiki)

Assessment

Volkswagen shares rose by 4%, partly driven by indications that the company’s guidance does not yet reflect the potential mitigating effects of U.S. tariffs. There is also growing market optimism that the EU and U.S. might agree on a reduced tariff rate of 15%, which would make an operating margin of at least 4.5% achievable.

Analysts had been expecting a 2025 operating margin of 4.76%, so incorporating tariff mitigation could bring Volkswagen’s projected margin closer to this consensus.

Additionally, Volkswagen’s performance program at the Brand Group Core is showing positive results. In Q2 2025, the operating return on sales at the Brand Group Core improved to 6.3%, up from 3.2% in Q1. While Audi and Porsche weighed on overall profits, this was largely due to restructuring charges and elevated product costs.

Overall, the earnings call was more upbeat than prior commentary had suggested.

Analysts said Volkswagen Q2 and 2025 outlook are in line with estimates and praised performance at the core brand

- Neutral, €92: UBS analyst Patrick Hummel said Volkswagen’s Q2 results and outlook are in line with expectations. However, the consensus expectations for 2025 are likely to decline slightly after Traton lowered its guidance.

- Neutral, €111: RBC analyst Tom Narayan said the strong EBIT performance at the core brand supported the business development. He added that the midpoint of the operating return on sales guidance is in line with the consensus.

- Buy, €125: Jefferies analyst Philippe Houchois said Volkswagen’s resilient core business and downgraded guidance are no surprise.

- Buy, €146: Warburg Research analyst Fabio Hölscher pointed out that Volkswagen met expectations in Q2. He added that the outlook was also in line with expectations and that US tariff remains the driving force.

- Hold, €110: DZ Bank analyst Michael Punzet said tailwinds from cost-cut measures should mitigate the headwind from US tariff, declining Porsche performance and margin dilution from ramp-up of BEVs.