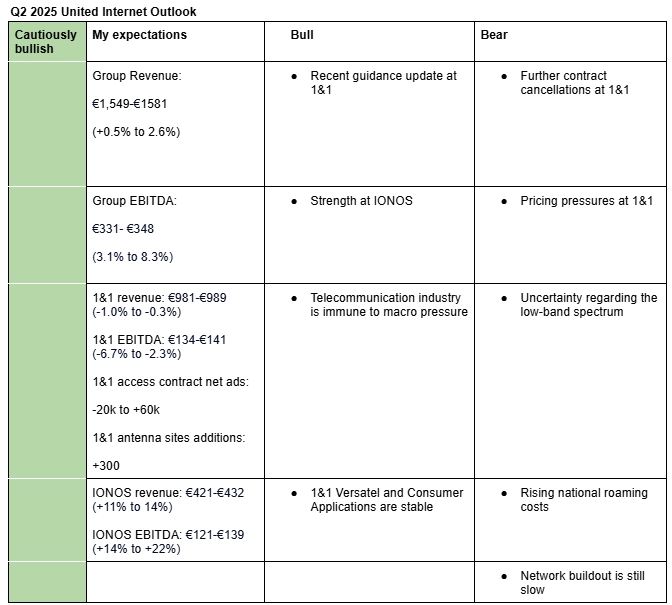

Cautious optimism ahead of United Internet Q2, as IONOS strength offsets 1&1 headwinds

I am cautiously bullish on United Internet’s Q2 2025 earnings. I expect strength at IONOS to largely offset weakness at 1&1, which continues to face competitive pressure and churn related to network migration. My estimates also reflect the resilience of the broader industry. However, the share price could come under pressure from near-term headwinds at 1&1 such as uncertainty around the low-band spectrum, possibility of a slower-than-expected network buildout, and management commentary on rising national roaming costs.

Given the upsides described at Notion, I reiterate a buy/hold rating on the United Internet shares. Here is a description of my bullish and bearish factors.

Bullish factors

- Recent guidance update at 1&1: On June 27, 1&1 reiterated its service revenue guidance for 2025 (flat growth). 1&1 contributes 64% revenue to United Internet and the guidance update signals limited downside risk to revenue in Q2 2025.

- Strength at IONOS: IONOS’s operating performance is currently the bright spot at the group. I expect the strength at IONOS to fully compensate revenue and EBITDA decline at 1&1 in Q2 2025. IONOS contributes around 25% revenue and 33% EBITDA to United Internet. Together, IONOS and 1&1 contribute 89% revenue and 79% EBITDA to United Internet.

- 1&1 Versatel and Consumer Applications are stable: 1&1 Versatel and Consumer Applications (GMX and WEB.DE) are showing stable revenue and EBITDA growth trends. United Internet continues to make investments in Consumer Applications that should boost their EBITDA margin in the near-term.

- Industry is immune to macro pressure: The telecommunication industry is largely immune to macro pressure since people cannot do without calls or mobile data. Similarly, United Internet’s business is largely non-cyclical. Therefore, the slowdown in Germany’s economy is unlikely to have much impact on United Internet’s operating performance.

Bearish factors

- Further contract cancelation at 1&1: 1&1 expects continued churn as a result of customer migration from O2 network to own network until the end of 2025.

- Pricing pressure at 1&1: Competition in Germany’s telecommunications market remains intense. Commentary from Vodafone’s and O2’s earnings calls indicates that pricing pressure persisted into Q2. As a result, I do not expect average revenue per user (ARPU) to grow at 1&1 during the quarter.

- Uncertainty regarding the low-band spectrum: 1&1 and the incumbent operators are expected to reach an agreement by January 2026. However, with the year already halfway through and no progress publicly disclosed, uncertainty around the outcome is rising. A recent draft by Deutsche Telecom calling for the "establishment of flexible ‘use it or share it or trade it or lose it’ conditions and frequency trading" may signal resistance to share the low-band frequency with 1&1. O2 also signaled in May resistance to share it. A delay in securing access to low-band spectrum would force 1&1 to rely more heavily on national roaming, prolonging elevated network operating costs and delaying margin improvement.

- Rising national roaming costs: On June 27, 1&1 lowered its 2025 EBITDA guidance by €26 million, citing higher than expected national roaming costs driven by increased usage of Vodafone’s network. This elevated usage may be due to limited coverage from 1&1’s own infrastructure, raising the risk that roaming costs could increase further in the near term as the network buildout remains in its early stages.

- Network buildout is still slow: Antenna site rollout at 1&1 remains slow. As of last quarter, the company had only 1,000 active sites (unchanged from Q4 2024), yet it needs 6,000-6,500 by the end of 2025 to meet its 25% population coverage obligation. Failure to meet this target could result in regulatory penalties, similar to the 2022 shortfall, which carried fines of €50,000 per missing site (yet to be imposed).

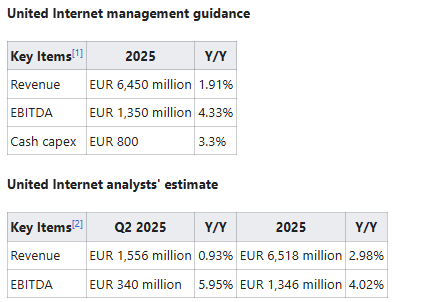

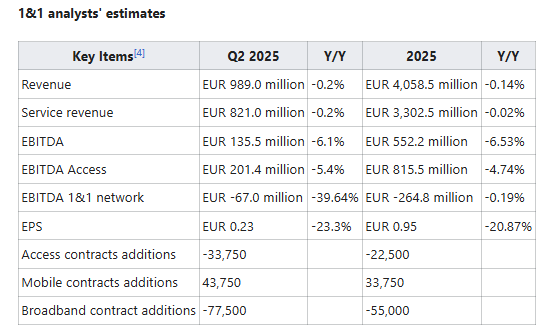

Here are analysts estimates and management guidance for Q2 2025 and FY2025: