This topic discusses Q2 2024 Meta Platforms earnings. It includes our final assessment and decision before the earnings release. We will also summarize the results here. Here is our Wiki article on the same:

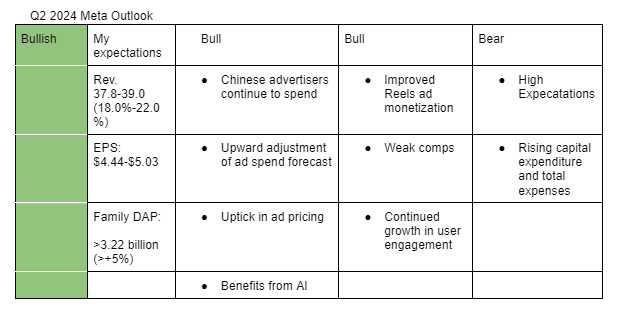

Based on insights at hand, I am positive on Meta’s Q2 2024 earnings. My projections are informed by continued spend among Chinese advertisers, growing ad prices and recent upgrades of digital ad spending estimates for 2024.

Here is a description of my above bullish points;

-

Data published by Sensor Towers suggests that Chinese advertisers continue to spend on the likes of Meta Platforms. Similarly, data checks by Oppenheimer points to a similar trend.

-

Recently, Magna adjusted its forecast for 2024 U.S social media ad spending to 15.5% from 13.4%. This projection exclude cyclical events such as political and olympics events which will also benefit Meta Platforms.

-

Revealbot data which was cited by Wells Fargo indicates Meta’s CPM rose 19% y/y in Q2 2024.

-

I expect Meta’s continued advancement in AI to boost recommendations across Facebook and Instagram. Meta said in its Q1 2024 earnings call that over 50% of Instagram posts and 30% of Facebook feeds are recommended by AI.

-

Data checks by Citi indicate a 160 basis points expansion in Reels ad loads quarter-to-date.

-

Q2 2024 results will still benefit from a weak comparison period. Q2 2023 revenue had grown by only 11% y/y.

-

Based on data checks by research firms, user engagement across Meta Platforms continues to grow. For example, TD Cowen survey established that Instagram young users increased time spent by 8 minutes to 54 minutes per day during the quarter.

Risks during the earning season include;

-

Expectations that Meta will report solid earnings is high. As such, a small miss could cause a significant drop in share price.

-

Meta already said that it expects its capex and total expenses to rise significantly over the course of 2024. However, further comments that signal no end to these spendings could be recieved negatively by the market.

N/B: I will continue to gather insights on the Meta’s Q2 2024 earnings and possibly adjust my outlook. Here are management’s and analysts’ expectations:

Management Guidance (Revenue): $36.5 billion- $39 billion (14.1%-21.9%)

Analysts’ Estimate (Revenue): $38.3 billion (+19.8%)

Analysts’ Estimate (EPS): $4.72 (+58.3%)

Analysts’ Estimate (Capex): $9.5 billion (+50%)

- Alphabet advertising revenue rose by 11.1% y/y to $64.6 billion, in-line with analysts’ estimate of $64.5 billion.

- YouTube advertising revenue came in at $8.66 billion, missing $8.94 billion estimate.

- Google Search and other revenue increased 13.8% to $48.51 billion, beating estimate of $47.71 billion.

- Total revenue was up by 14% y/y to $84.7 billion, also in-line with analysts’ estimate of $84.5 billion.

-

Alphabet said in the earnings call that YouTube started lapping strong comparison period during the quarter.

“What you’re also seeing here is with YouTube, we were anniversary-ing the ramp in APAC-based retailers that began in the second quarter last year and foreign exchange headwinds as well that we noted,” CFO Ruth Porat said.

“As we look forward to the third quarter, we will be lapping the increasing strength in advertising revenues in the second half of 2023, in part from APAC-based retailers,” she added

-

Alphabet shares are down 4% following Porat’s comments that could dampen margin expansion in Q3.

“In the third quarter, operating margins will reflect the impact of both the increases in depreciation and expenses associated with the higher levels of investment in our technical infrastructure, as well as the increase in cost of revenues due to the pull forward of hardware launches into Q3,” she pointed out.

-

The company also reiterated that they will continue investing in AI infrastructure.

“Looking ahead, we continue to expect quarterly capex throughout the year to be roughly at or above the Q1 capex of $12 billion,” Porat said.

“Look, obviously we are at the early stage of what I view as a very transformative area,” CEO Sundar Pichai said, “the risk of under-investing is dramatically greater than the risk of over-investing for us here.”

Assessment

Comments on depreciation will probably be another theme for Meta investors. Meta shares are down 3% pre-market probably dragged by Alphabet comments that depreciation will likely rise in Q3 due to high investment in technical infrastructure. Additionally, Alphabet’s reiteration that they will continue investing in AI could inform investors that Meta will likely reiterate the same.

Yes I agree that some investors might be worried about the level of investments and when they will pay-off and might fear a costly “technology race”.

That said to me it is obvious that underinvesting would be the way larger risk, given the transformative nature of the technology as outlined here.

Some investors might also be a bit worried as this quarter reminds us that comps going forward will be tougher, due to the China retailer spend ramp up in Q2 2023.

In my opinion there is nothing to worry about as effect will only be short term and I think technology investments can easily pay off over the long run.

I also think expectations for a larger beat might have been very high and that Meta can still beat expectations regardless as I expect social to continue gaining market share.

Here is a summary of Q 2024 Tinuiti Digital Ads Benchmark Report:

- Meta ad spend rose 10% y/y in Q2 2024 (Q1 2024:+16%)- sequential deceleration was due to stiffer comparison, CPM was up 5% y/y (Q1 2024: 0%)- the biggest jump since Q2 2022 while impressions rose 4% y/y (Q1 2024:+15%).

- Facebook ad spend rose 4% y/y (Q1 2024:+9%), impressions fell from growth of 11% in Q1 2024 to 5% in Q2 while CPM fell 1% (Q1 2024:-2%) partly due to growth in the share of Facebook impressions coming from Reels video and overlay ads, which are much cheaper than Feeds.

- Instagram ad spend grew by 24% y/y in Q1 (Q1 2024:+34%), CPM rose by 23% y/y (Q1 2024:+6%)-the largest quarterly increase since Q1 2022 while impressions were flat (Q1 2024:+27%) due to tough comparison period.

- TikTok ad spend was up 10% y/y in Q1 (Q1 2024:+21%), driven by a 49% increase in CPM (Q1 2024:+15%), impressions declined by 26% (Q1 2024:+6%).

- Tinuiti tracks ad spending by Temu on Google Search ads space and according to them, Temu’s ad impressions are back on the rise after faltering in the final weeks of Q1 2024.

Assessment

In the most recent two quarters, Meta revenue outperformed Tinuiti Meta ad revenue by an average of 11.5%. A similar trend could repeat itself in Q2 earnings.

It’s good to see that TikTok’s CPM rose significantly while impressions declined sharply as it could force advertisers to shift to the likes of Instagram, particularly as dateline for a ban unless divested approaches.

A rebound in Temu’s ad impressions is also good news for Meta Platforms ( China-based advertisers represented 10% of Meta’s overall revenue in 2023).

This video puts Alphabet’s capex well into perspective. It almost doubled from 13.18 billion in H1 2023 to 25.20 billion in H1 2024.

I have to admit that I was not fully aware of the extent of Alphabet’s capex increase.

Spending increases at this level are certainly not good for competitors like Meta, which also wants to build their own AI models.

@Aron Did we get any insights into Alphabet’s capex planning beyond 2024? I think, moving forward, we need to have a closer eye on capex when reporting competitor results.

We should also focus more on predicting capex for portfolio companies themselves.

I think if Meta’s 2024 capex projections in Q2 2024 would significantly exceed previously communicated numbers the stock might react negatively afterhours regardless of top and button line numbers.

In the long run I continue to be not worried about increased capex for Meta which could be temporary in case it would not pay off.

(Increased capex for Alphabet is another story as they are facing potentially existential threats and might need to keep spending to defend their position. Meta on the other side has strong network effects and is therefore less reliant on technological leadership)

No, they did not provide capex planning beyond 2024

I mean, did they leave any hints in the conference call, or are there any credible experts on Bloomberg/CNBC etc. or any other good sources who have a good take on how Alphabet’s capex or the capex of the other AI big tech players will develop beyond 2024?

-

They only said we are in early stages of a transforming technology and that they risk more by underinvesting.

“We are at an early stage of what I view as a very transformative area and in technology, when you’re going through these transitions, aggressively investing upfront in a defining category, particularly in an area in which in a leveraged way cuts across all our core areas or products, including Search, YouTube, and other services, as well as fuels growth in Cloud and supports the innovative long-term bets and Other Bets is definitely something for us makes sense to lean in. I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing, we clearly – these are infrastructure which are widely useful for us.”

-

Most experts are only talking about 2024. Evercore’s Mark Mahaney thinks we should see margin expansion at Alphabet from here onwards (min 0:38) while RBC’s Brad Erickson thinks that its AI spend will not get marginally worse since they now have a good visibility (min 3:23).

- Pinterest Q2 2024 revenue rose by 21% y/y to $854 million, topping analysts estimate of $848 million.

- It’s guiding Q3 2024 revenue in the range of $885-900 million, versus $907 million estimate.

- Its MAUs during the quarter were 522 million, above analysts estimate of 520.1 million.

-

Pinterest said in the earnings call that the ad market was stable in Q2 compared to Q1.

“So, I’d say, generally, just a broader macro, we’re seeing an ad market, and we think is relatively stable versus last quarter,” CEO Bill Ready said.

-

Though there were broad strength in retail advertising, they noticed some weakness in food and beverages.

“However, this growth was partially offset by softness within CPG, specifically food and beverage advertisers, who are navigating broader headwinds within that category,” CFO Julia Donnelly said.

-

The Q3 guidance that missed analysts estimates reflects tough comps and expectations that softness in food and beverages advertising will continue.

“However, as we move into Q3, we are facing tougher comps since our revenue growth nearly doubled from Q2 to Q3 last year,” Donnelly pointed out.

" Finally, our guidance does not assume a material improvement in trend for the food and beverage category," Donnelly said.

-

It’s worth pointing out that Pinterest doesn’t accept political ads.

-

Microsoft said in its Q4 2024 earnings call that their FY2025 capex will be higher than in 2024, adding that the investments will be guided by “demand signals”.

“To meet the growing demand signal for our AI and cloud products, we will scale our infrastructure investments with FY2025 capital expenditures expected to be higher than FY2024,” CFO Amy Hood said.

“As a reminder, these expenditures are dependent on demand signals and adoption of our services that will be managed through the year.”

-

Hood said Cloud and AI related spend represented nearly all of Microsoft’s $19 billion (+78%) capex during the quarter.

In a recent interview with Bloomberg’s Emily Chang, Mark Zuckerberg defended AI investments.

“I think AI is gonna be very fundamental. I think that there’s a meaningful chance that a lot of the companies are overbuilding now and that you look back and you’re like, “Oh, maybe we all spent some number of billion of dollars more than we had to.” But on the flip side, I actually think all the companies that are investing are making a rational decision because the downside of being behind is that you’re out of position for, like, the most important technology for the next 10 to 15 years,” he said. (min 8:51)

It appears to me that NVIDIA is up 11.5% today mainly based on those comments.

Do you have an idea/theory what they said in the call that caused the Microsoft stock to raise from -8% initially back to only being down 1% as of now? I realized that there was a sudden jump in share price in after hours trading at one point probably during the earningscall.

I think NVIDIA shares were also boosted by AMD which topped earnings estimates.

Nothing in particular to pinpoint as a reason for recouped share losses at Microsoft during the earnings call. My guess is that the call quashed some worries. CFO Amy Hood said they expect Azure revenue to accelerate in the second half of 2025 since they are now ramping up capacities which was responsible for weak performance in Q4.

“In H2, we expect Azure growth to accelerate as our capital investments create an increase in available AI capacity to serve more of the growing demand.”

Meta beat on Q2 earnings, provide better-than expected guidance

-

Meta Q2 2024 revenue rose by 22% y/y to $39.1 billion, in-line with management’s upper guidance and topping analysts estimate of $38.3 billion.

-

EPS was $5.16 versus analysts estimate of $4.72 while operating margin rose to 38% from 29% a year ago.

-

The average Family daily active people (DAP) grew by 7% y/y to 3.27 billion, exceeding analysts estimate of 3.26 billion.

-

Meta’s capital expenditures during the quarter were $8.47 billion, lower-than $9.5 billion estimate.

-

Meta is guiding Q3 2024 revenue in the range of $38.5-41 billion (analysts estimate: $39.14 billion), reiterating its 2024 total expenses guidance in the range of $96-99 billion and raising its 2024 capex outlook to a range of $37-40 billion (analysts estimate: $38 billion) from $35-40 billion.

-

The company said it expects higher expenses and capital expenditure in 2025 compared to 2024 due to higher infrastructure costs.

“While we do not intend to provide any quantitative guidance for 2025 until the fourth quarter call, we expect infrastructure costs will be a significant driver of expense growth next year as we recognize depreciation and operating costs associated with our expanded infrastructure footprint.”

“While we continue to refine our plans for next year, we currently expect significant capital expenditures growth in 2025 as we invest to support our artificial intelligence research and product development efforts.”

Here are the main insights from the earnings call and follow-up call Q&A;

-

Li said in the follow-up call that their compute needs currently outstrip the available data centres and they have had to shift capacity around to free up capacity for GenAI training and that leads to foregone revenue but they have factored that in Q3 guidance.

Details

“Our compute needs outstrip our available data center capacity right now…We’ve also had to do a little bit of shifting capacity around to free up capacity for GenAI training. And altogether, we expect that that will result in some foregone revenue growth from ads and organic content ranking improvements that we would have otherwise made, but that has been factored into our Q3 outlook. And we generally expect this to be a near term dynamic until we start bringing additional data center capacity online next year, which will meet our capacity needs.”

-

Susan Li said in the earnings call that ad market continues to be healthy and that they will be lapping strong comps in Q3.

Details

“We are continuing to see healthy global advertising demand, and we are also delivering ongoing ad performance improvements just related to all of the investments that we’ve continued to make over time. And improving the sort of ads, targeting ranking, delivery, all of the fundamental infrastructure there. And we expect that all of that will continue to benefit ad spend in Q3. We do expect year-over-year growth to slow in Q3, as we are lapping strong growth from China-based advertisers, as well as strong Reels impression growth from a year ago. And we also expect modestly larger FX headwinds in Q3 based on current rates.”

-

Li pointed out in the follow-up Q&A that the expected ad growth in 2024 and 2025 will primarily be a function of core AI work.

Details

“The incremental revenue that you see this year and largely next year, coming from the ads business, that will primarily be a function of the investments that we have been making in the core AI work that goes into the ongoing ads performance improvements as we make our ranking, delivery, targeting, et cetera systems, more performant over time.”

-

Li said in the follow-up call that they shared last time that two-thirds of their China ad revenue comes from advertisers outside the top 10 spenders in China in 2023 and pointed out that spend among Chinese advertisers remain strong.

Details

“We don’t have an update on that for this year, but I would say it continues to be a diverse advertiser base. And more broadly, I think we are continuing to see a longer-term trend of growth from China-based advertisers…And again, most of our China-based ad revenue continues to come from a longer tail of advertisers,” she added.

-

Zuckerberg pointed out that Llama 4 will use 10x more compute than Llama 3, adding that he rather invest now than wait until they are too late.

Details

“The amount of compute needed to train Llama 4 will likely be almost 10 times more than what we used to train Llama 3, and future models will continue to grow beyond that. It’s hard to predict how this trend – how this will trend multiple generations out into the future. But at this point, I’d rather risk building capacity before it is needed rather than too late, given the long lead times for spinning up new inference projects.”

-

Susan Li said they will build their infrastructure with flexibility in mind.

Details

“We are continuing to build our AI infrastructure with fungibility in mind, so that we can flex capacity where we think it will be put to best use. The infrastructure that we build for gen AI training can also be used for Gen AI inference. We can also use it for ranking and recommendations by making certain modifications like adding general compute and storage.”

Assessment

Overall, the Q2 results, outlook and insights during the earnings call and follow-up call were positive. The fact that Meta AI infrastructures are build with flexibility in mind reduces the risks that the investments made will be worthless in case GenAI turns to be a bubble. The lost revenue as a result of shifting capacity emphasizes the power of its recommendation architecture while the fact that its ad revenue growth this year and next year is primarily a function of core AI work could suggest that Meta is taking market share from other platforms.

Snap slightly misses Q2 revenue estimate, forecasts weak Q3

-

Snap reported Q2 2024 revenue of $1.24 billion (+16%), missing analysts estimate of $1.25 billion and an adjusted EPS of $0.02 that was inline with the estimates.

-

It’s guiding Q3 2024 revenue in the range of $1.335 billion and $1.375 billion ($1.355 billion at the midpoint) versus analysts estimate of $1.36 billion.

-

Snap said in its earnings call that it witnessed weakness in brand advertising from some consumer discretionary verticals.

“Brand-oriented advertising revenue declined 1% year over year, driven by particularly weak demand from certain consumer discretionary verticals including retail, technology, and entertainment, as well as the timing impact of holidays shifting out of Q2 in the current year,” CFO Derek Andersen said.

-

Its shares fell more than 20% in extended trading.

Here are some of the analysts calls following Meta’s earnings;

-

Buy, $550->$590: Stifel analysts said Meta delivered a solid earnings beat in Q2 and better-than expected Q3 guidance.

-

Outperform, $550->$600: Evercore said Meta’s comments on ad market performance quashed concerns raised by YouTube’s and Spotify’s ad revenue.

-

Buy, $565->$600: Jefferies was impressed that there are now more than 1 million advertisers using GenAI ad tools which is about 10% of the total advertisers in the platform.

-

Outperform, $570: RBC praised the flexibility of Meta’s AI infrastructures.

-

Overweight, $540->$560: KeyBanc believes efficiencies created by AI can help Meta gain more market share.