Overview earnings expectations for Q1 2025, and actual numbers

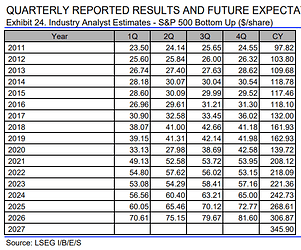

Q1 2025 SP500 EPS expected at 60.05, an 6.17% y/y

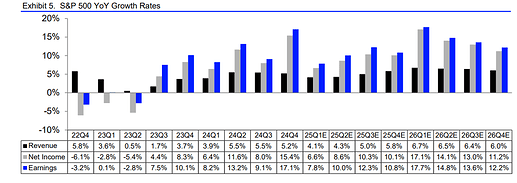

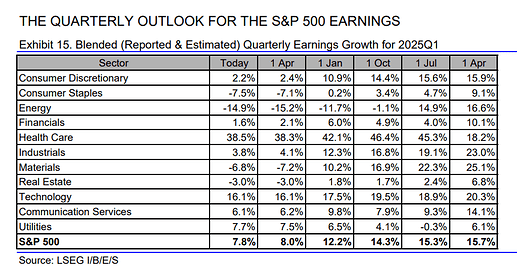

- Q1 2025 S&P 500 earnings growth forecasted at 7.8% y/y, the slowest pace in five quarters. Excluding Health Care and Information Technology, growth is just 0.1% y/y

- Earnings are projected at $507 billion, down 9.0% q/r from the prior record quarter, marking the weakest rate since 2020.

- Net profit margins expected to decline from a record 12.2% to 11.6%, marking a reversal after five quarters of improvement.

- Sectors experiencing largest margin revisions downward include Materials, Real Estate, and Industrials.

- Forward P/E multiple has dropped from 22.3x at the start of 2025 to 18.5x, still relatively elevated (78th percentile historically).

- Q1 growth expectations were revised down by 4.3 percentage points, above the long-term average of -3.3 points

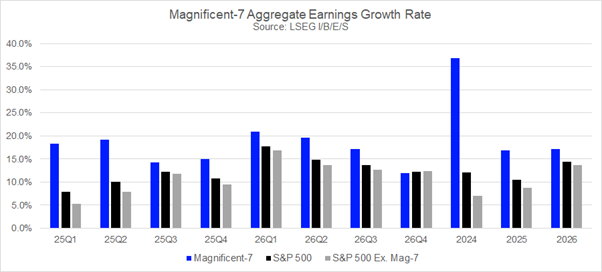

- Notably, Mag-7 earnings (+18.3%) are expected to outpace S&P 500 earnings by smallest margin since 2023 Q1.

Assessment: Headline growth remains modestly positive, underlying indicators that could imply more weakness → weakening margins, cautious guidance, broad downward revisions, and historically low beat rates

Biggest risk in my opinions comes from corporate guidance, since due to the uncertainty companies could provide very wide ranges or even not provide guidance a lot.

Bank earnings were very strong for Q1 2025, but provided uncertain outlook for the economy

- Morgan Stanley Ted Pick

“The simple truth is that we do not know where trade policy will settle nor what the effects will be on the economy,”. He said that market unpredictability had prompted some clients to defer activity.

- JPMorgan CEO Jamie Dimon

the economy is “facing considerable turbulence.” He pointed to a juxtaposition of “potential positives” from tax reform and deregulation against “potential negatives” of tariffs and inflation, plus geopolitical tensions.

“Our excellent economist, Michael Feroli, I called him this morning… They think it’s about 50-50 for recession…”

- Robin Vince, the CEO of BNY

firm was prepared for a wide range of economic and market scenarios “as the outlook for the operating environment is becoming more uncertain

- BlackRock CEO Larry Fink

“uncertainty and anxiety about the future of the markets and the economy are dominating each and every client conversation.” Fink said the administration’s tariff announcements last week “went beyond anything I could have imagined in my 49 years in finance.”

- Charlie Scharf, the CEO of Wells Fargo

“We expect continued volatility and uncertainty and are prepared for a slower economic environment in 2025, but the actual outcome will be dependent on the results and timing of the policy changes.”

Q1 2025 Earnings Update

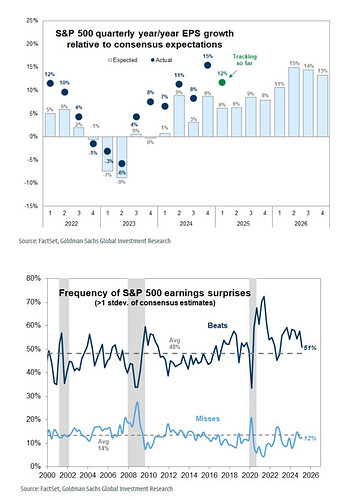

Goldman’s John Flood: Backward-looking 1Q earnings results have been better than expected. 1Q EPS growth tracking +12% vs. +6% consensus estimate at the start of earnings season. Better than expected margins have driven the positive surprise so far with the average earnings surprise tracking at 5% vs. an average sales surprise of 1%. 51% of companies beat consensus estimates by more than 1 SD of EPS estimates, vs. long-term average of 48% (12% have missed vs historical avg of 14%).

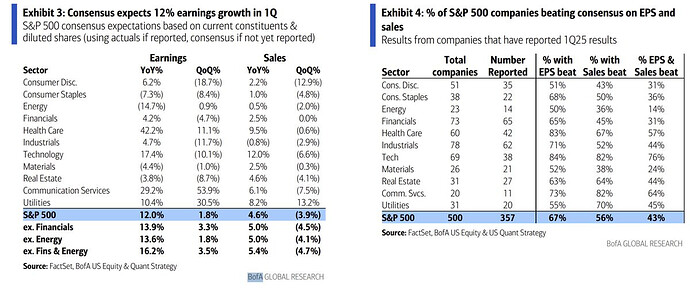

BoA: 357 S&P 500 companies (80% of index EPS) have now reported. Consensus 1Q EPS (actuals & estimates) is tracking a 6% beat. Big Tech earnings were better than expected, with the Mag 7 ex. NVDA [which hasn’t reported] beating by 16% in aggregate, while the rest of the index beat by a still solid 4%. Overall, 67%/56%/43% of companies beat on EPS/sales/both, better than the historical average of 59%/59%/41%, although a smaller proportion of companies beat on sales than usual.