I will mainly focus on customer contract additions and comments around it. If the customer additions come in lower than expected due to network outage last year, the market may not like it. However, if the customer additions are lower than expected due to the migration, it may not have any impact on the shares.

I will also focus on commentary around the low-band spectrum. If the commentary is negative, the shares will likely react negatively since the low-band spectrum is currently the main risk.

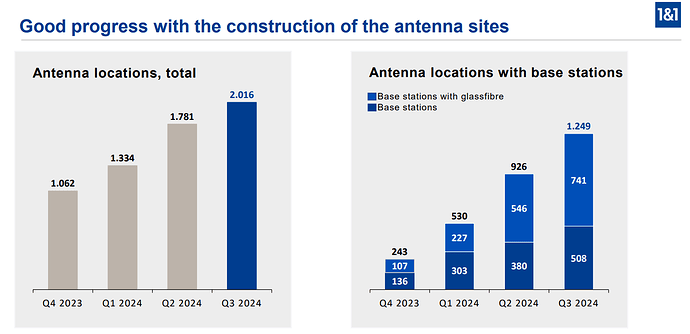

I think 200-300 antenna sites (base stations) per quarter is not bad compared to prior years. Dommermuth said they plan to make it 200-300 antenna sites per day. The Cartel Office’s preliminary findings suggest that Vantage Towers could be forced to give priority to 1&1 instead of Vodafone in the construction of antenna sites. Vantage Towers had to avail 3,800 antenna sites to 1&1 at the end of 2025, but only provided a fraction of it. Hence being compelled to provide this should significantly boost the number of antenna sites. Even if 1&1 increase antenna sites buildout to 500 per quarter, that would be an addition of more than 10,000 at the end of 5 years. They only need around 12,000-13,000 active antenna sites (those connected to far-edge data centers) to reach 50% coverage in Germany by 2030. Given that the active base stations are now positively tracking the overall antenna sites as shown in the screenshot below (page 13), I think the pace of antenna sites construction is now a low risk. Obviously, the progress of active antenna sites construction is something that we should continue to monitor closely.

Q4 2024 antenna sites: 2,309 (page 8)

Q4 2024 base stations with glass fibre: 1,000

1&1define base stations with glassfibre as those that are active and base stations as those that are not fully service-ready.