This topic covers 1&1’s upcoming Q1 2025 earnings. A preview of the results will be published here shortly. For a detailed overview of earnings preparations, please visit the related wiki article:

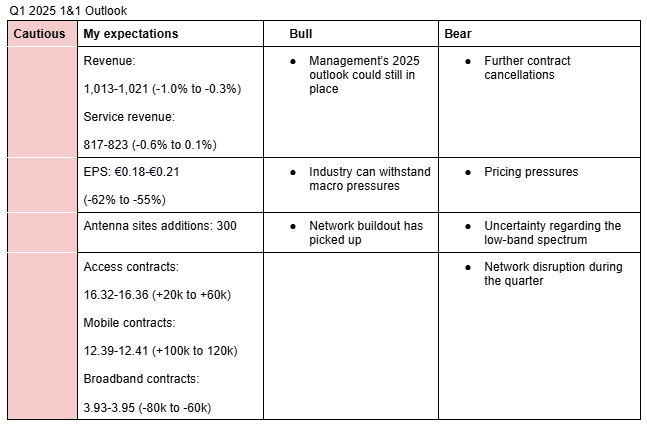

I am cautious on 1&1’s Q1 2025 earnings. My estimates are informed by the ongoing pricing pressures in Germany, management’s guidance for the full year, and the impact of last year’s network outage. Here is a description of my bullish and bearish points.

Bullish points

-

Management’s outlook could still in place: In the published analysts consensus estimates, management may have signaled that their 2025 outlook is still on track.

"There are two further consensus collections available:

- Visible Alpha, with a comparable consensus result to the consensus we collected.

- Bloomberg, in which up to 8 analysts currently participated, with the notable characteristic that for example estimates for 2025 do not reflect our forecasts in total. This means, for example, that the guesstimate for Capex for 2025 is well above our guidance," management wrote.

-

Telecommunication industry can withstand macro slowdown: The telecommunications sector is considered immune to macro pressures since most people cannot do without it. Therefore, the slowdown in Germany’s economy may not materially affect the usage of 1&1’s products.

-

Network buildout has picked up: Management’s comments on 27th March signaled that network buildout is progressing well. For instance, Dommermuth pointed out that there are now 5,000 active antenna sites in the pipeline and that they are doing 200-300 antenna sites per quarter. Therefore, I don’t expect any negative news on this front that could drive the shares down.

Bearish comments

- Further contract cancellations: There will likely be more customer churns in the quarter due to the ongoing customer migration as well as the network outage in May last year. The second half of last year indicated that the management may not have strong visibility on the impact of network outage last year. Similarly, CEO Ralph Dommermuth pointed out in March 27, 2025 that he sees a lapse of possibly 10,000-20,000 contracts in Q1 due to the huge migration.

- Pricing pressures in Germany remains intense: Pricing pressures in Germany, particularly from o2 and Deutsche Telecom continued into Q1. As a result, 1&1 launched attractive offers from March as well. This will negatively impact the average revenue per user (ARPU) during the quarter and customer signups.

Summary of Q1 2025 Mobile Pricing Trends in Germany

Key Insights

Key Insights

- Aggressive Promotions in H2 2024:

- O₂ (Telefónica) led with deep discounts (e.g., Unlimited Max at half-price: €29.99/month; various other launch discounts).

- Deutsche Telekom offered cashback (€120) and increased data allowances, promoting unlimited family plans.

- Vodafone implemented long-term discounts (25% off monthly fees for two years).

- Promotion Status in Q1 2025:

- Many aggressive offers continued but showed initial signs of easing:

- O₂ ended some significant launch discounts (up to €15/month on mid-tier plans) in February 2025 but extended unlimited data deals until June 2025.

- Deutsche Telekom maintained Q4 promotions into Q1; new tariffs introduced from April aimed at structural rather than promotional value.

- Vodafone continued the 25% discount; however, handset promotions and flash deals became less frequent.

- Many aggressive offers continued but showed initial signs of easing:

- 1&1’s Pricing Response:

- Launched aggressive offers in March 2025 (100 GB for €19.99/month, unlimited data entry-tier at €9.99 initially).

- Permanently increased data allowances across core plans without price hikes.

- Positioned itself as a highly competitive value-for-money provider to counter incumbents.

Analyst & Expert Commentary

Analyst & Expert Commentary

- Analysts viewed Q1 2025 as exceptionally competitive with intense price pressure negatively impacting ARPU and operator margins.

- Deutsche Bank and Bernstein cautioned on ongoing aggressive pricing, highlighting short-term customer gains but longer-term margin strain.

- Experts anticipated moderation later in 2025 as promotional intensity appeared to peak.

- Uncertainty regarding the low-band spectrum: This might be the main theme going into the earnings. There have been no recent comments regarding it, making the talks around it uncertain.

- Network disruption during the quarter: There have been two network disruptions since the start of the year. This may reduce the number of customer signups, which could affect the 2025 earnings outlook.

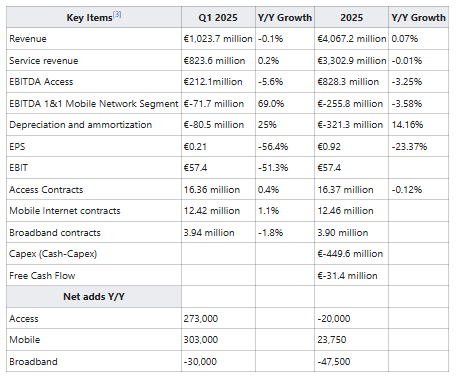

Here are the analysts estimates for Q1 2025 and FY2025:

Given the stiff competition, the churn associated with migration of customers to own network, and the uncertainty regarding the low-band spectrum, I think it might be worth it taking some profits before the earnings.

Good arguments. Will likely reduce the position directly at 8:00 when the German pre-market trading opens or place an order.

Given that they should release numbers at around 7:30 we will have a chance to see numbers first before deciding.

Which are the key numbers to focus on in your opinion to base our decision on and why?

I did not get the comments about 200-300 antenna sites per quarter. Isn’t that incredibly slow?

I will mainly focus on customer contract additions and comments around it. If the customer additions come in lower than expected due to network outage last year, the market may not like it. However, if the customer additions are lower than expected due to the migration, it may not have any impact on the shares.

I will also focus on commentary around the low-band spectrum. If the commentary is negative, the shares will likely react negatively since the low-band spectrum is currently the main risk.

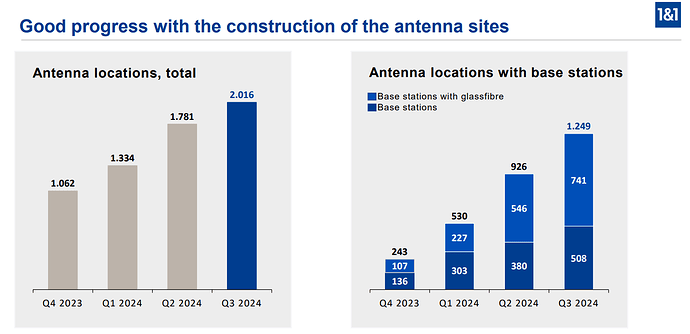

I think 200-300 antenna sites (base stations) per quarter is not bad compared to prior years. Dommermuth said they plan to make it 200-300 antenna sites per day. The Cartel Office’s preliminary findings suggest that Vantage Towers could be forced to give priority to 1&1 instead of Vodafone in the construction of antenna sites. Vantage Towers had to avail 3,800 antenna sites to 1&1 at the end of 2025, but only provided a fraction of it. Hence being compelled to provide this should significantly boost the number of antenna sites. Even if 1&1 increase antenna sites buildout to 500 per quarter, that would be an addition of more than 10,000 at the end of 5 years. They only need around 12,000-13,000 active antenna sites (those connected to far-edge data centers) to reach 50% coverage in Germany by 2030. Given that the active base stations are now positively tracking the overall antenna sites as shown in the screenshot below (page 13), I think the pace of antenna sites construction is now a low risk. Obviously, the progress of active antenna sites construction is something that we should continue to monitor closely.

Q4 2024 antenna sites: 2,309 (page 8)

Q4 2024 base stations with glass fibre: 1,000

1&1define base stations with glassfibre as those that are active and base stations as those that are not fully service-ready.

Thanks for the overview. I think the 200-300 sites per day must be something said as a joke how fast they want to be? Otherwise this would be 70k+ antenna sites per year. Was there anything specific in that comment that signaled a lot of confidence when listening to it?

Edit: I looked it up. There was a mistake done by the english translator + therefore also in the transcript. In the original version in german (1:04h) he did not say per day but only said that they want to increase it.

Even going from 200-300 sites per quarter to 500 sites per quarter can be a massive challenge. Any more insights that makes you confident that they can reach 500 per quarter in the not so distant future?

I think progress and esp. the outlook on that topic will be important as well.

EBITDA will also be important. Without further information i think it is more likely that it will come in at 140m in Q1 2025 as analysts expect as this is more in line with the annual guidance (p.21) of management of €571 million than your projections of €124-132 million. This is not considering impacts of a price war though and you might be correct, or other factors you are considering? Overall we need to focus more on EBITDA in case of 1u1. Our usual focus on EPS is a simplification which works better in stable environment but not well anymore if businesses invest heavily and depreciations rise strongly.

How do you think overall of the impact for revenue of price wars? I see that you model it as very stable with -1% to -0.3% y/y.

They actually didn’t want to provide guidance for antenna sites because they want to avoid negative media reports if they don’t reach it. That may signal they are not very confident in their progress. My 500 estimate is based on the 5,000 pipeline and the fact that there’s a huge backlog from Vantage Towers. Also their progress has picked up based on that chart.

My EBITDA projection for Q1 is mainly based on my assumption that cost of sales will be stronger in Q1 and weaker as we move through the year due to strong comps in Q2 and Q4 and also pricing headwind, which is likely to decline over the coming quarters.

Yes, I don’t expect pricing headwind in Q1 will be as significant as in Q4 since O2 ended some of the offers in February.

Do we know how long it typically takes to complete an antenna location? Do we know how many of the 5000 under construction are under construction by Vantage Towers?

My first thought is that potential pricing pressure show only show up marginally in numbers given that the typical contract last 24 months. There are monthly cancelable contracts but they are more rare. GPT estimates (I think it’s only guessing) that 80% of contracts are 24 months.

That said after changes in the telecommunication law (tkg) the contracts are not renewing automatically anymore for another 24 months but people can cancel monthly. (I think we reported about that law change I that time but I couldn’t find it?) This means millions who already had 24 months contracts should be able to change more flexibly.

On the other side telcos are likely looking for ways to get costumer consent for longer voluntary extensions and a lot of costumers are not so price sensitive that they always care about changing.

Overall I would estimate that a price war in a quarter would only affect maybe less than 5% of contracts negatively. Less if promotional offers only have been for a period of time.

How confident are you that we seeing something out of the ordinary overall? Or might this just be part of some regular promotions which is part of how the telco industry works?

What I could imagine could cause EBITDA to be lower in some quarters vs others is higher cost with the migrations booked in them. I think I saw somewhere that Q2 might be the peak of migrations?

1&1’s Q1 2025 EBITDA significantly beats estimates on lower cost of sales, revenue slightly misses estimates

- 1&1 Q1 2025 total revenue fell 0.6% y/y to €1,019 million (analysts estimate: €1,024 million); service revenue was flat y/y at €822 million (analysts estimate: €824 million), while hardware revenue fell 3% y/y to €196 million.

- EBITDA fell 15% y/y to €156 million (analysts estimate: €140 million), EBITDA in the access segment fell 0.8% y/y to €222 million (analysts estimate: €212 million), while EBITDA in the 1&1 Mobile Network Segment rose 58% y/y to -€67 million (analysts estimate: -€72 million).

- The number of customer contracts increased by 50,000 y/y to 16.35 million (analysts estimate:12.36 million), mobile contracts increased by 130,000 to 12.42 million, in line with analysts estimate, while broadband contracts fell by 80,000 to 3.93 million (analysts estimate: 3.94 million).

- Cash capex during the quarter rose to €27.9 million from €10.1 million in Q1 2024 (full-year 2025 management guidance: €450 million).

- Management reiterated its 2025 outlook: EBITDA expected to decline 3.4% to €571 million, based on Access segment EBITDA of around €836 million (2024: €856.1 million) and 1&1 Mobile Network segment EBITDA of around -€265 million (2024: -€265.3 million); service revenue is expected to remain at the prior-year level (€3,303.1 million).

Assessment of the earnings

Revenue came in above my midpoint estimate of €1,017 million, indicating that the core business remains stable.

EBITDA was €16 million higher than the consensus estimate and €27 million above my midpoint estimate, largely driven by lower-than-expected cost of sales. Cost of sales rose 4.5% y/y to €756 million, which was below my midpoint estimate of €784 million (+8%). During the earnings call, management stated that cost of sales was mainly driven by 1&1 startup expenses, but they did not clarify whether the increase was due to migration, personnel, or other cost components.

The earnings call provided few new insights. In particular, the CFO withheld details that are typically disclosed and, at times, took a long time to respond to questions—potentially indicating limited familiarity with certain aspects of the business.

I found the CFO’s comments on antenna site deployment contradictory. He stated that 1&1 still expects to reach 25% population coverage by the end of 2025, while also guiding toward just 2,000 active antenna sites by that time. Previously, management has said that 6,000–6,500 active antenna sites would be needed to reach 25% coverage. Considering 1&1 reported 5,000 sites under development last quarter, I had expected an increase in active sites this quarter—but they reiterated the 1,000 figure. This suggests further execution delays and raises the risk of missing the 2025 coverage requirement.

When 1&1 failed to meet the 2022 target of 1,000 active sites, reports indicated that BNetzA could impose a fine of €50,000 per missing site. BNetzA later suspended enforcement after the Cologne Administrative Court ruled the 2019 frequency auction was unlawful, due to improper political influence from the Transport Ministry—particularly on coverage obligations. The outcome of BNetzA’s appeal remains pending. If the court ruling is upheld, the 2019 auction could be declared void and existing coverage obligations would likely be revised. However, if BNetzA wins the appeal and 1&1 still fails to meet its 2025 rollout target, it could face penalties of up to €200 million (i.e., 4,000 missing sites × €50,000). A delay in achieving the required coverage also postpones key economic benefits, such as reduced national roaming costs.

In the earnings call, the CFO also acknowledged uncertainty around post-migration network performance. He said that while 1&1 has performance data when users are stationary at home, they do not yet know how the network will perform once customers begin using it in motion—another important risk to monitor.

D’Avis also did not comment on the ongoing negotiations regarding low-band spectrum — not even on the 2.6 GHz band, where discussions were previously viewed as relatively low-risk.

Overall, while the core business appears stable, execution risks related to antenna site buildout have resurfaced, and there is now uncertainty around network quality post-migration and the outcome of low-band spectrum negotiations. Given these risks, combined with the recent uptick in the share price, I continue to recommend taking some profits.