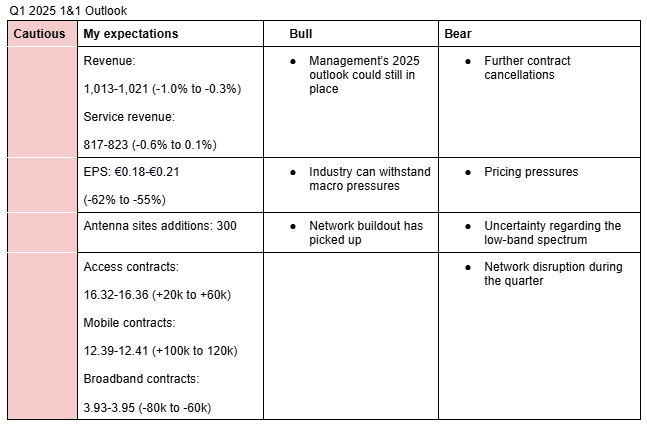

I am cautious on 1&1’s Q1 2025 earnings. My estimates are informed by the ongoing pricing pressures in Germany, management’s guidance for the full year, and the impact of last year’s network outage. Here is a description of my bullish and bearish points.

Bullish points

-

Management’s outlook could still in place: In the published analysts consensus estimates, management may have signaled that their 2025 outlook is still on track.

"There are two further consensus collections available:

- Visible Alpha, with a comparable consensus result to the consensus we collected.

- Bloomberg, in which up to 8 analysts currently participated, with the notable characteristic that for example estimates for 2025 do not reflect our forecasts in total. This means, for example, that the guesstimate for Capex for 2025 is well above our guidance," management wrote.

-

Telecommunication industry can withstand macro slowdown: The telecommunications sector is considered immune to macro pressures since most people cannot do without it. Therefore, the slowdown in Germany’s economy may not materially affect the usage of 1&1’s products.

-

Network buildout has picked up: Management’s comments on 27th March signaled that network buildout is progressing well. For instance, Dommermuth pointed out that there are now 5,000 active antenna sites in the pipeline and that they are doing 200-300 antenna sites per quarter. Therefore, I don’t expect any negative news on this front that could drive the shares down.

Bearish comments

- Further contract cancellations: There will likely be more customer churns in the quarter due to the ongoing customer migration as well as the network outage in May last year. The second half of last year indicated that the management may not have strong visibility on the impact of network outage last year. Similarly, CEO Ralph Dommermuth pointed out in March 27, 2025 that he sees a lapse of possibly 10,000-20,000 contracts in Q1 due to the huge migration.

- Pricing pressures in Germany remains intense: Pricing pressures in Germany, particularly from o2 and Deutsche Telecom continued into Q1. As a result, 1&1 launched attractive offers from March as well. This will negatively impact the average revenue per user (ARPU) during the quarter and customer signups.

Summary of Q1 2025 Mobile Pricing Trends in Germany

Key Insights

Key Insights

- Aggressive Promotions in H2 2024:

- O₂ (Telefónica) led with deep discounts (e.g., Unlimited Max at half-price: €29.99/month; various other launch discounts).

- Deutsche Telekom offered cashback (€120) and increased data allowances, promoting unlimited family plans.

- Vodafone implemented long-term discounts (25% off monthly fees for two years).

- Promotion Status in Q1 2025:

- Many aggressive offers continued but showed initial signs of easing:

- O₂ ended some significant launch discounts (up to €15/month on mid-tier plans) in February 2025 but extended unlimited data deals until June 2025.

- Deutsche Telekom maintained Q4 promotions into Q1; new tariffs introduced from April aimed at structural rather than promotional value.

- Vodafone continued the 25% discount; however, handset promotions and flash deals became less frequent.

- Many aggressive offers continued but showed initial signs of easing:

- 1&1’s Pricing Response:

- Launched aggressive offers in March 2025 (100 GB for €19.99/month, unlimited data entry-tier at €9.99 initially).

- Permanently increased data allowances across core plans without price hikes.

- Positioned itself as a highly competitive value-for-money provider to counter incumbents.

Analyst & Expert Commentary

Analyst & Expert Commentary

- Analysts viewed Q1 2025 as exceptionally competitive with intense price pressure negatively impacting ARPU and operator margins.

- Deutsche Bank and Bernstein cautioned on ongoing aggressive pricing, highlighting short-term customer gains but longer-term margin strain.

- Experts anticipated moderation later in 2025 as promotional intensity appeared to peak.

- Uncertainty regarding the low-band spectrum: This might be the main theme going into the earnings. There have been no recent comments regarding it, making the talks around it uncertain.

- Network disruption during the quarter: There have been two network disruptions since the start of the year. This may reduce the number of customer signups, which could affect the 2025 earnings outlook.

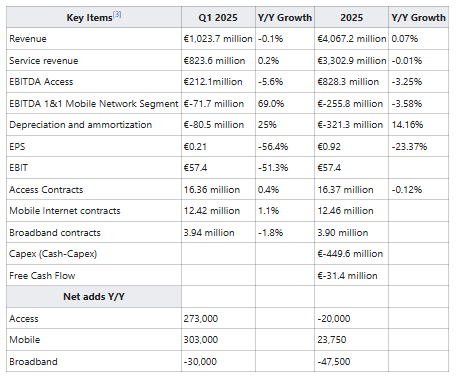

Here are the analysts estimates for Q1 2025 and FY2025:

Given the stiff competition, the churn associated with migration of customers to own network, and the uncertainty regarding the low-band spectrum, I think it might be worth it taking some profits before the earnings.