High-level overview for Q1 2024 US Index Earnings

*I am still unsure which estimates from each company should be used. *

I have seen between analyst that EPS is the most used metric, and they cite mostly Refinitiv or Bloomberg, and some Factset. But I am not sure if this is because they are the better ones, or their platforms are easier to get the data and convenient.

*For now, I will continue to use Refiniv for estimates, and SP for EPS by Sector.

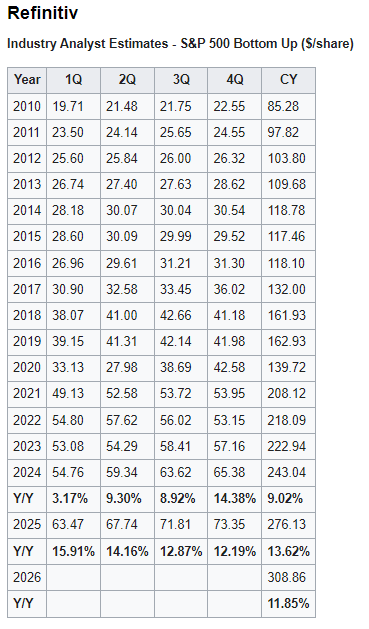

Refinitiv

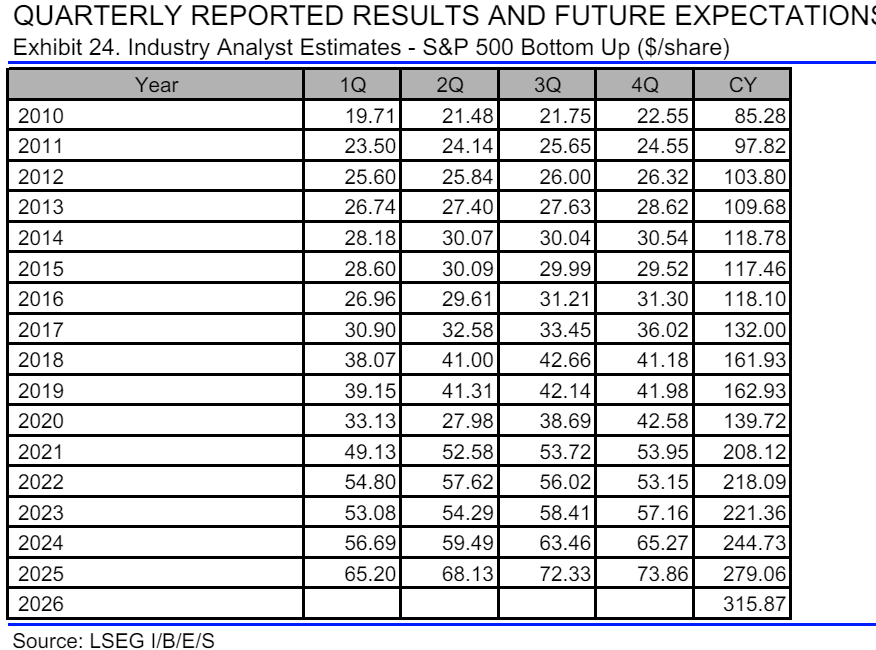

- Refinitiv estimates report an expected 54.76 EPS for the SP500 in Q1 2024. A 3.17% y/y increase.

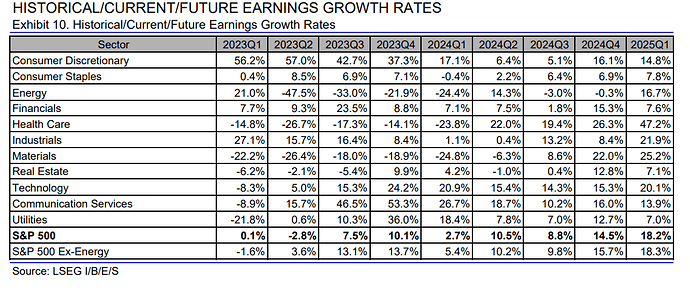

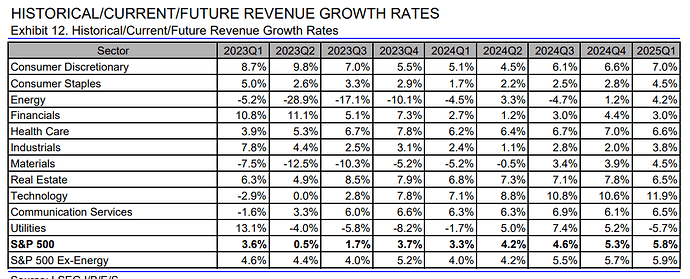

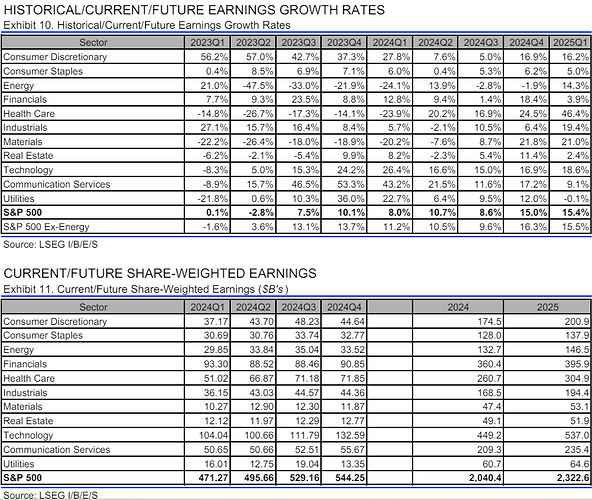

- This is their earnings estimates by sector (not the same as EPS data, but they are not disclosing how they calculate).

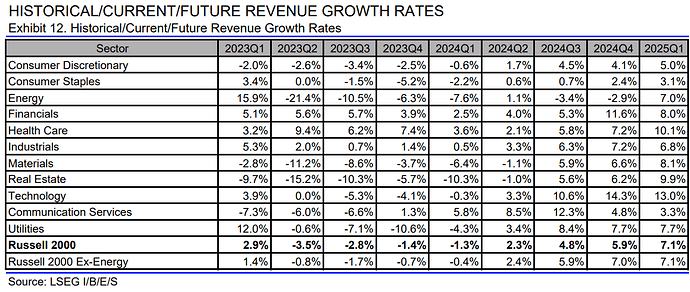

In this metric, they have a 2.7% Y/Y earnings increase for the index. And a 3.3% increase in Revenue.

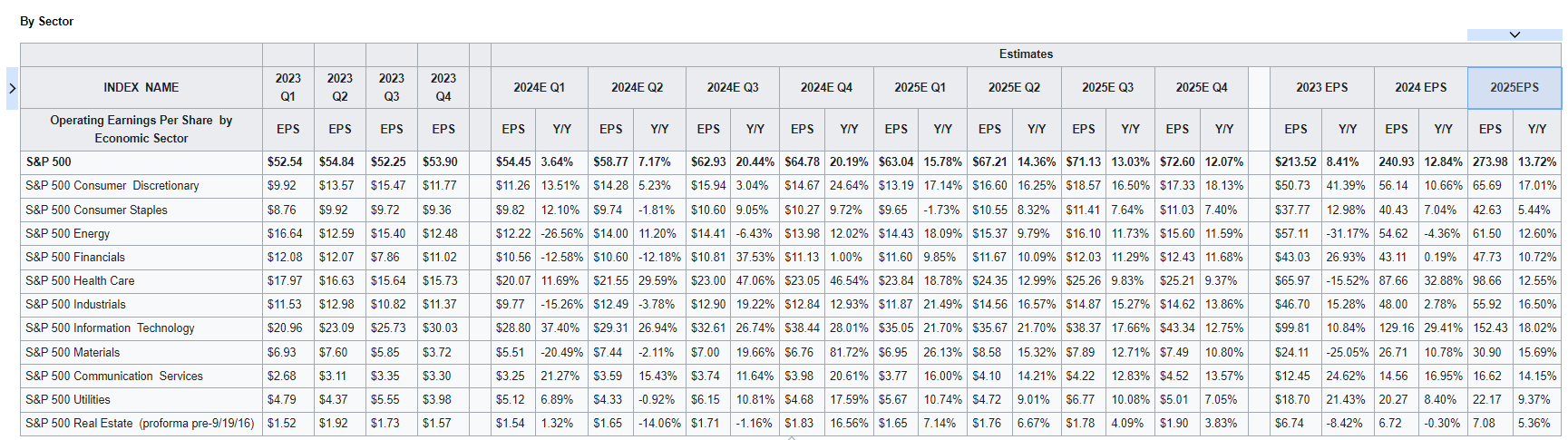

SP Global

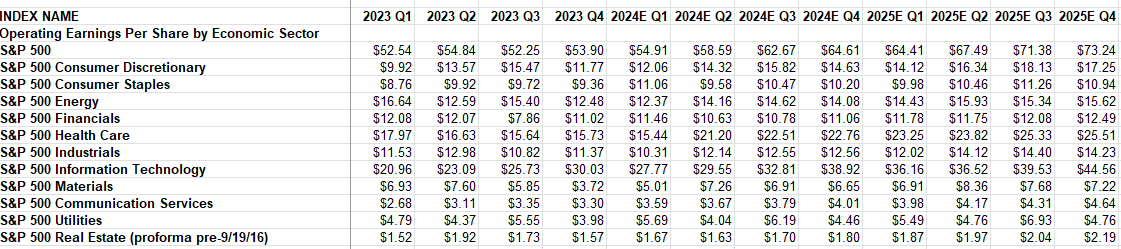

I realized SP 500 reports both GAAP and Non GAAP EPS (what they called "operating earnings). Their EPS estimates are only for Non-GAAP, and is the one that are more or less related to Refinitv EPS numbers too, but not exactly.

- S&P EPS shows a 3.67% Y/Y for or Q1 2024 for SP500.

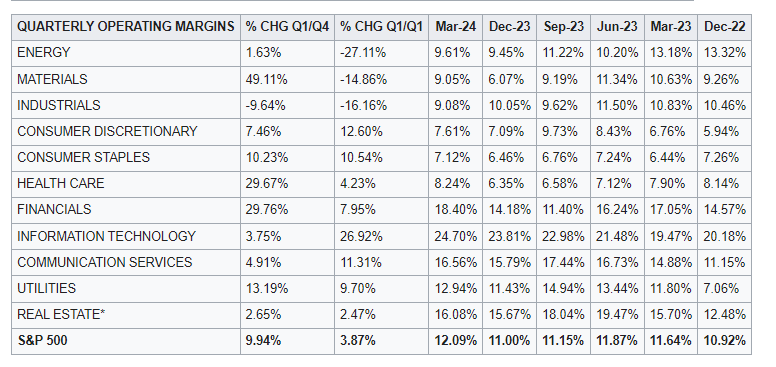

- SP estimates show an increase in margin for Q1 2024.

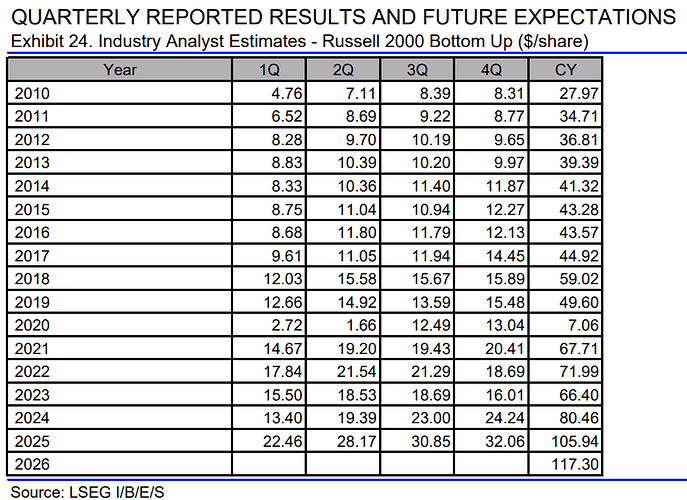

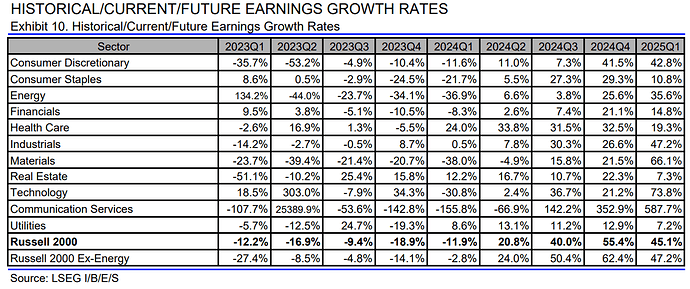

Small Caps from Rusell 2000 are expected to continue with weak earnings, but a recovery after that.

- A -13.55% Y/Y on EPS.

This is how Q1 2024 earnings will most likely end (almost all companies reported already), according to Refintiiv and SP Global.

I have seen some news articles, and LSEG data is the one quoted the most between these two, and is the one the analysts like Ed Yardeni uses.

- 56.69 EPS (6.80% Y/Y), Refinitv was estimating 54.76 EPS (3.17% Y/Y)

- Their earnings measure was 8% Y/Y vs 2.7% estimated.

- Revenue ended at 3.9% vs 3.3% estimated.

- 54.91 EPS (4.51% Y/Y) vs 54.45 estimated (3.67% Y/Y)

- Margin is expected to end at 11.64% vs 12.09% estimated.

Morgan Stanley’s chief strategist Mike Wilson says that only 30-40 of S&P 500 companies have been responsible for the earnings growth of the last quarters.

@Magaly do we know on a company by company basis who the companies are and how much the contributed each to growth?

Overall a good data source how each of the 500 companies did including who are the losers would be interesting.

I haven’t encountered any free sources until now that provide detailed insights into earnings on a company-by-company basis. However, I’ll be looking into it and let you know if I find any useful sources.