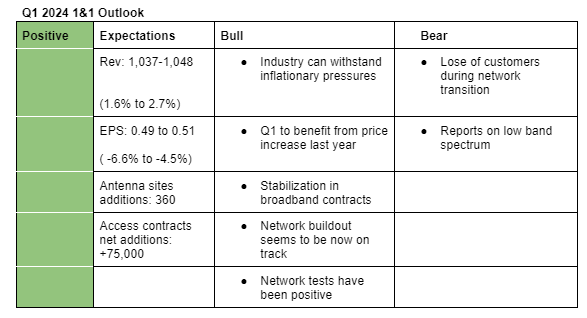

I am positive on 1&1 Q1 2024 results. My guestimates are based on the fact that 1&1 has beaten analysts revenue and EPS estimate by an average of 1.6% and 3.3% respectively in the past four quarters. Here is an explanation of my above bullish and bearish points.

Bullish;

- 1&1 operates in an industry that is essential for most people hence inflationary pressures are unlikely to have an impact on its earnings.

- I expect Q1 2024 results to benefit from price increases initiated in Q2 2023.

- 1&1 said during the recent earnings call that broadband contracts have stabilized.

- 1&1 seems to be now on track in its network buildout as evidenced by its recent announcement that it achieved the 350 antenna sites target.

- Network tests carried out by Teltarif were positive. This reduces the amount of churn during the migration of customers.

Bearish;

-

1&1 said they expect to lose customers that are hard to quantify this year as they transition to their network. Though they said these are low-valued clients, hence expected impact on revenue will be low, we can’t fully know until we see the results.

-

The main agenda among investors will probably be the progress on the network buildout as we have witnessed in the past. Therefore, if management’s comments are in support of recent media reports that the low-band frequencies might go to the old users, investors may react negatively since this will make the network more expensive.

N/B:

Here are the analysts’ expectations:

Revenue (Q1 2024): €1,031.9 million (+1.1% y/y)

EPS (Q1 2024): €0.49 (-7.5% y/y)

Revenue (FY2024): €4,207.1 million (2.7% y/y)

EPS (FY2024): €1.71 (-4.5% y/y)