Understanding asset allocation gives a powerful lens for understanding the U.S. economy and the role of the U.S. dollar in global markets.

Foreigners own $62 US assets, but have been selling since the beginning of 2025

- Foreigners own $62.12 trillion US assets in Q4 2024, and they have a net $26.23 trillion position with the US (assets - liabilities). This was $46 trillion in assets, and net $14 trillion as of Q4 2020.

- Particularly, the investment portfolio is $33 trillion, of which $18.5 T are stocks (US total market size $ ~62 trillion, Global Market size ~125 trillion), $8.5 T are US Treasuries (total debt in public hands ~$29 trillion), and $6.15 T other debt securities.

- TIC data shows that private sector net capital inflows into U.S. stocks and bonds last year totaled $980 billion, following a net inflow of $668 billion the year before and $1.6 trillion in 2022. That’s net purchases from overseas investors and net selling of foreign assets by U.S. investors.

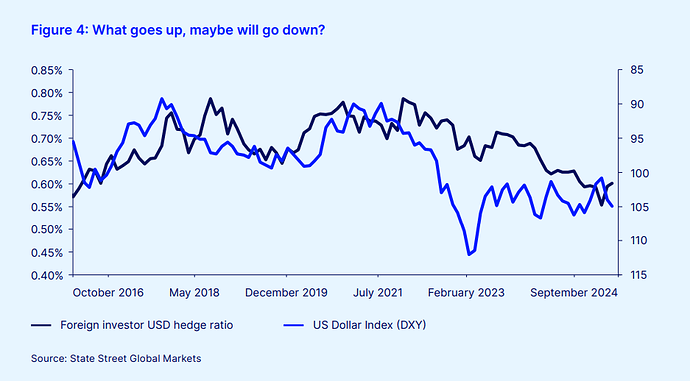

- According to Deutsche Bank, European portfolio holdings of US equities have risen from 5% to 20% since 2010 and that unhedged FX exposure to US assets is very high.

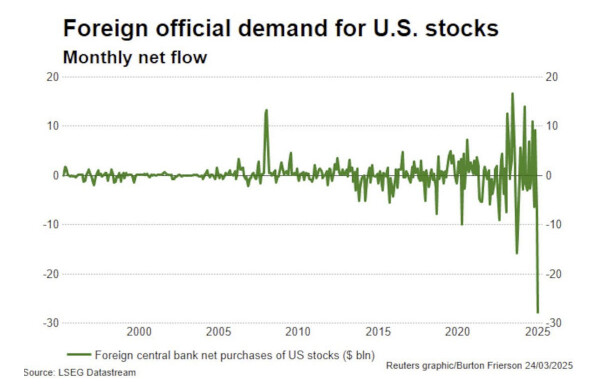

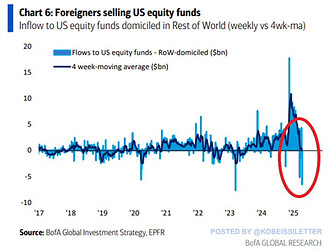

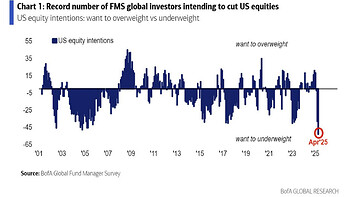

Foreigners have been selling, particularly in 2025, particularly US stocks, the most in years (still small amounts compared to total assets).

- Net sales of U.S. equities by foreign central banks reached $28 billion in January, and net sales of all U.S. assets by the private sector totaled $74.8 billion, according to official Treasury International Capital flows data.

- This trend, since then, seems to have continued into recent months, but data is still not available from TIC. Preliminary data from BofA Global Research indicates that during the five trading days ending April 9, 2025, foreign investors sold $6.5 billion worth of U.S. equities. This selloff was attributed to market turmoil stemming from tariff concerns

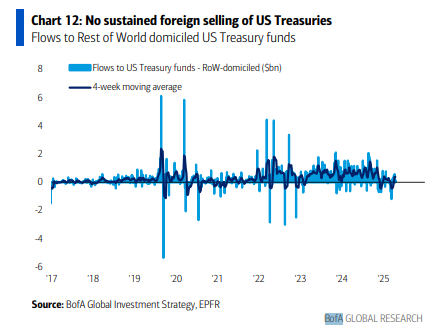

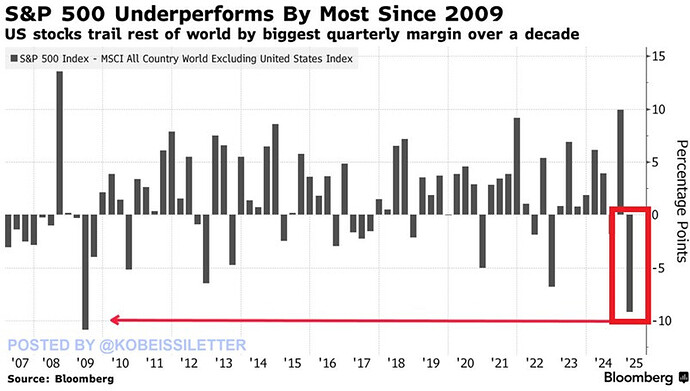

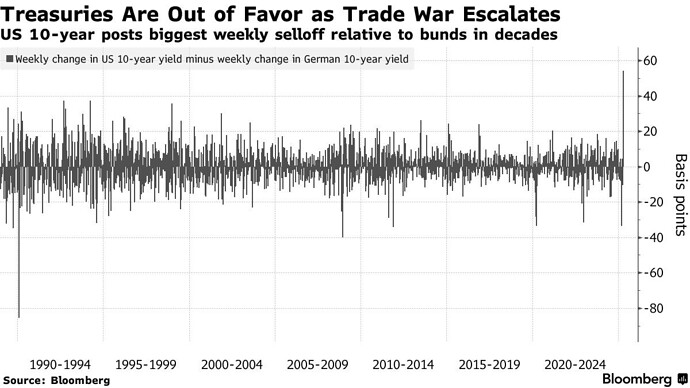

Changes in asset allocation from foreigners can also be observed from the underperformance on US stocks compared to rest of the world in Q1 2025, and also by underperformance of US treasuries compared to Germany Bunds in recent weeks.

- The S&P 500 dropped -4.6% in Q1 2025, the most since Q2 2022. At the same time, the MSCI All Country World Index excluding the US gained +5.0%.

- Investors flocked to bunds to shelter from the broader turmoil, leaving German yields largely unchanged last week, while the rate on the US 10-year debt surged more than 50 basis points. That’s the biggest underperformance since at least 1989 according to available data.

1 Like