Valuation model update

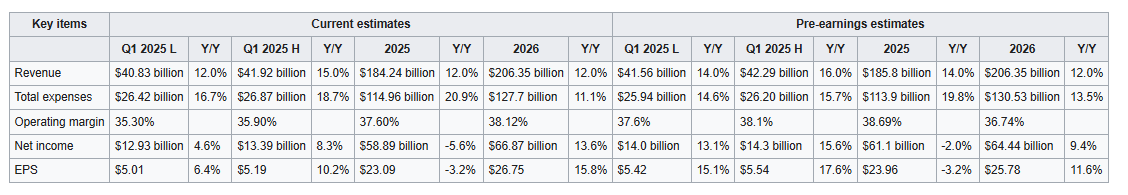

Following the Q4 2024 earnings, I updated the valuation model as shown in the table below.

I have considered the following;

- FX headwind during the quarter and potentially throughout 2025. Management is guiding for 3% in Q1 while I had projected around 6%.

- Management guided for total expenses that’s around $5 billion higher than that expected by analysts. However, like in 2024, I don’t expect Meta to exceed the mid-point of its guidance ($114-$119 billion).

- I expect growth in total expenses in 2026 to be lower than in 2025 due to continued efficiency gains and maturity of AI investments.