Topic to discuss the developments in the Japan’s debt situation and its implications

Overview Japan’s Debt

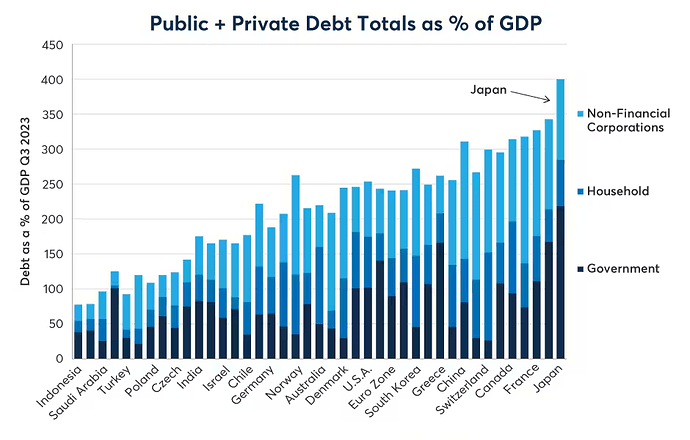

- Japan’s public sector debt amounts to 220% of GDP, according to the Bank of International Settlement (BIS).

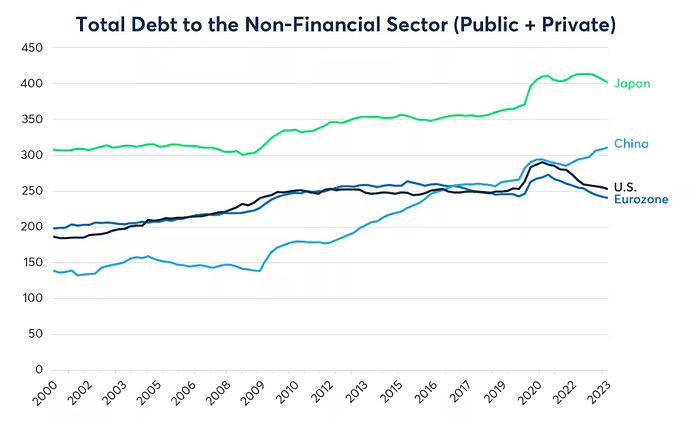

- Japan’s total level of private + public sector debt amounts to over 400% of GDP, compared to around 250% in the eurozone, U.S. and U.K.

As a reference, Japan’s 2023 GDP was slightly over $ 4 trillion in 2023.

There are some factors that make Japan’s debt situation a bit different than that of the U.S., and that has allowed them to continue to extremely high levels of debt, among them:

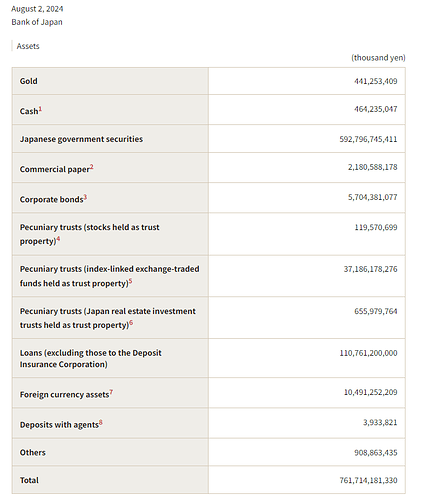

- Japanese state is asset-rich. The Bank of Japan, owns domestic government bonds over 100% of GDP. It also owns around 7% of Tokyo-listed stocks, as well as many foreign securities.

- BoJ has engaged in a massive and highly profitable carry trade. The central bank has acquired high-yielding domestic stocks and foreign securities which it funded by issuing short-term debt

- The average maturity of outstanding Japanese government bonds is around nine years, while the weighted average maturity of U.S. Treasury bonds is less than six years.

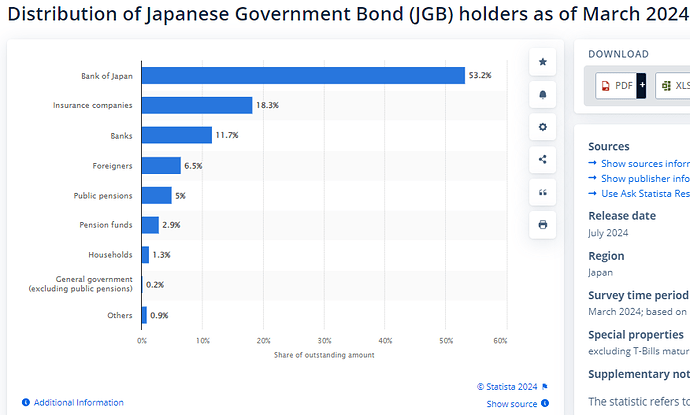

- Most of Japan’s debt is owned by domestic investors. The country’s external position is bolstered by a large current account surplus and foreign exchange reserves worth more than $1 trillion. This reduces the country’s reliance on foreign creditors and makes it less vulnerable to external shocks

The major holder of government debt in Japan is the Central Bank

This is the composition of the Bank of Japan Balance sheet in Yen.

This is what they say about the foreign assets, however, most of their foreign assets are not accounted here, but instead under international reserves.

Foreign currency deposits held at foreign central banks and the Bank for International Settlements, securities issued by foreign governments, foreign currency mutual funds, and foreign currency loans, such as (1) loans by U.S. dollar funds-supplying operations against pooled collateral and (2) loans pursuant to the special rules for the U.S. dollar lending arrangement to enhance the fund-provisioning measure to support strengthening the foundations for economic growth conducted through the loan support program.