Friedrich Merz, leader of Germany’s Christian Democratic Union (CDU) and the front runner in the upcoming Germany’s elections has outlined a series of proposals aimed at reviving Germany’s economy and improving its competitiveness. This topic aims to assess whether these polices will create better business conditions for Volkswagen and their potential impact on the valuation model. You can find an in-depth assessment of the impact of his policies on Volkswagen in Notion:

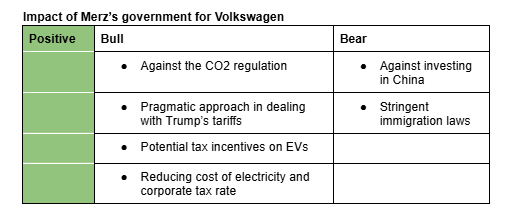

Merz’s government is likely to improve business conditions for Volkswagen. I am particularly positive on his agenda to have the EU abolish the CO2 fines for automakers and suspend the CO2 regulation. I also believe that his pragmatic approach to Trump’s tariffs is possibly the right move since it will prevent the situation from escalating and enable German companies to get a listening ear in Trump’s administration. However, his tax policies which could save Volkswagen around €990 million euros per year may not be feasible in the short-term considering the current economic situation in Germany and potential wrangles within the coalition. Here is a description of Merz’s policies and their potential impact on Volkswagen:

-

Central to Merz’s agenda is the reduction of energy costs by €0.05/KWh through lowering of taxes and levies on grid fees and reducing the corporate tax rate to 25% from around 30%. My calculations indicates that reducing the corporate tax rate to 25% could save Volkswagen around €886 million annually based on our 2024 estimate for earnings before taxes (EBT) of €17,714 million. Similarly, we estimate that reducing the electricity cost by €0.05/KWh could save Volkswagen around €105 million annually. However, critics and economists view the tax agenda as unrealistic since it will reduce the tax revenue by almost €100 billion. They argue that to offset this revenue headwind, the economy will have to grow by 10%. Similarly, if there will be a coalition between CDU and SPD (most likely scenario), there will likely be contentions regarding the tax cuts since Scholz has depicted it as favoring the rich.

-

Merz wants the penalties for failing to meet the CO2 regulations to be abolished and the CO2 regulation to be suspended. Experts believe this agenda could gain traction in the EU since the European People’s Party (EPP), which the CDU belongs, holds significant influence over legislative decisions. A coalition with the SPD or the Greens is also not expected to impede this agenda since the automotive industry in Germany is important to the overall economy. If Merz is successful in this agenda, the €1.5 billion euros headwind facing Volkswagen in 2025 will be significantly reduced. Suspending the regulation will also allow Volkswagen to focus on producing combustion engine vehicles which are in better demand and have better margins than electric vehicles (EVs).

-

Merz is cautioning companies against investing in China, saying the federal government will not compensate them if they incur losses in the region. China being an important market for Volkswagen makes this policy unfavorable. However, a coalition with the SPD is expected to continue offering the likes of Volkswagen a listening ear. Similarly, rising trade tensions with the US could force his government to use China as an hedge.

-

Unlike Scholz, Merz is against subsidizing electric vehicles (EVs), saying it is not sustainable in the long-run. Instead, he wants to support production across industries by improving business conditions such as taxation. However, experts expects his coalition government to support tax incentives for EVs. The tax model is what CEO Oliver Blume wants as well.

-

Merz is against the EU imposing retaliatory tariffs against US imports. Instead, he wants companies to win Trump’s heart through innovation and good products. Scholz has also emphasized on talks instead of retaliatory tariffs, hence a coalition with SPD is unlikely to impede Merz’s pragmatic approach. A good relationship with US may grant the likes of Volkswagen advantages with regards to Trump’s tariffs as envisioned recently by CEO Oliver Blume.

-

Merz is seeking a repeal of labor laws, leading to re-entry of people into the labor market. However, he is also calling for stringent immigration rules, which may make Germany a less attractive destination for skilled labor. This could contradict his efforts to reduce labor costs for companies such as Volkswagen.

Merz’s government to have a narrow majority after CDU/CSU and SPD got 28.6% and 16.4% of the votes respectively

- Merz’s CDU/CSU won German elections with 28.6% of the votes.

- AfD came second after garnering 20.8%, though Merz has ruled out a coalition with it.

- A coalition with the SPD which garnered 16.4% of the votes will provide Merz’s government with a narrow majority.

- Shares in German companies rose, with Volkswagen shares up 1.6% since the results were broadly in-line with market expectations.

Ok let’s drill down on the effects that will most likely come from your assessment and is most impactful which is on the CO2 regulation side.

How high do you assess the likelihood that the EU will change its regulation and by when?

How do you see the trajectory of CO2 fines for Volkswagen if EU regulation is not changed? (Please link to post of the specific topic in your answer)

By how much could the EU regulation be changed? How large is the difference between the old trajectory of EU fines for Volkswagen and the new one under Friedrich Merz from your analysis? (Provide scenario calculations for the next years in both scenarios in the specific CO2 topic and link it here in your response)

I think the most likely outcome is improved flexibility on meeting the targets and not elimination of the penalties. While this could benefit Volkswagen in the short-run, in the long-run it could find itself no meeting the targets again due to its recent shift in strategy to continue producing ICEs longer than expected. But yeah, the current stance on providing more flexibility on the targets is stronger under Merz’s tenure.

I=9

Merz said the coalition will create a 500 billion euro infrastructure fund and loosen debt ceiling on defense spending

- Merz said that the parties that will likely form the governement have agreed to create a 500 billion euro infrastructure fund to invest in areas such as transportation, energy grids and housing in the next 10 years and amend the constitution to allow defense spending that amounts to 1% of GDP to be exempt from debt limit.

- European stocks rose following Merz’s announcement- at the time of this reporting, Volkswagen and Sixt, and 1&1 shares are up 2.7%, 6.2% and 3.9% respectively.

- Economists welcomed the move saying it could spur economic growth.

Expert opinions

“The leaders of the new coalition have unveiled the biggest and fastest fiscal policy shift in post-unification German history,” said George Saravelos, head of global FX strategy at Deutsche Bank. “The announcements exceed even our optimistic expectations.”

“At face value, these two policy announcements would clearly benefit the German economy … However, we wouldn’t rule out that the official coalition talks will still bring some expenditure cuts, which would lower the positive impact of the announced fiscal stimulus,” said Carsten Brzeski, Global Head of Macro for ING Research. “The developments of the last few days have pushed the likely next German government to make a historical move by announcing a fiscal package that could finally mark the start of better years for the economy.”

“Details around the announcement will of course be key. But this an important step to significantly ease German fiscal policy and to start reversing years of underinvestment into the domestic economy and on defence spending,” said Marchel Alexandrovich, economist at Saltmarsh Economics. “Germany, above almost every other European country, has the fiscal headroom to adjust to the new economic and political reality facing its economy, and the markets should welcome the news.”

“The result of the discussions on the special infrastructure fund and the reform of the debt brake is a real game-changer. If they succeed, the German economy’s stagnation could soon be over. Not just because urgently needed investments will come, but also because the mood should shift dramatically,” said Sebastian Dullien, Research Director at Macroeconomic Policy Institute.

I=6

CDU and SPD agreed to introduce a purchase incentive for electric vehicles and reduce the energy costs by at least five cents per kilowatt hour

- In an exploratory paper signed between the CDU and SPD, the potential coalition have agreed to introduce a purchase incentive for electric vehicles and reduce the energy costs by at least five cents per kilowatt hour.

- The end of purchase subsidies in 2023 was one of the main factors behind a 27.4% or 143,000 drop in EV sales in 2024.

- The purchase incentive that ended in 2020 amounted to €6,000 for BEVs and €4,500 for hybrid vehicles.

- In January, it was reported that the CSU was proposing to introduce a purchase incentive of 3,600 euros on BEVs.

Assessment

This is good news for both the production costs and the sale of BEVs in Germany. A reduction in the cost of a BEV by 3,600 euros will make Volkswagen’s BEVs attractive. For instance, reducing the price of Volkswagen ID.3, which costs 36,900 euros by 3,600 euros will make it cheaper than BYD’s Atto 3. This could revitalize demand for EVs and help Volkswagen make progress in its CO2 target.

I=9

Dax rises 1.7% after Merz reached a deal with Greens for massive increase in state borrowing

- Merz’s party reached an agreement with the Greens for a massive increase in state borrowing, two sources close to the negotiations said.

- Merz needed Greens’ support to achieve the two thirds majority needed for the necessary constitutional changes.

- Merz wanted to secure the funds before the new parliament convenes on March 25 where they risk being blocked by an expanded contingent of far-right and far-left lawmakers.

- DAX index rose 1.7% following the news.

- Here are expert opinions on the development:

-

Nicholas Rees, head of macro research at Monex Europe said they are still challenges to overcome despite Greens’ support.

“They’ve managed to get over the first hurdle. There are a lot of challenges still to come. In Germany it takes a long time to spend money. So, despite the fact markets are very optimistic right now, we think they’re going to be disappointed.”

[/details] -

Chris Turner, Global head of markets at ING said the market expected the fiscal policy to go through.

“I think most of the market thought it (the fiscal reform) would go through. If we see confirmation today, rather than Tuesday, that it’s gone through, then we’re preempting some of the gains from next week.”

-

Andreas Bruckner, BoFa European equity strategist said this is a welcome news for the market.

“The market of course loves this news because they need the Greens to push through this fiscal package.”

-

German parliament voted in favor of Merz’s debt brake reform and 500 billion euro infrastructure and climate fund

- Germany’s Bundestag voted in favor of debt brake reform and the 500 billion euro infrastructure and climate fund, with 513 votes in favor and 207 votes against.

- The legislation now goes to Bundesrat, the upper house, where a vote is scheduled for Friday.

- The bill had to be passed before the new parliament convenes on March 25 where they risk being blocked by an expanded contingent of far-right and far-left lawmakers.

- DAX index rose 0.75% following the passage of the bull.

I=7

German upper house passes debt brake and €500 billion spending package reform

- German upper house of parliament has passed the 500-billion-euro infrastructure and climate fund reform bill.

- This paves the way for massive defense and infrastructure spending by Merz’s government.

- This development didn’t change around 0.7% decline in the DAX index.

Friedrich Merz failed to be elected German Chancellor in the first parliamentary vote, contrary to expectations

- Friedrich Merz failed to be elected German Chancellor in the first parliamentary vote, contrary to expectations.

- Merz received 310 votes, falling short of the 316 needed—even though the coalition commands 328 seats.

- It’s uncertain whether parliament (the Bundestag) would immediately proceed to another round of voting or delay it.

- Under Germany’s constitutional rules, if a chancellor candidate doesn’t reach an absolute majority in three consecutive votes, the president can appoint the candidate who wins the most votes in the fourth round or dissolve the Bundestag.

- The Bundestag has 14 days to elect a candidate with an absolute majority and Merz can stand up for election again, although other lawmakers can join the race.

- Germany’s DAX index fell 0.85% following the report.

Merz was elected Chancellor in second-round of voting, garnering 325 of the total votes.